Gold Weekly Forecast: Correction deepens on hawkish Fed tone, US-China trade truce

Gold (XAU/USD) remained under bearish pressure and touched its weakest level since early October, below $4,000, pressured by the Federal Reserve (Fed) Chairman Jerome Powell’s cautious remarks on policy easing and a de-escalation in the United States (US) – China trade conflict. Upcoming macroeconomic data releases from the US and comments from Fed officials could

Gold (XAU/USD) remained under bearish pressure and touched its weakest level since early October, below $4,000, pressured by the Federal Reserve (Fed) Chairman Jerome Powell’s cautious remarks on policy easing and a de-escalation in the United States (US) – China trade conflict.

Upcoming macroeconomic data releases from the US and comments from Fed officials could influence Gold’s valuation in the near term.

Gold extends correction from record-high

Gold started the week under heavy bearish pressure and lost more than 3% on Monday. Growing optimism about the US and China reaching a trade truce allowed risk flows to dominate markets, making it difficult for Gold to find demand as a safe haven.

Following a high-level meeting with Chinese officials, US Treasury Secretary Scott Bessent said over the weekend that China was ready to make a trade deal to avert a new 100% tariff on Chinese imports, and added that a framework was prepared for the meeting between US President Donald Trump and Chinese President Xi Jinping.

As Trump signed framework trade agreements with multiple nations, including South Korea, during his Asia tour, Gold remained on the back foot and fell to its lowest level since early October, below $3,900, on Tuesday.

Following a recovery attempt in the first half of the day on Wednesday, Gold turned south in the American session and closed the fourth consecutive day in negative territory.

The Fed decided to cut the policy rate by 25 basis points (bps) to the range of 3.75%-4% following the October policy meeting, as anticipated. The US central bank also announced that it will conclude the aggregate balance sheet drawdown on December 1.

While responding to questions in the post-meeting press conference, Fed Chair Jerome Powell noted that another rate cut in December is “far from assured” and explained that the outlook for employment and inflation has not changed much since the September meeting. Powell further reiterated that the central bank needs to manage the risk of more persistent inflation. The benchmark 10-year US Treasury bond yield climbed above 4% following Powell’s cautious remarks on policy easing, and the US Dollar (USD) gathered strength, weighing on XAU/USD.

On Thursday, the negative shift seen in the risk sentiment helped Gold stage a rebound. After recovering above $4,000, the precious metal went into a consolidation phase on Friday.

Gold investors await US data, Fed commentary

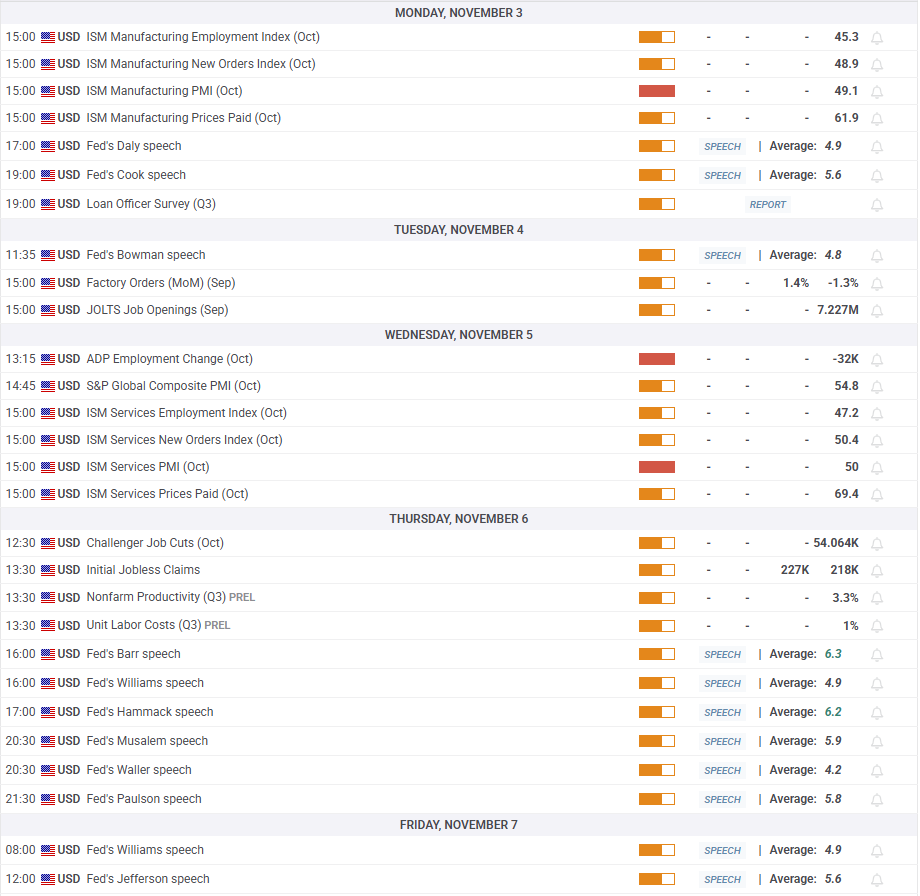

The US economic calendar will feature several macroeconomic data releases that could provide valuable insights into the labor market conditions and the overall economic situation, given the postponed or cancelled releases due to the ongoing government shutdown.

On Monday, the Institute for Supply Management (ISM) will publish the Manufacturing Purchasing Managers’ Index (PMI) data for October. A significant improvement in the headline PMI, and/or the Employment component of the survey, could support the USD with the immediate reaction and cause XAU/USD to stretch lower.

On Wednesday, Automatic Data Processing (ADP) will release the private sector payroll data for October. Earlier in the week, the ADP reported on Tuesday that private payrolls increased by an average of 14,250 jobs in the four weeks ending October 11, and announced that it will start publishing a weekly preliminary estimate, which will present a four-week moving average of the total employment change in the private sector.

Hence, the market reaction to the upcoming ADP data could remain short-lived. Later in the day, the ISM Services PMI data for October could trigger a straightforward reaction, with the better-than-forecast headline PMI reading and a noticeable recovery in the Employment component boosting the USD while weighing on XAU/USD and vice versa.

Investors will also pay close attention to comments from Fed officials. According to the CME FedWatch Tool, the probability of one more Fed rate cut in December declined below 70% on Friday from 90% ahead of the Fed meeting.

In case policymakers echo Powell’s tone by refraining from committing to another interest rate reduction before the end of the year, the USD could continue to gather strength alongside rising T-bond yields, opening the door for another leg lower in Gold. Conversely, XAU/USD could hold its ground if Fed officials hint that they are on track to ease the policy rate further unless they see a convincing sign that tariffs are lifting inflation.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart stays near 50 and Gold continues to trade below the 20-day Simple Moving Average (SMA), while holding in the upper half of an ascending regression channel coming from the beginning of the year.

On the downside, $3,970 (Fibonacci 38.2% retracement of the August-October rally) aligns as an interim support level before $3,900 (mid-point of the ascending channel, round level) and $3,850-$3,820 (Fibonacci 50% retracement, 50-day SMA).

In case Gold rises above $4,090 (20-day SMA) and stabilizes there, $4,130 (Fibonacci 23.6% retracement) could be seen as the next resistance level before $4,200 (round level).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK and U.S. Coordinate Stablecoin Regulations to Avoid Market Fragmentation and Foster Innovation

- The Bank of England aligns stablecoin rules with U.S. standards to prevent market fragmentation and boost innovation. - Deputy Governor Sarah Breeden announced a Nov. 10 consultation paper, softening earlier strict proposals and emphasizing transatlantic collaboration. - A joint U.S.-UK task force aims to harmonize regulations, accelerating cross-border stablecoin adoption while balancing innovation and stability. - The framework will focus on transparency and consumer protections, though critics warn ra

XRP News Today: XRP's Drive Toward Institutional Adoption Challenges the Trade-off Between Practical Use and Centralized Control

- XRP ownership debates highlight community splits over 1,000-token value claims versus inflation-adjusted critiques and supply concentration risks. - XRP's $2.50 price faces bearish technical indicators, with derivatives data showing declining retail interest and potential support at $2.18. - Ripple's institutional tools (Prime, RLUSD) boost on-chain adoption but raise questions about XRP's role as a funding mechanism versus functional utility. - Analysts predict $4–$10 price potential if macro/regulatory

LUNA Drops 13.02% Over the Past Week as Recovery Efforts Continue After Collapse

- LUNA dropped 13.02% in 7 days as of Nov 6, 2025, amid ongoing post-2022 collapse recovery efforts. - Terra 2.0 rebranded from algorithmic stablecoin model to governance-driven DeFi and payment solutions. - Financial analysts monitor LUNA's volatility as a case study for blockchain governance and ecosystem resilience. - The token's 80% annual price drop highlights risks in algorithmic models and decentralized finance adaptation.

Is It Possible for the Unpredictable GIGGLE Memecoin to Support Consistent Charity Efforts for 70,000 Children?

- Binance donates 50% of GIGGLE trading fees to Giggle Academy, which has educated 70,000 children globally. - GIGGLE memecoin's volatile price swings (from $86M to $277M then $60M) raise concerns about market manipulation and speculative risks. - CZ clarifies GIGGLE is a community-created token unaffiliated with Giggle Academy, which emphasizes transparency in fund allocation. - Regulatory scrutiny and crypto community debates highlight tensions between memecoin-driven philanthropy and investor protection