ETC has dropped by 38.51% over the past year as the market remains uncertain

- ETC fell 38.51% in 1 year amid market uncertainty, with 16.43% monthly and 3.57% weekly declines. - Technical indicators show bearish bias, weak RSI/MACD, and institutional selling pressure above key moving averages. - Analysts highlight macroeconomic risks and lack of bullish catalysts, with traders adopting defensive strategies like put options. - Backtest analysis of -10%+ declines could reveal recovery probabilities and optimal trading strategies for current consolidation patterns.

As of October 30, 2025, ETC experienced a 0.06% decrease over the past day, settling at $15.42. Over the previous week, it declined by 3.57%, fell 16.43% in the last month, and dropped 38.51% over the past year. This ongoing slide highlights persistent weakness in the asset, sparking concerns about its future resilience and chances for a rebound.

Throughout the past year, ETC’s price has shown considerable volatility, with steep pullbacks amid widespread market instability. Although there have been brief periods of stabilization, the asset has struggled to recover the upward momentum it had earlier in the year. Experts believe that both macroeconomic trends and industry-specific factors will keep influencing its direction.

Technical analysis presents a mixed outlook. Some short-term chart patterns hint at a possible bottom, but the broader trend continues to point downward. The lack of strong positive drivers has left ETC vulnerable to additional declines. Notably, the asset has been unable to stay above important moving averages, indicating that institutional selling may still be weighing on the price.

ETC’s technical setup also reveals a growing bearish sentiment, with both the RSI and MACD indicators showing little support for short-term rallies. This has prompted traders to adopt more defensive strategies, increasing their use of put options and hedging. Investors are now watching closely for a breakout from the current consolidation phase, which could trigger a more significant move in either direction.

Backtest Hypothesis

One could design a backtesting strategy to review how ETC has performed in similar market environments in the past. By pinpointing periods since January 1, 2022, where the asset declined by at least 10% over a year, it’s possible to examine how it behaved in the months that followed. For instance, such a backtest might reveal the average returns over 1, 3, and 6 months after these drops, as well as the best holding periods for maximizing gains. This method would help estimate the likelihood of a recovery and determine if a systematic trading plan could have reduced losses or captured profits in these situations. In light of current technical signals, these findings could help traders and investors identify potential entry or exit opportunities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary Capital Sets November 13 Launch for XRP Spot ETF

Canary Capital removes delay clause in updated S-1 filing, confirming XRP Spot ETF launch on November 13.XRP Spot ETF Nears Launch with New S-1 FilingWhy Removing the ‘Delaying Amendment’ MattersGrowing Institutional Interest in XRP

BlockDAG’s $435M+ Presale and Testnet Outshine Filecoin & Chainlink in 2025’s Investing in Crypto Race

See why BlockDAG’s $435M+ presale, verified testnet, and hybrid system make it the top choice for investing in crypto compared to Filecoin and Chainlink.Filecoin’s Gradual Rise Shows Renewed ConfidenceChainlink’s On-Chain Data Reveals Heavy Whale BuyingBlockDAG’s Verified Testnet Redefine Investing in CryptoLooking Ahead: Why BlockDAG Leads the 2025 Market

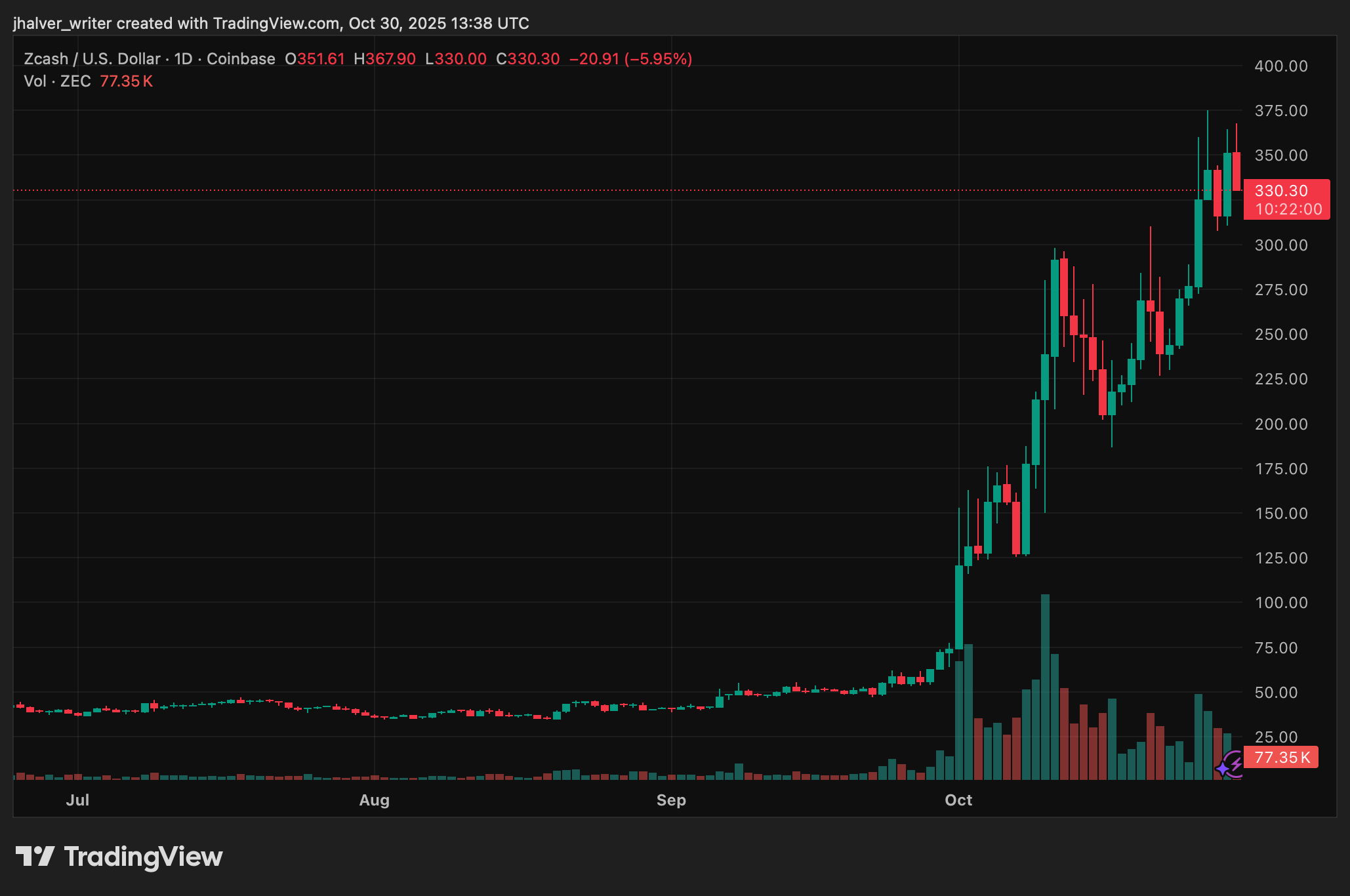

Zcash Rally Gains Steam, Can ZEC’s 4.5M Shielded Supply Push It Back Into the Top 20?

Saylor says Strategy unlikely to buy up rivals as there’s too much uncertainty