Japan is on the verge of a major overhaul in how its banks interact with cryptocurrency. The Financial Services Agency (FSA) is proposing reforms that would allow Japanese banks to hold digital assets for investment purposes, marking a major move that breaks with current rules.

Under the plan, banks’ securities subsidiaries could also register as crypto-asset service providers (CASPs), giving them the ability to offer trading and exchange services directly to clients.

Sponsored

Regulators say the goal is to bring crypto into the mainstream financial system while protecting investors through established, trusted institutions.

Japan’s major banks, including Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho, are among the largest in the world by assets and maintain extensive international operations. Their potential entry into crypto could not only expand domestic adoption but also influence global trade, investment, and cross-border digital asset activity.

Currently, despite the push toward wider adoption, the FSA remains cautious about risks, particularly price volatility, and plans to require banks to issue clear warnings about potential losses.. If approved, the reforms are expected to take effect by the end of 2025.

The FSA announced that its “Working Group on Crypto Asset Systems” will hold its fifth meeting next Friday, November 7, highlighting that regulatory discussions are ongoing.

Rapid Adoption Drives Change

Japan has long been a pioneer in crypto regulation. It was one of the first major economies to establish a formal licensing system for exchanges in 2017, giving the market legal clarity and investor protection.

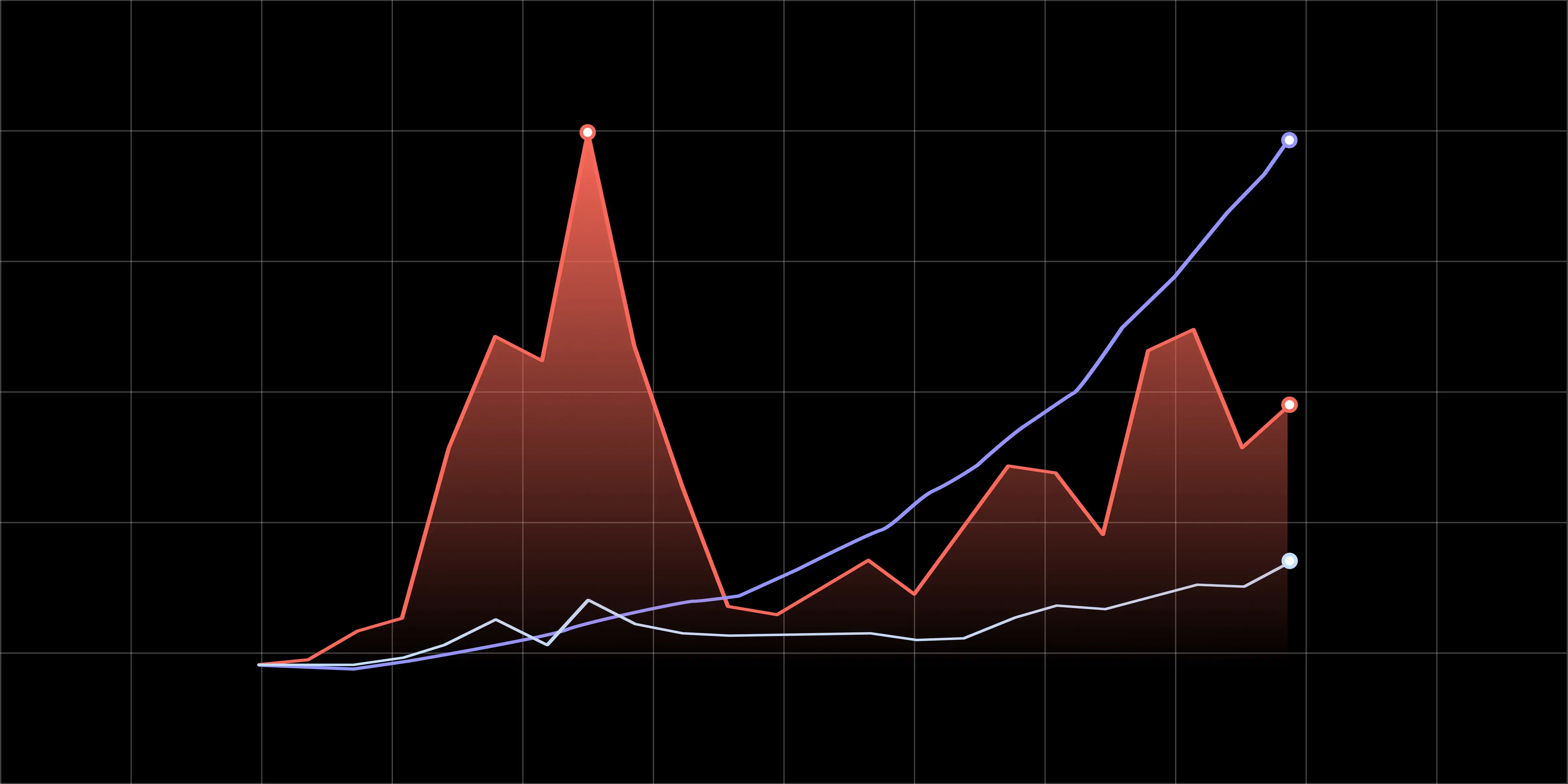

Crypto adoption in the country has skyrocketed. By February 2025, more than 12 million accounts were registered—a more than threefold increase over five years—placing Japan among the top nations for crypto adoption per capita.

Activity on the blockchain has kept pace with this growth. From July 2024 to June 2025, the total value of crypto received in Japan jumped 120% year-on-year, highlighting the country’s expanding role in the global digital asset ecosystem.

On the Flipside

- Market players are already reacting. Bybit has temporarily suspended new user registrations from Japanese residents starting today, as it prepares for stricter local regulations.

Why This Matters

The changes signal a strategic shift in Japan’s approach: integrating crypto into traditional banking while balancing innovation with oversight.

Delve into DailyCoin’s hottest crypto news today:

Pi Crafts “Android For Robots” With OpenMind, Eyes $0.40

OpenAI Eyes $1 Trillion IPO, Aims to Fund Next Phase of AI

People Also Ask:

Japan has a clear legal framework for cryptocurrency, governed by the Financial Services Agency (FSA). Exchanges must register as Crypto-Asset Service Providers (CASPs) and comply with anti-money laundering, cybersecurity, and investor protection rules.

Currently, Japanese banks cannot directly hold or trade crypto for clients. However, recent proposals could allow banks and their securities subsidiaries to hold digital assets and register as CASPs.

By February 2025, over 12 million accounts were registered, and on-chain activity surged, showing Japan as one of the top countries in crypto adoption per capita.