Institutional Bitcoin Demand Cools as Bull Market Roars Elsewhere | US Crypto News

Institutional appetite for Bitcoin is fading, according to Glassnode data showing BlackRock’s spot Bitcoin ETF attracting fewer than 600 BTC in net weekly inflows over the past three weeks — a stark contrast to the 10,000 BTC surges that preceded previous rallies.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because while Wall Street partys on AI-fueled gains, Bitcoin’s biggest backers are quietly stepping back. Fresh data shows BlackRock’s Bitcoin ETF inflows have plunged, hinting that institutional enthusiasm may be cooling just as the bull market heats up.

Crypto News of the Day: Institutional Appetite for Bitcoin Weakens

The sharp decline in Bitcoin ETF inflow, reported in a recent publication, is raising eyebrows across the crypto market, even as US equities continue their AI-fueled surge.

New data from Glassnode shows that institutional demand for Bitcoin has slowed dramatically, contrasting with the growing euphoria in traditional markets led by technology and infrastructure plays.

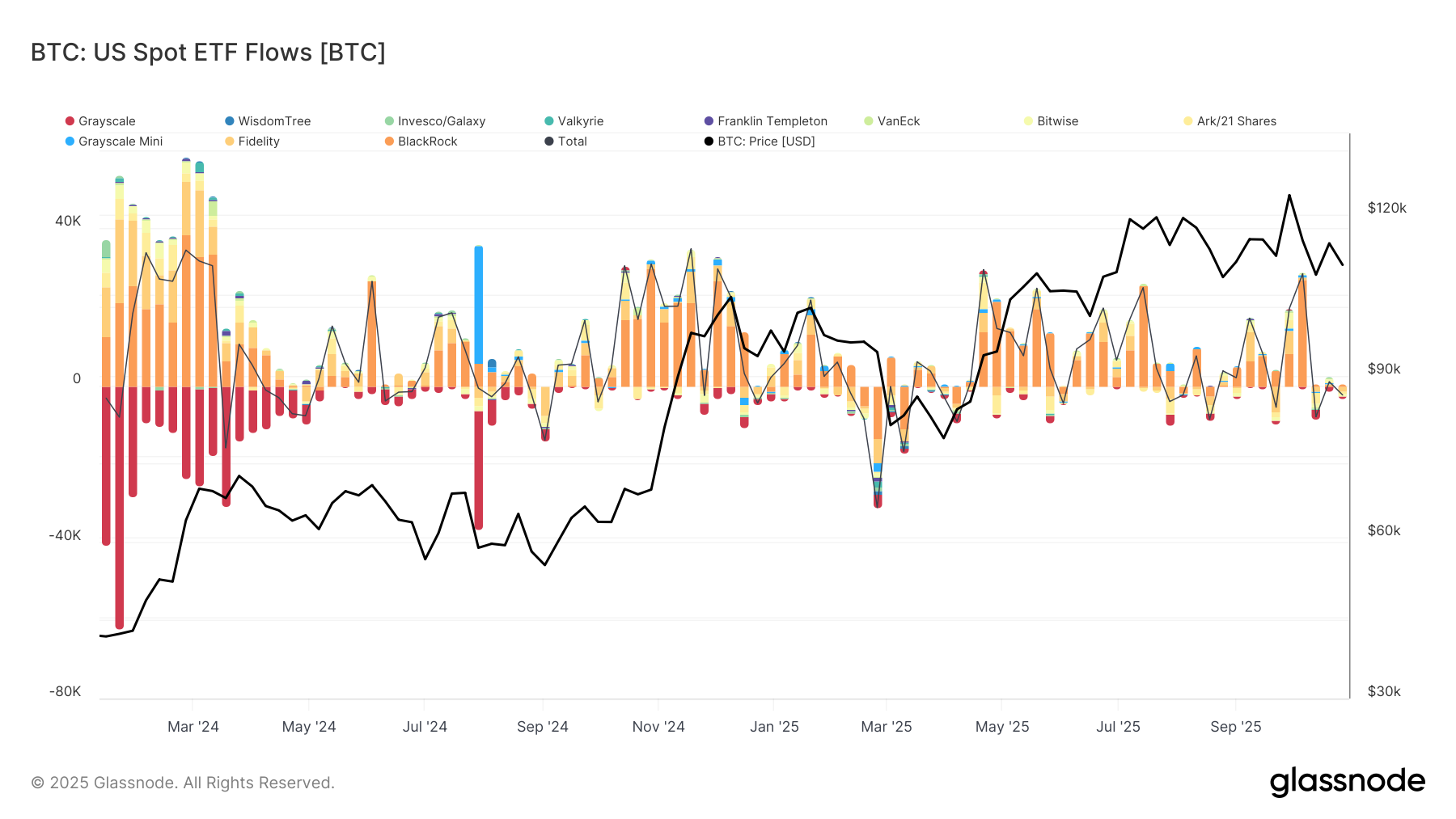

According to Glassnode, BlackRock’s spot Bitcoin ETF has seen less than 600 BTC in net weekly inflows over the past three weeks. This represents a significant decline from the 10,000 BTC-plus inflows that have historically preceded major rallies in this cycle.

“Over the past three weeks, BlackRock’s spot BTC ETF has seen less than 0.6k BTC in weekly net inflows. This represents a sharp decline from the > 10,000 BTC net inflow per week that preceded each major rally this cycle, signaling a notable slowdown in institutional demand,” wrote analysts at Glassnode.

The slowdown marks one of the weakest periods of institutional accumulation since the ETF’s launch. The figures suggest that large investors may be taking a breather after months of heavy accumulation.

Bitcoin’s price has struggled to maintain momentum, but has slipped below $110,000, trading at $107,868 as of this writing.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

ETF flows are now considered a leading indicator of sentiment among institutional investors.

Despite the soft inflow data, on-chain analysts spotted movement beneath the surface. Whale Insider reported that BlackRock transferred 1,198 BTC, worth approximately $129 million, to Coinbase, suggesting ongoing portfolio realignment or custody adjustments.

JUST IN: BlackRock deposits 1,198 $BTC ($129.09 million) and 15,121 $ETH ($56.1 million) to Coinbase within the last hour.

— Whale Insider (@WhaleInsider)

Such movements do not necessarily indicate selling. However, they highlight how major asset managers are actively managing exposure amid volatile macro conditions. ETF providers often rebalance or consolidate holdings across custodians as liquidity and demand fluctuate.

Stocks Surge as Crypto Stalls

While Bitcoin demand cools, traditional markets are powering higher. Evercore ISI maintains a bullish outlook on US equities, projecting the S&P 500 to reach 7,750 by 2026.

The firm reportedly cites strong leadership from AI-driven sectors like tech, communications, and consumer discretionary. Evercore strategist Julian Emanuel said the current bull market remains intact, although he warned of near-term volatility tied to shifts in Fed policy and tariffs.

EVERCORE: U.S. BULL MARKET STILL STRONG, BUY STOCKSEvercore ISI advised buying U.S. stocks, saying the S&P 500 could hit 7,750 by end-2026 as key signs of a market top are missing. Analyst Julian Emanuel said gains are being led by AI-driven sectors like tech, communication…

— *Walter Bloomberg (@DeItaone)

With the VIX near year-to-date lows, Emanuel recommended using SPY strangles as hedges in a “still-healthy” uptrend.

ETF analyst Eric Balchunas echoed this optimism, calling it a market that’s “forgotten how to fall.” He noted that the -3x S&P ETF has reverse-split five times, a sign of how punishing this cycle has been for bears.

NEW: Bears Face Extinction in a Market That's Forgotten How to Fall.. The -3x SPX ETF has reverse split 5 times, a crazy data point showing just how brutal this mkt has been for bears. While they'll get their moment (pullbacks are part of life) we also show that long term it pays…

— Eric Balchunas (@EricBalchunas)

The diverging trends highlight a key tension in global markets. AI and equity exuberance are absorbing liquidity, while Bitcoin’s institutional narrative temporarily cools.

As macro liquidity tightens and investor enthusiasm tilts toward AI infrastructure, Bitcoin’s next leg may depend more on when big money returns to the digital frontier than on policy signals.

Chart of the Day

Bitcoin Spot ETF Flows. Source:

Bitcoin Spot ETF Flows. Source:

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Trump denies knowing Binance founder CZ after pardon for money laundering.

- Why Bitcoin treasuries matter: Key takeaways from Bitwise CEO Hunter Horsley.

- Arthur Hayes’ Maelstrom exec exposes 44% loss in top crypto VC bet even as BTC doubles.

- New rule could bring Binance-level liquidity to Hong Kong.

- Could Zcash replace Bitcoin? Experts say yes.

- Fake news floods Pi Network community as exchange supply hits a new high.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 31 | Pre-Market Overview |

| Strategy (MSTR) | $269.51 | $265.15 (-1.62%) |

| Coinbase (COIN) | $343.78 | $341.25 (-0.55%) |

| Galaxy Digital Holdings (GLXY) | $35.01 | $36.51 (+4.26%) |

| MARA Holdings (MARA) | $18.27 | $18.63 (+1.97%) |

| Riot Platforms (RIOT) | $19.78 | $20.46 (+3.44%) |

| Core Scientific (CORZ) | $21.54 | $22.86 (+6.13%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zinc's Decline: An Early Warning Sign for the Crypto Industry

- Digital asset treasuries face sharp sell-offs as investor confidence wanes, with the S&P GSCI Zinc Index dropping 1.56% on Nov 5, 2025. - The zinc index's volatility mirrors crypto market declines, signaling a shift to safer assets amid regulatory uncertainty and macroeconomic pressures. - SEC actions against crypto platforms have intensified market jitters, with analysts warning of cascading liquidations if declines persist. - Zinc's performance now serves as a key barometer for digital asset risk, refl

Dogecoin News Today: Dogecoin's Unstable Buzz Fades as ETFs Turn Attention to Alternative Coins

- Dogecoin (DOGE) hovers near $0.15704, with analysts warning a breakdown could trigger sharp declines amid waning retail and institutional interest. - On-chain data and derivatives metrics signal deteriorating sentiment, as Bitcoin/Ethereum ETF outflows shift capital toward altcoins like Solana . - Weak large-holder support and declining community-driven hype expose DOGE to volatility, with prices at risk of falling below $0.15 without fundamental catalysts.

Chainlink and SBI Join Forces to Integrate Blockchains and Boost Institutional Adoption of Tokenized Assets

- Chainlink partners with SBI Digital Markets to build cross-chain digital asset solutions using CCIP technology. - Collaboration aims to accelerate institutional adoption of tokenized assets via secure multi-chain operations and existing pilots with UBS . - CCIP addresses blockchain interoperability challenges, positioning SBI Group as a key player in Japan's regulated digital asset market. - Recent partnerships with Ondo Finance highlight growing demand for cross-chain infrastructure in tokenized real-wo

Investor Excitement Rises as OpenAI's Breakthroughs in AI Aim for $4.8 Trillion Market

- OpenAI's rumored 2027 IPO sparks speculative trading, with indirect investments surging 108% as investors bet on its $4.8T AI market potential. - Product innovations like Operator AI and o1 model, plus $11.6B 2025 revenue projections, highlight OpenAI's disruptive potential in tech sectors. - Young investor Samik Sidhu's $72,700 AI-linked gains mirror broader trends, as Microsoft-NVIDIA partnerships and Stargate Project amplify expectations. - Legal risks (copyright lawsuits) and Microsoft dependency con