Polkadot Break Above $2.85 Ahead? Reversal Setup Forms Beneath Heavy Resistance

Polkadot’s price action is beginning to hint at a possible shift in momentum, with a reversal setup forming just below the critical $2.85 level. The bulls are gradually building pressure, eyeing a breakout that could confirm a change in trend. Still, the presence of strong resistance overhead means the coming sessions will be crucial in determining whether DOT can break free or face another rejection.

DOT’s Downtrend Shows Signs Of Exhaustion As Buyers Eye A Short-Term Recovery

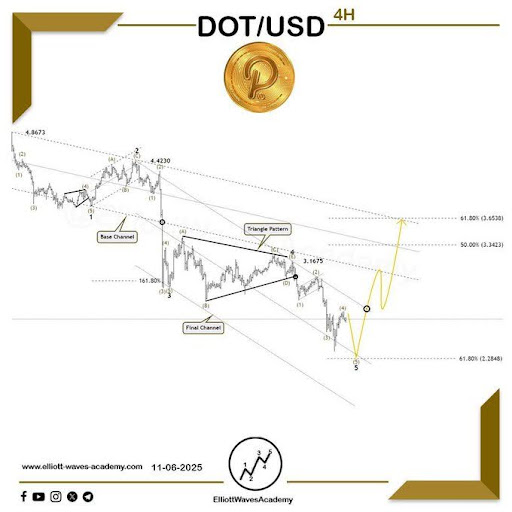

Giving a follow-up on the expected path of DOT in the 4-hour timeframe, Elliott Waves Academy revealed that the series of declines through the sub-waves of the recent impulsive move may be nearing its end. This suggests that the current downward trend is exhausting itself, at least in the short term, with a potential recovery ahead.

Related Reading: Polkadot Recovery Stalls As Bearish Pressure Returns With $3.5 In Sight

Elliott Waves Academy observes that a diagonal pattern appears to be forming, which is outlining the intricate details of wave (1)/(A). This diagonal formation is key to the analysis, as it typically signals the termination of a prior trend and precedes a reversal.

The analyst points to a confirmed break above the upper boundary of this diagonal pattern. Such a break would officially open the path for an upward recovery toward the zone between $3.3423 and $3.36538.

On the other hand, the $2.2848 level is deemed crucial for maintaining the immediate recovery outlook. Elliott Waves Academy warned that if this critical $2.2848 level is broken, further significant downside is expected through an extension of the existing bearish waves.

Polkadot Remains Trapped Beneath Major HTF Resistance Levels

Crypto_Jobs shared on X that the long-term chart for Polkadot remains largely stagnant and constrained beneath major high-timeframe (HTF) resistance zones at $3.200 and $3.780. The analyst cautioned traders to remain conservative with any swing (long) setups while the price trades below these critical resistance barriers.

Examining the current price action, Crypto_Jobs described market conditions as neutral, with Polkadot fluctuating within a tight range between $2.500 and $2.700. The sideways movement reflects a lack of clear direction, as both bulls and bears struggle for dominance. Despite this period of indecision, the chart showcases an emerging pattern that could soon dictate the next significant move.

The crypto analyst noted the possible formation of an inverse head and shoulders pattern, with a neckline around the $2.700–$2.850 to $3.00 zone. A confirmed breakout above this neckline could signal renewed bullish momentum, potentially leading to a 5–10% price surge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.

Revealing the Value of Green Gold: The Transformative Impact of Institutional-Grade Platforms on Clean Energy Markets

- Clean energy markets hit $35.42B in 2025 but face VPPA/PPA liquidity gaps as U.S. policy rollbacks raise costs by 11.8% YoY. - REsurety's CleanTrade platform digitizes PPA trading, unlocking $16B in liquidity via CFTC-approved SEF infrastructure within two months. - Strategic S&P Global partnership standardizes PPA/REC valuations, addressing institutional investors' risk management gaps in green energy markets. - While global PPA markets grow at 14.6% CAGR to $9.5B by 2035, U.S. policy uncertainty remain