Date: Sat, Nov 08, 2025 | 06:00 AM GMT

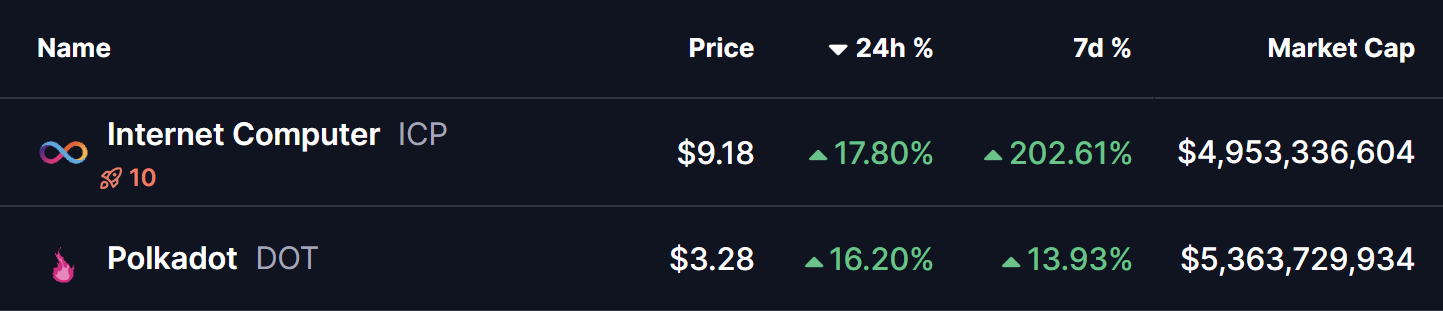

The cryptocurrency market continues to highlight strong performance among Dino altcoins. Internet Computer (ICP) has already surged by more than 200% in just one week, and now attention is shifting toward several other tokens showing similar early-stage setups — including Polkadot (DOT).

DOT has picked up strong momentum with an impressive 16 percent jump in the last 24 hours. More importantly, its chart is starting to mirror the same bullish fractal that led ICP into its explosive breakout rally.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

On the daily chart, DOT’s latest price action aligns with the three-phase structure of the Power of 3 (PO3) model: accumulation, manipulation, and expansion. ICP has already completed this cycle, entering a full expansion phase that resulted in a massive 100 percent surge.

ICP and DOT Fractal Chart/Coinsprobe (Source: Tradingview)

ICP and DOT Fractal Chart/Coinsprobe (Source: Tradingview)

DOT appears to be following the same path. After bouncing strongly from the manipulation zone, the token is now entering its expansion phase by reclaiming the key $3.24 resistance level, which has flipped into support. DOT currently trades at $3.28, sitting just below its 200-day moving average at $3.89, which now becomes the next major hurdle.

What’s Next for DOT?

With DOT stepping into its expansion phase, holding above the $3.24 support remains critical. A successful reclaim of the 200-day MA would validate the bullish fractal and could open the doors for a strong continuation move. If this setup unfolds similar to ICP’s pattern, DOT may rally toward the $7.06 target zone, representing roughly a 111 percent potential rise from its recent low.

However, if DOT fails to hold the $3.24 area, the fractal setup could be invalidated, delaying any major upside movement.

At the moment, DOT’s structure is showing strong early signs of momentum, and if buyers maintain control, the token could soon follow ICP’s lead into a larger breakout phase.