Bitcoin Updates: Markets Tread Delicate Balance as Fed Remains Cautious, Crypto Prices Fluctuate, and Trade Agreements Remain Unstable

- Fed's cautious policy and unresolved trade tensions weigh on crypto markets, with Bitcoin below $108,000 amid $1.1B in liquidations. - Trump-Xi trade truce reduces U.S. tariffs to 47% but fails to fully address fentanyl issues, limiting bullish market reactions. - Crypto regulatory clarity emerges as Senate CFTC bill expands oversight, while institutions deepen digital asset integration. - Market stability remains fragile as Fed delays confirm policy uncertainty, complicating crypto recovery despite long

With the Federal Reserve refraining from major liquidity support, global markets are left in a delicate balance as trade relationships shift and the cryptocurrency industry experiences turbulence. Even after the central bank’s recent 25-basis-point rate reduction and the end of its quantitative tightening (QT) phase, assets such as

The summit between Trump and Xi in Busan, South Korea, represented a significant yet measured move toward easing trade friction. The U.S. lowered tariffs on Chinese goods from 57% to 47% and obtained promises from China to restart rare earth exports and strengthen controls on fentanyl shipments, according to

Meanwhile, the Fed’s more accommodative stance has not yet sparked a clear shift toward riskier assets. Although ending QT should, in theory, improve liquidity, Chair Jerome Powell’s comments introduced uncertainty by indicating that a rate cut in December is not assured, as

Adding to these challenges, the crypto industry stands at a regulatory turning point. The Senate Agriculture Committee is set to introduce a bill on crypto market structure, aiming to clarify the CFTC’s role in overseeing digital commodities and expanding its reach to spot and derivatives markets,

Still, confidence is cautious. Michael Saylor of MicroStrategy forecasts that Bitcoin could climb to $150,000 by the end of 2025, fueled by institutional participation and a maturing derivatives market,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: France Embraces Bitcoin and Stablecoins While ECB Advances Digital Euro Plans

- ECB accelerates digital euro plan for 2029 rollout to modernize eurozone finance and reduce cash reliance. - French lawmakers oppose it, citing privacy risks and advocating crypto/stablecoins as alternatives. - Global CBDCs advance, with Hong Kong’s e-HKD pilot and U.S. stablecoin-friendly policies. - Stablecoins like USDC gain traction, outpacing USDT with regulatory compliance and institutional adoption.

Milk Mocha: Blending Rarity and Emotion to Create Value in Crypto

- Milk Mocha ($HUGS) presale has become 2025's most anticipated meme coin with record whitelist signups and deflationary tokenomics. - The 40-stage presale burns unsold tokens weekly, creating scarcity while community governance and bear-themed branding drive engagement. - Analysts highlight its structured approach to value retention, contrasting with traditional meme coins' inflationary pitfalls through transparent on-chain burns. - Combining emotional branding with DAO governance and NFT integrations, $H

Rocket’s Rapid Growth and Leonardo’s Divestment Indicate Major Changes in the Industry

- Rocket Companies' Q3 2025 revenue surged 31.1% to $1.75B, driven by mortgage demand and Redfin acquisition, despite EPS dropping 50% to 4 cents. - Leonardo SpA announced a 9.4% Avio stake sale for €400M, reducing ownership to 19%, to fund Italy's space sector expansion amid rising aerospace demand. - Rocket's digital mortgage modernization and Leonardo's portfolio optimization highlight sector shifts toward tech-driven growth and strategic reinvestment.

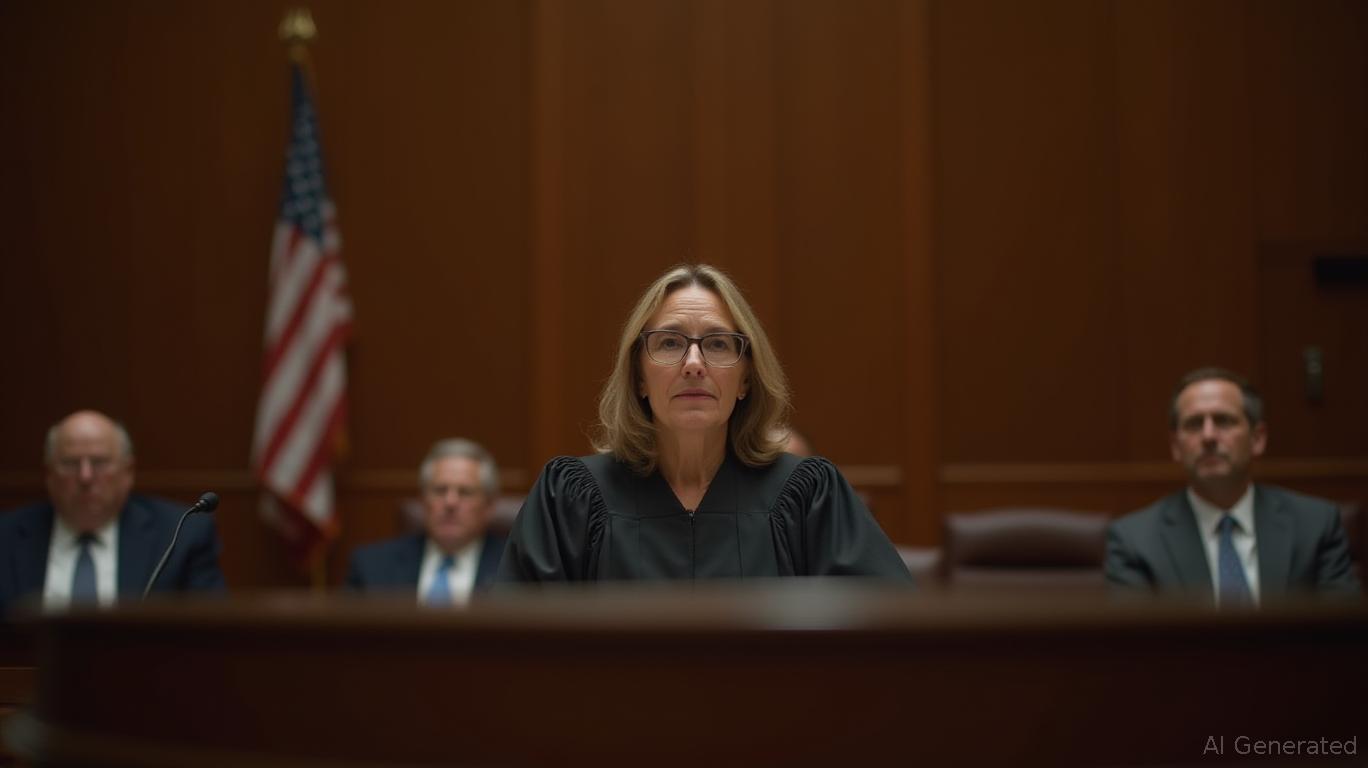

Court Upholds Federal Authority to Exclude Crypto Banks Due to Systemic Risk

- U.S. appeals court upheld Fed's denial of Custodia Bank's master account request, citing systemic risk concerns over crypto exposure. - Court rejected Custodia's argument that Fed violated statutory access rules, affirming central bank's discretion to block high-risk institutions. - Judge Tymkovich dissented, asserting Fed's statutes mandate access for eligible banks regardless of asset focus. - Custodia may seek rehearing amid potential jurisdictional splits and hinted at leveraging future Fed leadershi