BNB Drops to Key Support Level Above $930 as Markets React to Liquidity Pressures

The native token of the BNB Chain, BNB, slipped slightly over the last 24-hour period, moving to $933 after briefly surging to $974, as broader crypto markets showed signs of stress tied to tightening financial conditions.

The token’s price action played out in a narrow $46 range. Volume rose sharply during the morning’s move higher, 71% above the 24-hour average, but cooled into the close according to CoinDesk Research's technical analysis data model.

The rejection near $975 marked a technical ceiling, while BNB found support once again near $930.

“BNB’s ability to hold support mirrors the broader strength we’re seeing on-chain,” Johnny B., the founder of BNBPad.ai, told CoinDesk in an emailed statement. “Despite the market headwinds, BNB Chain saw 82 million active addresses in October, a new all-time high, while DEX volumes neared $120 billion based on DeFiLlama.”

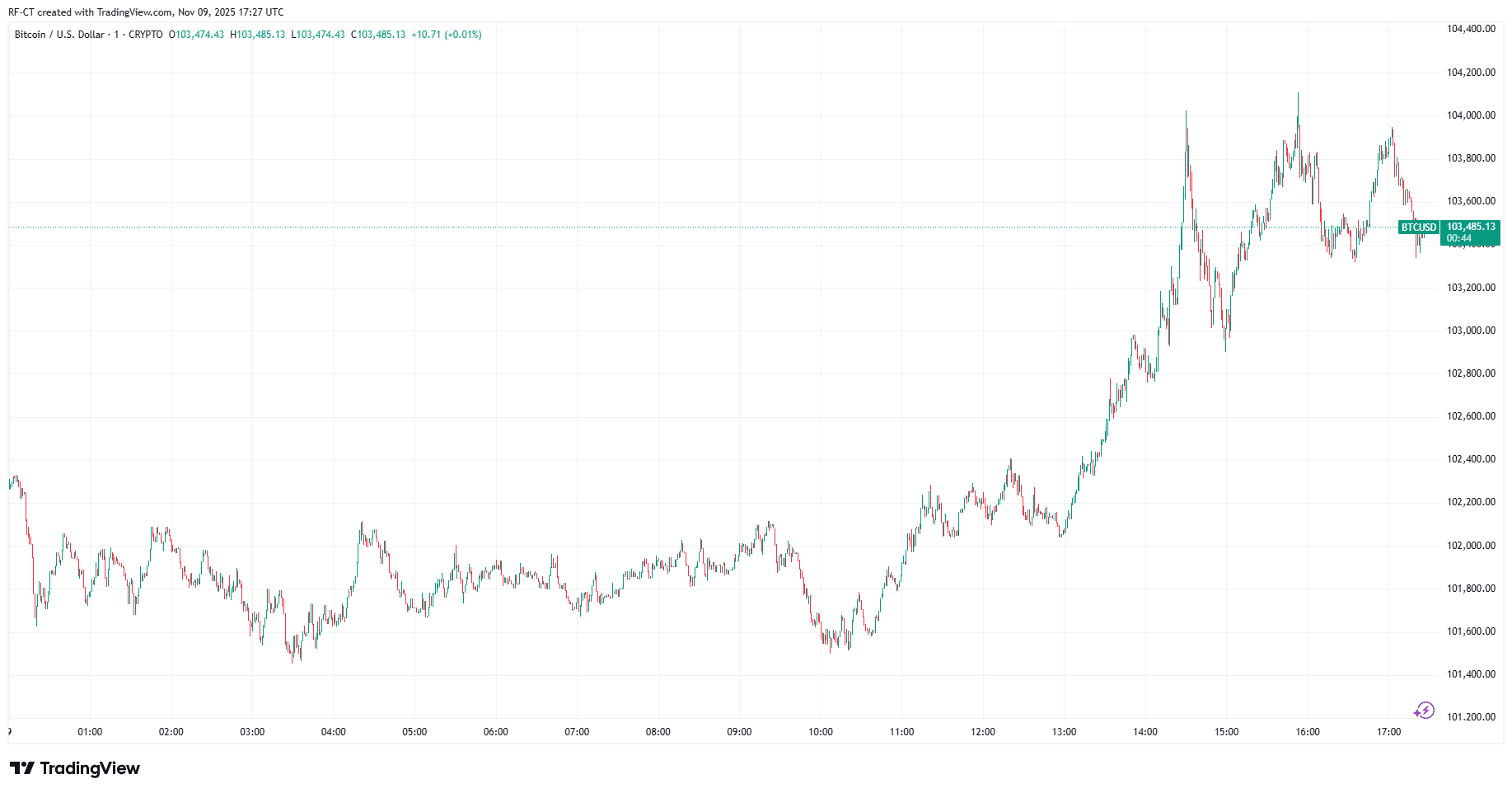

BNB’s muted performance came along a wider market drawdown. The broader market, as measured via the CoinDesk 20 (CD20) index, is down 0.9% in the last 24 hours while bitcoin is struggling to remain above $100,000.

A U.S. Treasury cash rebuild and falling bank reserves, down an estimated $500 billion since July, have drained capital from markets and made risk assets less attractive, according to a recent report from Citi.

That has seen stocks fall as well, with the tech-heavy Nasdaq 100 seeing a 4.7% decline this week, and the S&P 500 dropping by 2.7%.

In this environment, BNB’s ability to stay above its key $930 support level may reflect confidence in the network’s adoption and the performance of newer decentralized applications like Asper, even as the broader outlook dims.

A break above $975 could reopen the path toward recent highs, but further downside in major assets could test buyers’ resolve. BNB remains tied to technical setups for now, but broader market forces are starting to call the shots.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC Lists Five XRP Spot ETFs, Fueling Anticipation for U.S. Market Debut

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

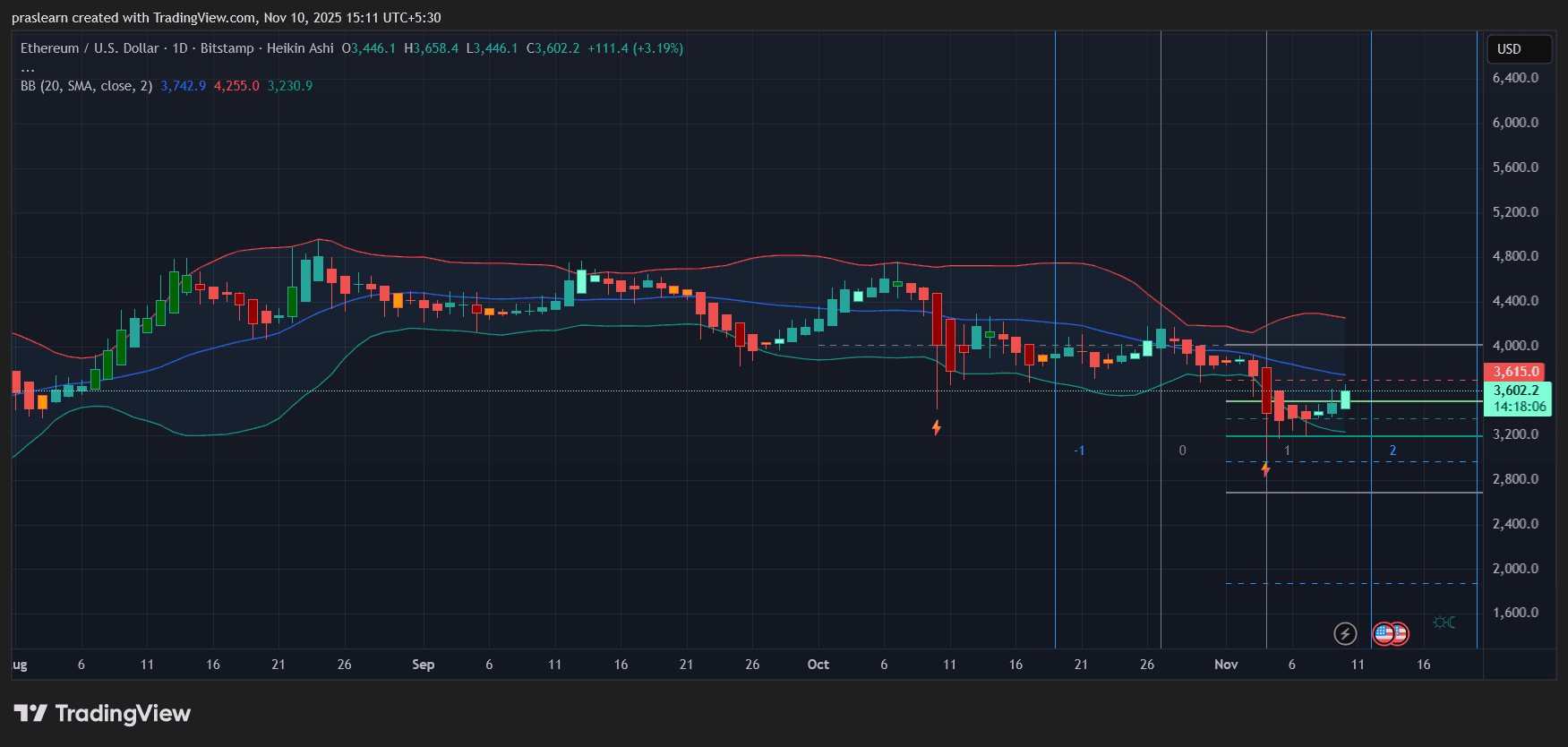

Will Political Calm Push ETH Price Toward $4,000?