Key Notes

- Whale wallet from 2018 moved $250 million in Bitcoin to Paxos while retaining 32,490 BTC valued at $3.4 billion.

- Bitcoin ETFs experienced three consecutive withdrawal days totaling $798 million in net outflows during late October.

- Technical indicators show BTC trading at $107,256 with RSI at 40.50 suggesting weakening momentum and potential breakdown risk.

A dormant Bitcoin BTC $106 878 24h volatility: 2.8% Market cap: $2.13 T Vol. 24h: $71.71 B wallet dating back to 2018 has transferred 2,300 BTC, worth roughly $250 million, to Paxos Exchange. The whale still holds approximately 32,490 BTC valued at $3.4 billion, according to Arkham Intelligence.

Dormant Bitcoin Wallet transfers 2,300 BTC (~ $250 million) to Paxos on Nov. 3, 2025 | Source: Arkham

The whale’s move aligns with a wave of profit-taking among large corporate Bitcoin investors in the US in the past week.

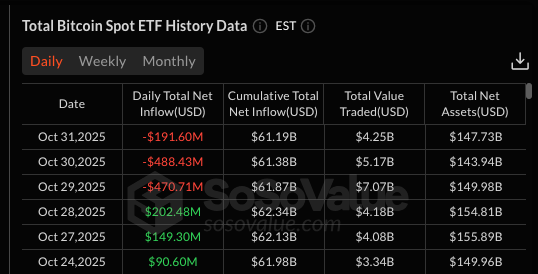

Bitcoin ETFs close October 2025 with 3 consecutive days of withdrawal | Source: Sosovalue

According to SosoValue data , Bitcoin ETFs recorded $798 million in net outflows last week, closing with three consecutive days of withdrawals.

Bitcoin Price Prediction: Bulls Defend $105K as RSI Dips Below Midline

Bitcoin price is struggling to reclaim the $110,000 zone after a sharp 2.97% decline on Nov. 3. The daily chart shows BTC currently trading around $107,256, with visible selling pressure from whale wallets and institutional outflows.

Bollinger Bands are tightening, suggesting that market volatility is now cooling. The upper band sits near $114,260, forming the primary resistance zone, while the lower band near $105,536 offers immediate support.

Bitcoin (BTC) Price Forecast, Nov. 3, 2025 | Source: TradingView

RSI at 40.50 reflects weakening momentum, hovering near oversold territory. The indicator’s downward slope below its signal line (45.86) reinforces bearish dominance in the short term. However, a rebound above 50 could mark a reversal, especially if ETF inflows resume and whale deposits stabilize.

Bitcoin’s current price Breakout Probability indicator depicts a 38% chance of an early rebound to $112,000. If that optimistic BTC price outlook fails to materialize, the 27% chance of a breakdown below $108,000 is the next likely directional move.

Best Wallet产品进展及市场表现

Best Wallet