$33,000,000,000 in 6 Hours Gained by Crypto Market in Massive Reversal

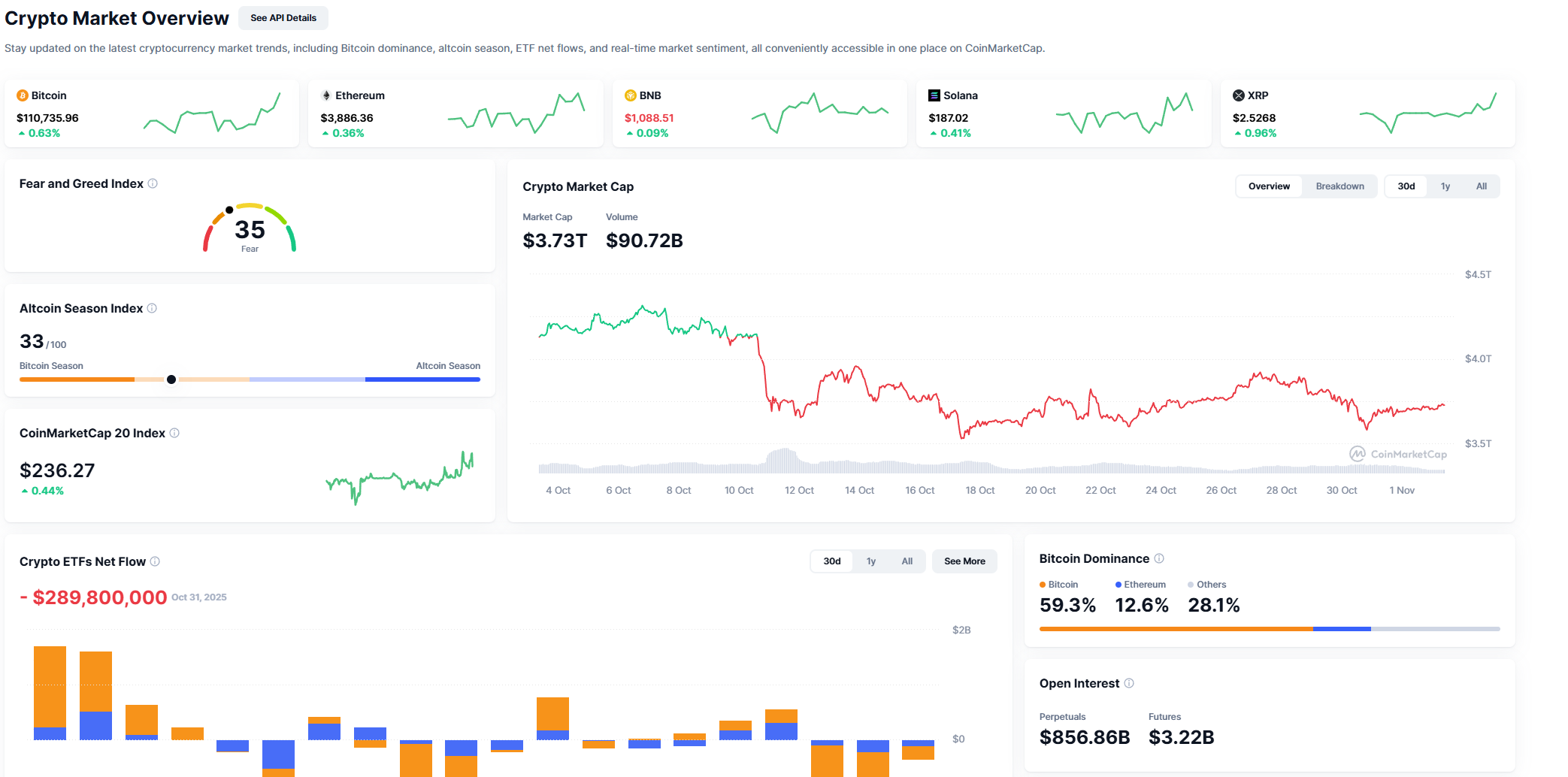

The cryptocurrency market experienced an abrupt surge of bullish momentum, adding over $33 billion in total capitalization in just six hours, indicating a short-term shift in traders’ risk-on stance. Bitcoin, Ethereum and XRP led the charge as the rally propelled almost all significant assets into the green.

Massive market growth

Bitcoin increased 0.67% to approximately $110,700, while Ethereum (ETH) increased 1.22% to regain the $3,850 mark, according to market data. Following closely behind, XRP saw a daily gain of 11%, which was sufficient to overtake BNB and reclaim the fourth-largest cryptocurrency position by market capitalization.

At $152.2 billion, XRP’s total market capitalization is now ahead of BNB’s $150.4 billion, a slight but significant lead that indicates a resurgence of investor interest. Solana (+1.04%), Cardano (+0.62%) and Dogecoin (+0.61%) are all included in the sea of green that is the overall market heat map.

Staying positive

As Bitcoin’s stable position above its 200-day moving average restored some confidence, buying pressure briefly increased even for smaller-cap assets. The technical setup for Bitcoin is still cautiously optimistic, it is still above the crucial $108,000 support zone, and the next resistance cluster is forming close to $113,800-$114,000, which is in line with the 100-day moving average.

Ahead of significant macro data releases, the timing of the rally points to aggressive short liquidations and updated institutional positioning. Although most large caps’ RSI levels are still neutral, this move might be more of a relief rally than the beginning of a full-scale bull run.

Right now, all eyes are on XRP, whose return to the fourth spot may spark new conversations about its long-term potential in payments and remittances. The general lesson, however, is obvious: traders are back in action, liquidity is returning, and the cryptocurrency market has just served as a reminder to everyone of how quickly momentum can change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. and China Reach Rare Earth Agreement: One Year of Stability Despite Ongoing Competition

- China suspended new export controls on rare earths and other materials for one year, easing U.S.-China trade tensions via a Trump-Xi agreement. - The deal includes U.S. tariff rollbacks and China halting investigations into semiconductor firms like Nvidia , with provisions expiring in 2026. - Experts warn China's 90% refining dominance and low-cost production ensure its strategic leverage remains unchallenged despite temporary concessions. - U.S. rare earth stocks rose, but analysts stress global supply

Bitcoin Updates: Clash Between State Legislation and Community Interests: Texas Community Fails to Enforce Regulations on Bitcoin Mining Operation

- Mitchell Bend, Texas residents rejected incorporation by 25% to regulate a Bitcoin mine's noise pollution, highlighting tensions between crypto operators and communities. - Marathon Digital Holdings opposed the move, filing a 47-page lawsuit claiming it violated state law and would harm operations, but a federal judge denied its restraining order request. - Proponents vowed to continue legal battles through Earth Justice, citing health complaints like sleep disturbances and nausea linked to the mine's co

Bitcoin Updates: Texas Community's Attempt to Control BTC Mining Falls Short, Underscoring Ongoing Regulatory Hurdles for the Industry

- Hood County voters rejected Mitchell Bend's incorporation bid by 25%, blocking noise regulations on MARA's Bitcoin mining facility. - MARA sued over petition flaws, claiming the proposed city aimed to "regulate it out of business," but the case was dismissed before the vote. - Residents cited environmental concerns while MARA implemented noise mitigation measures, highlighting tensions between crypto mining and local communities. - The outcome underscores regulatory challenges for Texas-based miners as l

Lina Khan will serve as co-chair for the transition team of New York City’s incoming mayor, Zohran Mamdani