Dogecoin News Update: SEC Sets November 2025 as Pivotal Deadline for Dogecoin ETF Approval

- Bitwise files a fast-track SEC 8(a) ETF application for Dogecoin , targeting November 2025 approval if regulators remain silent. - The move reflects growing institutional demand for crypto exposure amid regulatory uncertainty and a competitive ETF landscape. - Grayscale's DOJE ETF and rivals' XRP/Dogecoin products highlight intensified competition, with $24M+ in early trading volumes. - Analysts project 300% DOGE price gains if resistance breaks, while SEC's crypto-friendly leadership and legal battles w

Bitwise Asset Management has made waves in the crypto sector by submitting an application for a spot

By eliminating a "delaying amendment" from its S-1 registration, Bitwise's submission initiates the Section 8(a) process under the Securities Act. This mechanism enables the ETF to become effective automatically 20 days after filing unless the SEC steps in, according to

The anticipated introduction of a Dogecoin ETF follows the momentum of recent crypto ETF launches. Bitwise’s Solana (SOL) ETF, which attracted $56 million on its opening day, revealed strong institutional demand for crypto investment vehicles, according to

Market trends are also supporting these advancements. Dogecoin’s value has started to rebound, hovering near crucial support points, while blockchain data indicates increased accumulation, as reported by

Changes in regulation, including the appointment of crypto-supportive leaders like Paul Atkins as SEC Chair, have fostered a more favorable climate, CryptoTimes stated. Nonetheless, obstacles persist. The SEC’s ongoing lawsuit against Ripple, the entity behind XRP, continues to cast uncertainty over the crypto ETF landscape, as Coinpedia mentioned. Still, some analysts believe that the XRP Ledger’s dual role in value transfer and real-world payments could provide a competitive advantage in the ETF market, according to Yahoo Finance analysis.

With the countdown to a possible approval underway, the Dogecoin ETF could transform how institutions engage with

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Token TGE and Its Impact on the Market: Evaluating the Trigger for Altcoin Price Fluctuations and Institutional Embrace

- MMT token's 2025 TGE sparked 1330% price surge post-Binance listing, driven by $82M oversubscribed sale and strategic exchange listings. - TVL exceeding $600M highlights DeFi innovations like YBTC.B pools and ve(3,3) tokenomics, aiming to balance liquidity with governance incentives. - Institutional adoption targets through MSafe wallets and Momentum X platform, though speculative trading risks overshadow long-term stability. - Phishing threats and name confusion with NYSE fund MMT raise volatility conce

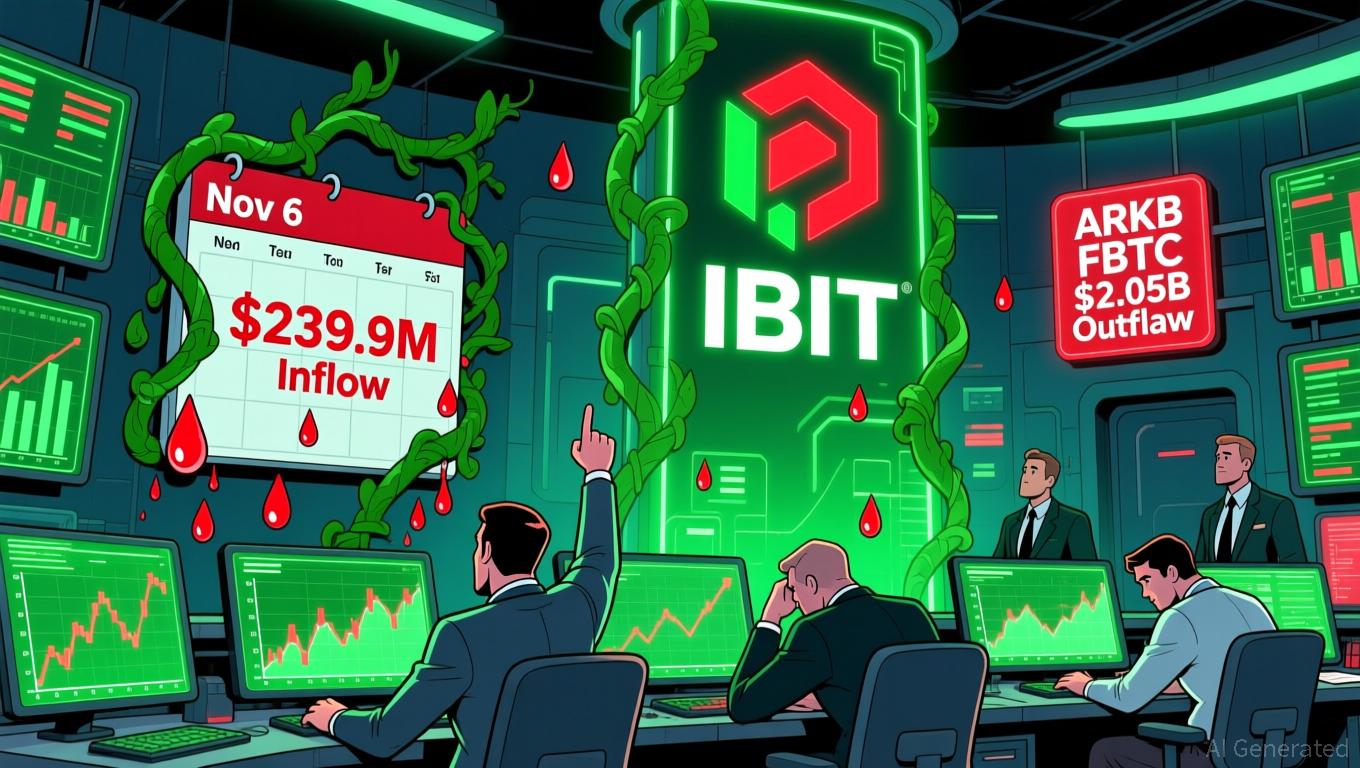

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod