Key Market Information Discrepancy on October 31st, a Must-See! | Alpha Morning Report

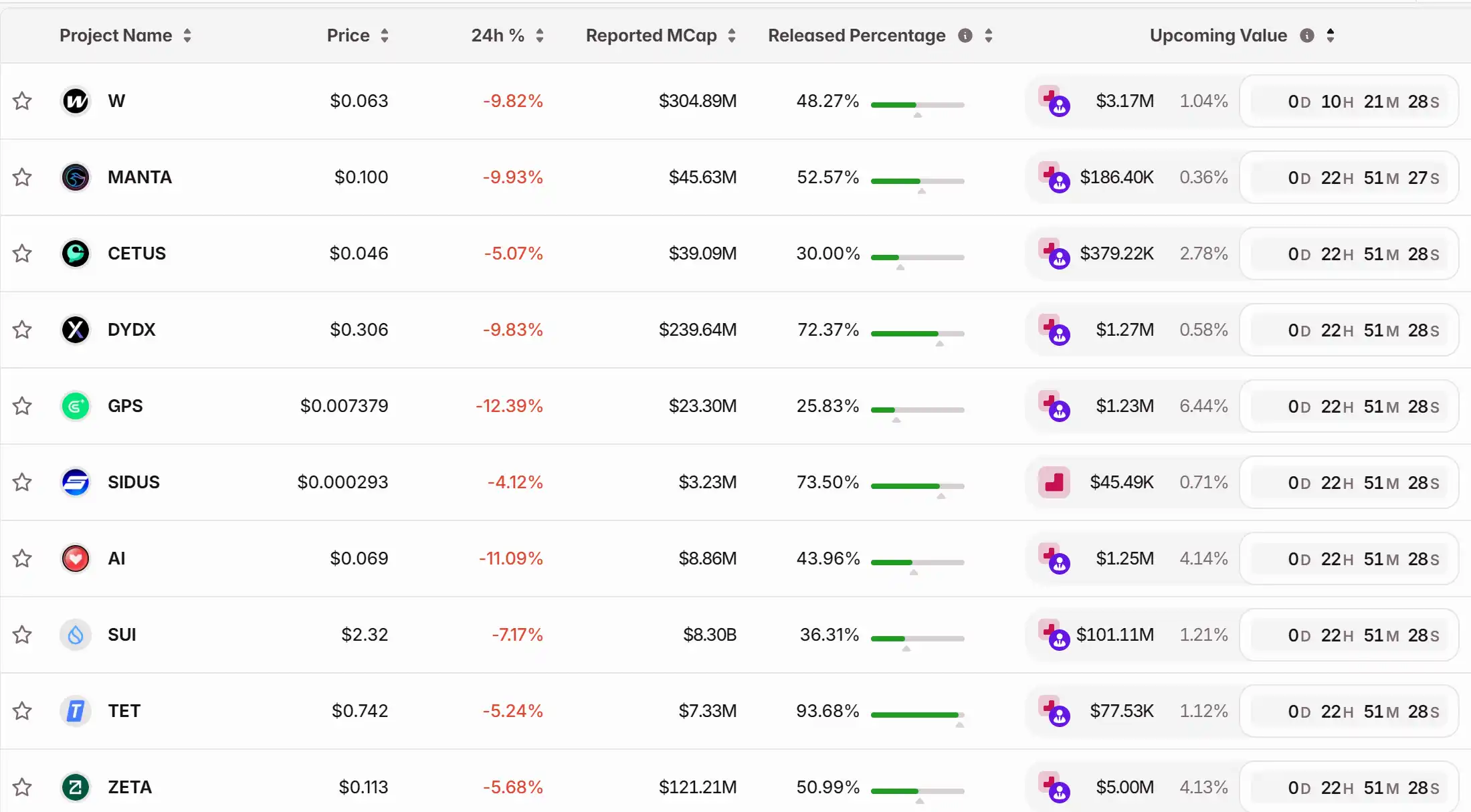

1. Top News: Ethereum's next major upgrade "Fusaka" is scheduled to go live on December 3rd 2. Token Unlock Schedule: $W, $MANTA, $CETUS, $DYDX, $GPS, $SIDUS, $AI, $SUI, $TET, $ZETA

Top News

1.Ethereum's Next Major Upgrade 'Fusaka' Scheduled to Go Live on December 3

2.Bitcoin Surges Past $110,000

5.$1.134 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Long Positions

Articles & Threads

1. "Making Money While Giving Away Money: Recent Developments in Top Perp DEXs"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXs) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, followed by Lighter at $86.16 billion in second place, Hyperliquid at $59.58 billion in third, with edgeX and ApeX Protocol ranking fourth and fifth with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX track, monitoring the developments of these top five platforms should provide a good sense of the overall direction of the industry.

2. "A Mysterious Team That Dominated Solana for Three Months Is Going to Launch a Coin on Jupiter?"

An anonymous team without a website or community that consumed nearly half of the transaction volume on Jupiter in 90 days. To better understand this mysterious project, we need to first delve into an on-chain transaction revolution quietly happening on Solana.

Market Data

Daily Marketwide Funding Rate (as reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Rising Number of XRP Wallets Sparks Optimism for Crypto Summer as Institutions Increase Investments

- XRP sees 21,595 new wallets in 48 hours, Santiment's largest surge in eight months, as price rebounds from $2.2 support. - Technical indicators show bullish RSI divergence and potential reversal patterns, with $2.6 resistance as key hurdle. - Ripple's $500M institutional investment and Mastercard-led RLUSD integration boost XRP's institutional adoption and regulatory clarity. - Ethereum's ecosystem expansion and potential XRP ETF listings amplify crypto summer optimism amid Fed's QE expectations.

Zinc's Decline: An Early Warning Sign for the Crypto Industry

- Digital asset treasuries face sharp sell-offs as investor confidence wanes, with the S&P GSCI Zinc Index dropping 1.56% on Nov 5, 2025. - The zinc index's volatility mirrors crypto market declines, signaling a shift to safer assets amid regulatory uncertainty and macroeconomic pressures. - SEC actions against crypto platforms have intensified market jitters, with analysts warning of cascading liquidations if declines persist. - Zinc's performance now serves as a key barometer for digital asset risk, refl

Dogecoin News Today: Dogecoin's Unstable Buzz Fades as ETFs Turn Attention to Alternative Coins

- Dogecoin (DOGE) hovers near $0.15704, with analysts warning a breakdown could trigger sharp declines amid waning retail and institutional interest. - On-chain data and derivatives metrics signal deteriorating sentiment, as Bitcoin/Ethereum ETF outflows shift capital toward altcoins like Solana . - Weak large-holder support and declining community-driven hype expose DOGE to volatility, with prices at risk of falling below $0.15 without fundamental catalysts.

Chainlink and SBI Join Forces to Integrate Blockchains and Boost Institutional Adoption of Tokenized Assets

- Chainlink partners with SBI Digital Markets to build cross-chain digital asset solutions using CCIP technology. - Collaboration aims to accelerate institutional adoption of tokenized assets via secure multi-chain operations and existing pilots with UBS . - CCIP addresses blockchain interoperability challenges, positioning SBI Group as a key player in Japan's regulated digital asset market. - Recent partnerships with Ondo Finance highlight growing demand for cross-chain infrastructure in tokenized real-wo