Tesla’s $1 Trillion Musk Deal: Strategic Move to Keep CEO or Example of Excessive Corporate Power?

- Tesla shareholders approved a $1 trillion compensation package for Elon Musk, tied to aggressive targets like $8.5 trillion valuation and 20 million vehicle deliveries. - Critics call the package excessive, while Tesla defends it as critical to retain Musk amid his SpaceX, xAI, and Trump administration commitments. - The Texas-based approval bypasses Delaware's strict governance rules, sparking debates over "race to the bottom" in corporate accountability. - Skeptics question feasibility of targets, with

At Tesla's annual meeting in Austin, Texas, shareholders gave their approval to a historic $1 trillion pay package for CEO Elon Musk, with more than three-quarters of votes in favor, as reported by a

This approval signals a significant change in how corporations are governed. After Musk's 2018 compensation plan was twice struck down by Delaware courts, Tesla moved its incorporation to Texas, where business laws are more flexible, the Los Angeles Times reported. This shift allowed Tesla's board to avoid Delaware's tough oversight on shareholder disputes, sparking concerns about a "race to the bottom" among states with looser corporate regulations, as noted by

Musk's latest pay plan is designed to reward long-term results, requiring him to hit a series of performance milestones to receive shares, according to the MarketWatch article.

This approval also brings attention to wider legal and regulatory issues. Delaware's Supreme Court is preparing to review a statute that redefined "controlling stockholder," a decision that could reshape corporate governance across the country, according to a

Musk, meanwhile, highlighted the compensation plan's importance for Tesla's AI and robotics goals. During the shareholder meeting, he said the package would help the company "eliminate poverty by expanding human services" and make Optimus humanoid robots the next revolutionary technology, as reported by the Los Angeles Times. However, his involvement in politics—including a brief role in the Trump administration—has raised concerns about his focus, with governance experts like Nell Minow calling him a "part-time CEO," according to a

This decision highlights a growing pattern: companies are increasingly using state laws to justify unprecedented executive pay. As Tesla's move sets a precedent, it prompts important questions about oversight and the direction of corporate governance in a patchwork legal system, The Guardian observed.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Token TGE and Its Impact on the Market: Evaluating the Trigger for Altcoin Price Fluctuations and Institutional Embrace

- MMT token's 2025 TGE sparked 1330% price surge post-Binance listing, driven by $82M oversubscribed sale and strategic exchange listings. - TVL exceeding $600M highlights DeFi innovations like YBTC.B pools and ve(3,3) tokenomics, aiming to balance liquidity with governance incentives. - Institutional adoption targets through MSafe wallets and Momentum X platform, though speculative trading risks overshadow long-term stability. - Phishing threats and name confusion with NYSE fund MMT raise volatility conce

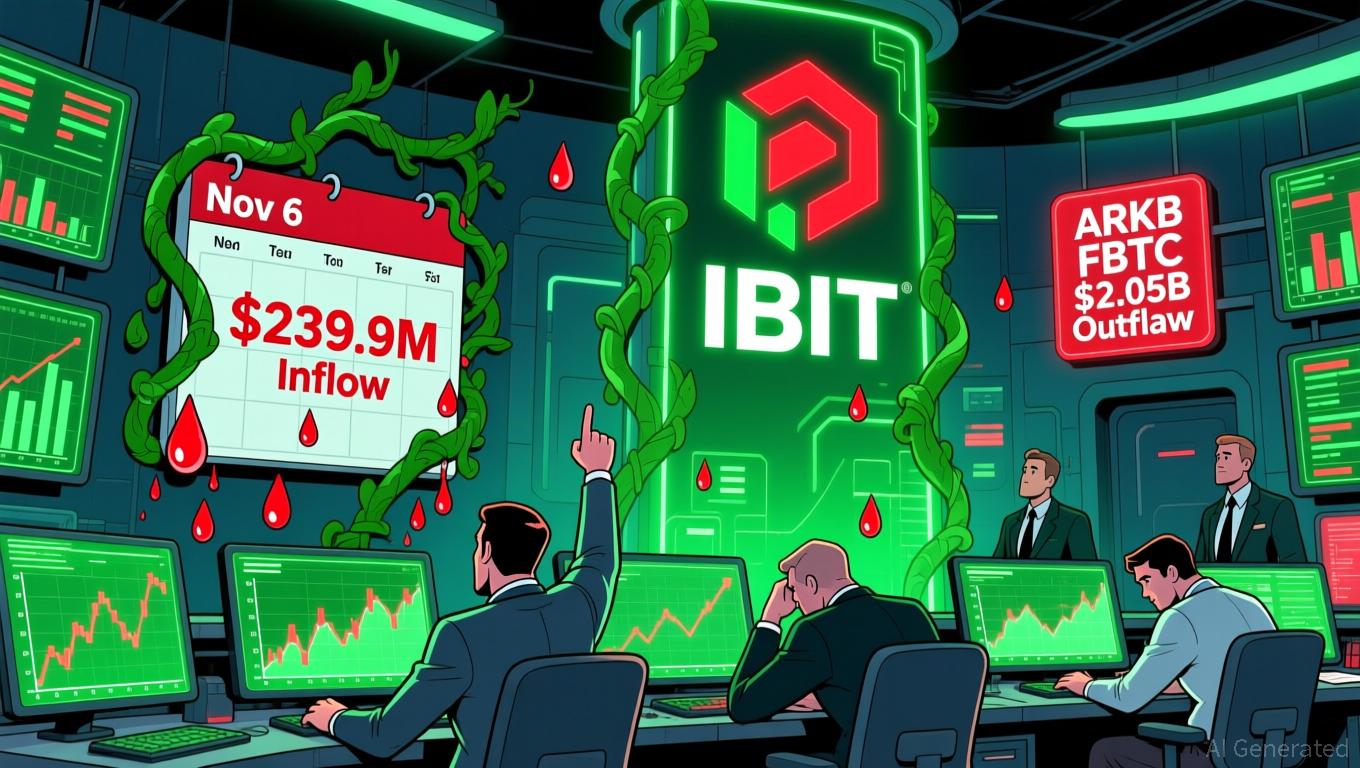

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod