Billions on the Move: October’s Winners and Losers in the Stablecoin Market

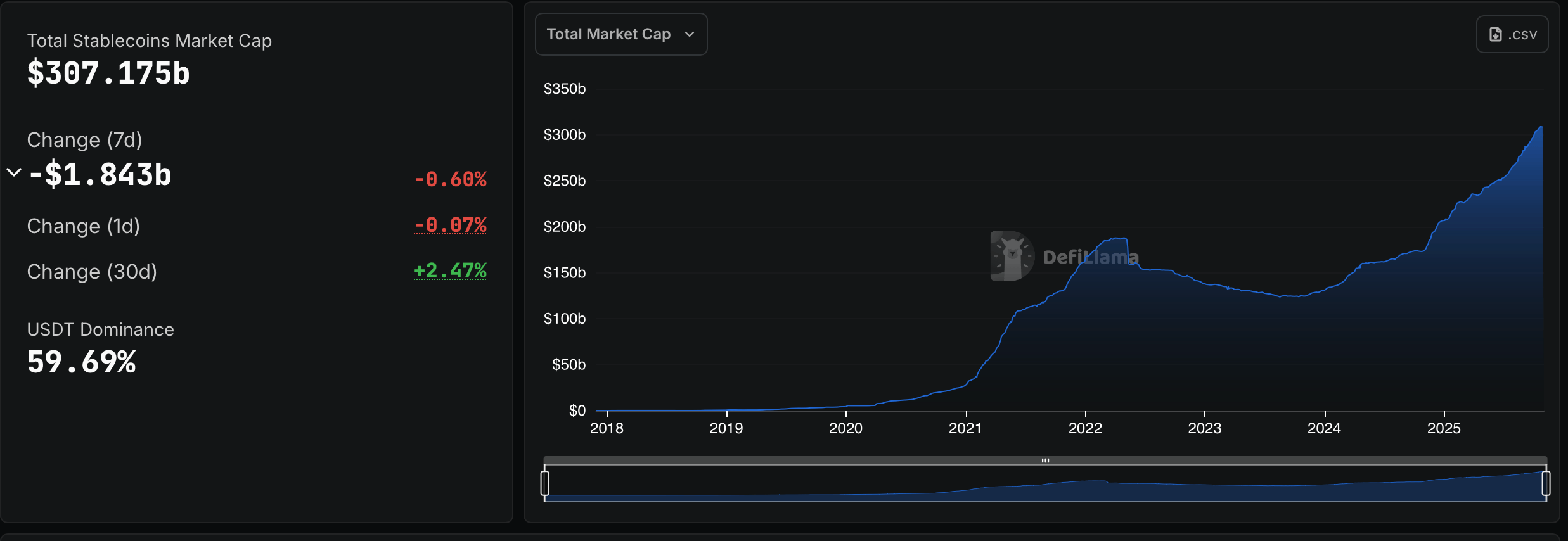

The latest data from defillama.com shows the stablecoin market didn’t skip a beat in October, climbing 2.47% even after trimming $1.84 billion in the past week. Tether ( USDT) was the main heavyweight, swelling its market cap by roughly $7.78 billion during the monthlong stretch.

October’s Stablecoin Snapshot: Who Rose, Who Fell, and Who’s Still Dominant

USDT continues to reign supreme, Defillama figures show it flexing a 4.43% monthly climb to a hefty $183.35 billion market cap. It currently commands 59.69% of the stablecoin sector’s $307.175 billion total value.

Circle’s USDC had its own moment in the spotlight this week, finally breaking past the $75 billion milestone. The runner-up stablecoin tacked on $1.744 billion, marking a 2.36% gain and landing at a tidy $75.51 billion cap.

Ethena’s USDe took a nosedive in October, tumbling 36.57% to settle at $9.36 billion after losing a hefty $5.39 billion in just a month. Sky Dollar (USDS) had a brighter story, leaping 21.67% to hit $5.19 billion, while DAI barely budged—up a modest 0.61% to $5.10 billion.

World Liberty Financial’s USD1 added some flair with an 11.08% lift to $2.98 billion, and Paypal’s PYUSD joined the climb, popping 14.82% to reach $2.81 billion. According to Defillama, Blackrock’s BUIDL inched up 2%, bringing its total to $2.59 billion.

Falcon USD (USDf) took flight with a 24.35% jump to $2.02 billion, while Ethena’s USDtb barely moved, ticking up 0.17% to $1.83 billion. Global Dollar (USDG) rocketed 37.84% to $991.35 million, and rounding out the top 12, Ripple’s RLUSD kept pace with a 21.97% climb to $963.09 million.

Overall, the stablecoin sector showed a mix of steady gains and sharp dips in October, with USDT and USDC tightening their grip on dominance. While Ethena’s USDe stumbled, several competitors like USDG and RLUSD posted eye-catching growth.

The month’s movements highlight how capital keeps flowing across the stablecoin spectrum, even amid the shifting market tides we’ve seen in recent times.

FAQ ❓

- What is the total value of the stablecoin market?

The global stablecoin market is valued at about $307.175 billion as of Oct. 2025. - Which stablecoin holds the largest market share?

Tether ( USDT) leads the pack with 59.69% of the total stablecoin market. - How much is Circle’s USDC worth now?

USDC recently crossed the $75 billion mark in market capitalization. - Which stablecoin saw the biggest decline in October?

Ethena’s USDe dropped 36.57%, losing more than $5 billion in value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Regulatory Concerns Intensify with the Introduction of South Korea's KRW1 Stablecoin into Arc's International Network

- Circle's Arc blockchain, designed as an "economic operating system," offers sub-second finality and USDC-based fees to streamline global finance. - South Korea's BDACS plans to deploy KRW1, a won-pegged stablecoin on Arc's testnet, bridging Korean markets to global stablecoin networks. - Arc's testnet has attracted 100+ institutions including BlackRock and Visa, aiming to redefine cross-border payments and asset tokenization. - Regulatory debates persist as South Korea's Bank of Korea proposes restrictin

Bitcoin News Update: BlackRock's ETF Supremacy Raises Concerns for Altcoin Futures

- BlackRock's iShares Bitcoin Trust ETF dominated 2025 with $28.1B inflows, overshadowing $1.27B outflows from other spot Bitcoin ETFs. - Altcoin ETFs face uncertainty without BlackRock's support, despite JPMorgan/Bitget's $3–8B inflow projections for Solana and XRP. - DeFi innovation advanced via Avalanche's BTC.b bridging, while Blazpay and BullZilla presales attracted $1M+ in speculative capital. - Bitcoin traded near $110,000 amid $488M ETF outflows, with Saylor forecasting $150,000 by year-end driven

Romania Prohibits Unregulated Prediction Markets, Classifying Them as Gambling

- Romania's ONJN banned unlicensed prediction market Polymarket, classifying its user-driven bets on real-world events as gambling requiring a license. - Regulators warned that treating counterparty betting as "trading" creates legal risks for player protection, AML compliance, and state revenue collection. - The crackdown follows $600M+ in wagers on Romanian elections and joins bans in France, Belgium, and the U.S., where Polymarket faces EU licensing hurdles. - Despite securing a CFTC-licensed exchange a

Monero Faces a $342 Test: The Assurance of Privacy Against Widespread Doubt

- Monero (XMR) trades near $342, with traders monitoring key support/resistance levels amid mixed sentiment. - Analysts highlight $342 as a critical threshold; breakouts could drive bullish momentum, while dips below $325 risk corrections. - Privacy coin faces challenges from regulatory uncertainty and cautious institutional adoption despite growing DeFi use cases. - Broader crypto market shows mixed trends, with NFT sales declining and tech stocks like Nvidia surging.