Top 5 Cryptocurrency Predictions for 2026: Crossing Cycles and Breaking Boundaries

End of the four-year cycle: Five major disruptive trends in cryptocurrency by 2026.

Original Author: Alexander S. Blume

Original Translation: AididiaoJP, Foresight News

At the end of last year, I predicted that 2025 would be a “transformative year of implementation” for digital assets, as significant progress had already been made toward mainstream adoption in both retail and institutional markets. This prediction has been validated in several ways: increased institutional allocation, more real-world assets being tokenized, and the continuous development of crypto-friendly regulation and market infrastructure.

We have also witnessed the rapid rise of digital asset treasury companies, though their path has not been smooth. Since then, as bitcoin and ethereum have become more deeply integrated into the traditional financial system and gained broader adoption, the prices of both have risen by about 15%.

It is now indisputable that digital assets have entered the mainstream. Looking ahead to 2026, we will see continued market maturation and evolution, with exploratory attempts giving way to more sustainable growth. Based on recent data and emerging trends, here are my five major predictions for the crypto sector in the coming year.

1. DATs 2.0: Bitcoin Financial Services Businesses Will Gain Legitimacy

Digital asset treasury companies have experienced rapid expansion this year, but not without growing pains. From flavored alcoholic beverages to sunscreen brands, all kinds of companies have rebranded themselves as buyers and holders of crypto, leading to investor skepticism, regulatory pushback, mismanagement, and depressed valuations—all of which have troubled this model.

Amid the wave of emerging companies, some DATs have also started holding assets we might call “altcoins,” but in reality, most of these projects lack historical performance or investment value and are merely speculative tools. In the coming year, many of the issues in the DAT market and its operating strategies will be resolved, and those entities truly operating on a bitcoin standard will find their place in the public markets.

Many DATs, even the largest ones, will see their stock prices begin to more closely reflect the value of their underlying assets. Management will face pressure to create value for shareholders more effectively. It is well known that a company simply holding a large amount of bitcoin while doing nothing (and maintaining large expenses such as private jets and high management fees) is not a good thing for shareholders.

2. Stablecoins Will Be Everywhere

2026 will be the year of widespread adoption for stablecoins. It is expected that USDC and USDT will be used not only for trading and settlement but will also penetrate more traditional financial transactions and products. Stablecoins may appear not only on crypto exchanges but also in payment processors, enterprise treasury management systems, and even cross-border settlement systems. For businesses, their appeal lies in enabling instant settlement without relying on slow or costly traditional banking channels.

However, similar to the DATs sector, the stablecoin market may also become oversaturated: too many speculative stablecoin projects launching, too many consumer-facing payment platforms and wallets emerging, and too many blockchains claiming to “support” stablecoins. By the end of this year, we expect many of the more speculative projects to be eliminated or acquired, and the market will consolidate under those more well-known stablecoin issuers, retailers, payment channels, and exchanges/wallets.

3. We Will Say Goodbye to the “Four-Year Cycle” Theory

I am now formally predicting: the “four-year cycle” theory of bitcoin will be officially declared dead in 2026. Today’s market is broader, with greater institutional participation, and no longer operates in a vacuum. In its place will be a new market structure and a continuous buying force, pushing bitcoin toward a trajectory of sustained, incremental growth.

This means overall volatility will decrease, and its function as a store of value will become more stable, which should attract more traditional investors and market participants globally. Bitcoin will evolve from a trading tool into a new asset class, accompanied by more stable capital flows, longer holding periods, and generally fewer so-called “cycles.”

4. U.S. Investors Will Be Allowed Access to Offshore Liquidity Markets

As digital assets become more mainstream and with favorable government policy support, changes in regulation and market structure will allow U.S. investors to access offshore crypto liquidity. This may not be a sudden shift, but over time, we will see more approved affiliated institutions, improved custody solutions, and offshore platforms that can meet U.S. compliance standards.

Certain stablecoin projects may also accelerate this trend. USD-backed stablecoins are already able to move across borders in ways that traditional banking channels cannot achieve. As major issuers enter regulated offshore markets, they are expected to become bridges connecting U.S. capital with global liquidity pools. In short, stablecoins may ultimately achieve what regulators have long failed to properly address: connecting U.S. investors to international digital asset markets in a clear and traceable manner.

This is crucial because offshore liquidity plays a key role in price discovery in digital asset markets. The next stage of market maturity will be the standardization of cross-border market operations.

5. Products Will Become More Complex and Sophisticated

In the new year, bitcoin-related debt and equity products, as well as trading products focused on bitcoin-denominated returns, will reach new levels of complexity. Investors, including those who have previously shunned digital assets, will embrace this newer, more sophisticated product suite.

We are likely to see structured products using bitcoin as collateral, as well as investment strategies designed to generate real yield from bitcoin exposure (rather than simply betting on price movements). ETF products are also beginning to go beyond simple price tracking, offering yield through staking or options strategies, although fully diversified total return products remain limited for now. Derivatives will become more complex and better integrated with standard risk frameworks. By 2026, bitcoin’s function will likely no longer be primarily as a speculative tool, but increasingly as a core component of financial infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin starts $100K ‘capitulation’ as BTC price metric sees big volatility

Ripple Unlocking 1 Billion XRP Worth $2.5 Billion on November 1st

Ethereum’s Fusaka Upgrade Coming, Despite Price Struggles

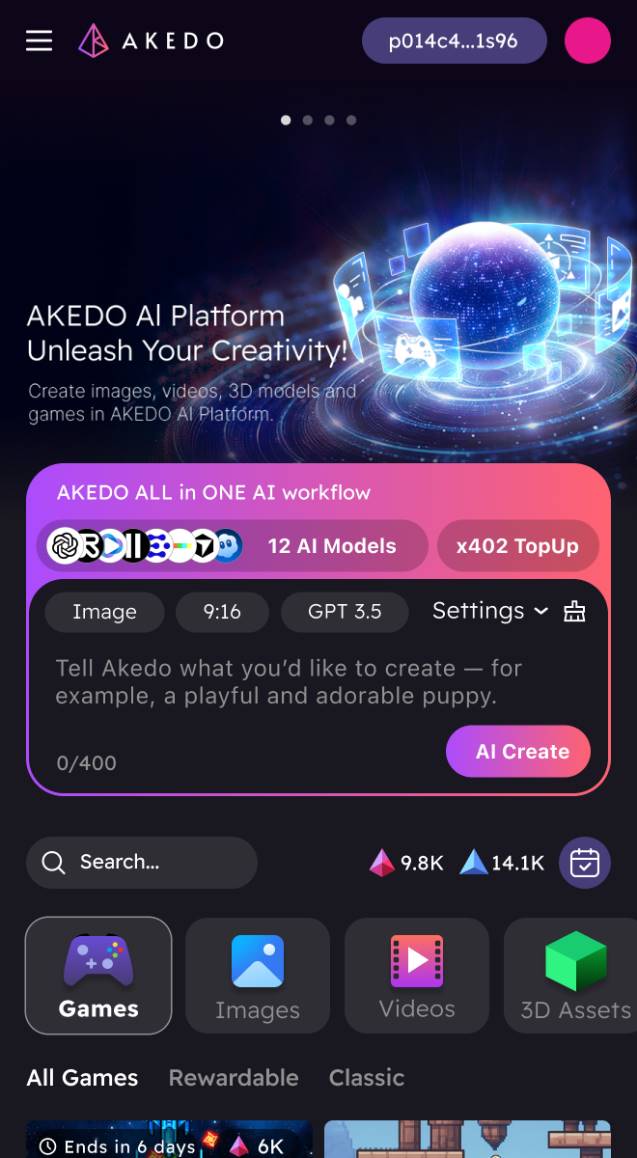

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.