Crypto Hacks Fall 85% In October 2025 – But How?

Most crypto hack losses in October 2025 stemmed from major security incidents at Garden Finance, Typus Finance, and Abracadabra.

The cryptocurrency market experienced a rare moment of relief in October, as the total value lost to hacks and exploits reached its lowest level of the year.

Data from blockchain security firm PeckShield shows that only $18.18 million was stolen across 15 separate incidents. This represents a steep 85.7% decline from the $127.06 million recorded in September.

Crypto Hacks Hit Year-Low Even as New Risks Emerge

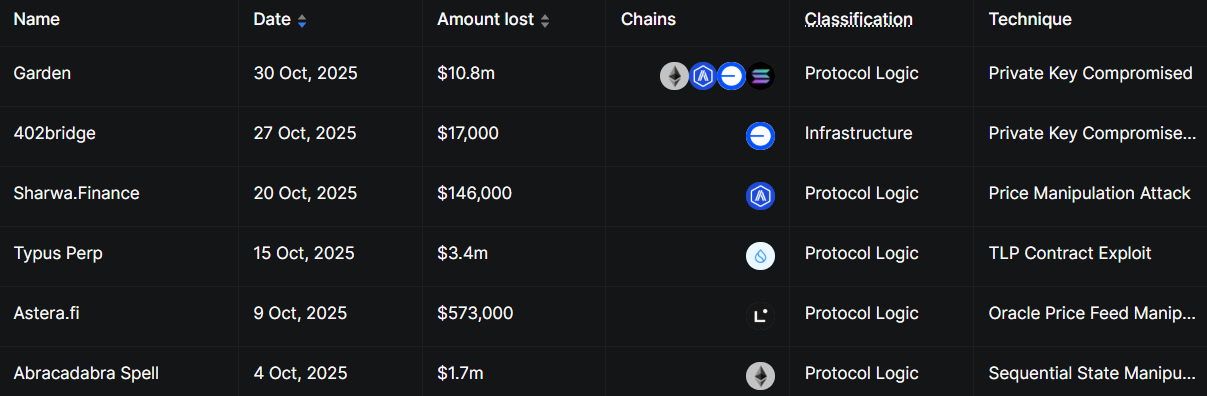

The largest incidents of the month occurred at Garden Finance, Typus Finance, and Abracadabra, which collectively accounted for $16.2 million of the total stolen funds.

Top Crypto DeFi Hacks in October 2025. Source:

Top Crypto DeFi Hacks in October 2025. Source:

Garden Finance, a Bitcoin peer-to-peer protocol, disclosed on October 30 that it had been exploited for more than $10 million after one of its solvers was compromised.

The breach, which affected only the solver’s own inventory, pushed October’s loss figures higher in the final hours of the month.

Without the Garden Finance incident, total losses would have hovered near $7.18 million — the lowest single-month value since early 2023.

Typus Finance, a yield platform built on Sui, suffered an oracle manipulation attack on October 15. The exploit drained roughly $3.4 million from its liquidity pools.

Investigators later traced the attack to a flaw in one of its TLP contracts, which caused the project’s native token to drop by about 35%.

Around the same time, DeFi lending platform Abracadabra endured its third exploit since launch. The attack resulted in roughly $1.8 million in MIM stablecoin losses after hackers bypassed solvency checks through a smart contract vulnerability.

While October’s modest loss figures suggest improved protocol security, cybersecurity experts warn that the threat landscape continues to evolve.

Earlier this month, BeInCrypto reported that state-sponsored groups, particularly North Korea-linked hackers, are experimenting with embedding malicious code directly into blockchain networks. This emerging tactic could bypass traditional security layers and create new risks for decentralized systems.

Essentially, this emerging phase of blockchain-focused cyberwarfare highlights a sobering reality that while DeFi protocols strengthen their defenses, threat actors continue to evolve at the same pace.

So, the industry’s best month of 2025 may therefore mark a temporary reprieve rather than the start of lasting safety.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Mastercard’s Blockchain Initiative: Regulated Networks Set to Transform International Payments

- Mastercard explores $1.5B-$2B acquisition of MiCAR-licensed crypto infrastructure firm Zerohash to expand Web3 capabilities. - Partners with Ripple to pilot RLUSD stablecoin for credit card settlements on XRP Ledger, enabling instant cross-border transactions. - Zerohash's regulatory compliance and $1B valuation align with Mastercard's strategy to bridge traditional finance and blockchain infrastructure. - RLUSD's NYDFS-backed growth and XRP Ledger integration could reshape global payments while reinforc

DoorDash Shares Drop 10% as Focus on Growth Reinvestment Outweighs Earnings Outperformance

- DoorDash's stock fell over 10% post-earnings despite $3.45B revenue beat, driven by 25% GOV growth and 21% order increase. - Management signaled $300M+ 2026 AI/tool investments and revised Deliveroo's EBITDA contribution down by $32-40M due to accounting changes. - Analysts cut price targets (Wells Fargo to $239) as $754M adjusted EBITDA (up 41%) was overshadowed by reinvestment concerns despite $723M free cash flow. - 42% YTD gains amplified sell-off sensitivity, with 31 analysts retaining "Moderate Buy

Savers Confront a Choice: Lock in Safe 5% Returns or Chase DeFi's Tempting 12%

- Fed rate cuts in 2025 spurred high-yield savings accounts offering up to 5.00% APY, outpacing traditional banks' 0.40% average. - DeFi platforms like ZEROBASE and Maple Finance offer 12-7% APY on stablecoins, but require higher risk tolerance and short liquidity periods. - Banks may reduce APYs if further Fed cuts occur, while FDIC-insured high-yield accounts remain popular for inflation protection. - Alternative assets like Bitcoin and dividend stocks (e.g., Viper Energy's 3.49% yield) show growing comp

Bitcoin News Update: Institutions Remain Wary as Retail Investors Drive Crypto Innovation—The Battle for Dominance Escalates

- Bitcoin fluctuates near $110,000 amid ETF outflows and revised institutional price targets, with long-term holders creating resistance through strategic BTC distributions. - Ethereum and XRP show resilience with ETF inflows and whale activity, while emerging projects like Remittix ($27.8M raised) and Noomez gain traction through innovative tokenomics. - Analysts remain divided: some see $120,000 potential if Bitcoin breaks key averages, while others warn of $72,000 corrections amid macroeconomic uncertai