Solana News Today: Solana's Drive for Institutional Adoption Poses a Challenge to Ethereum's Lead in Tokenization

- Bitwise's Solana Staking ETF (BSOL) raised $289M rapidly, leveraging 82% staking yields (7% annual) to attract institutional investors. - Reliance, JPMorgan, and Western Union are integrating Solana for digital assets, citing 65,000 TPS capacity and low-cost transactions. - Solana's tokenization growth includes gold-backed GLDY stablecoin and $90M+ tokenized equities, challenging Ethereum's $480B market cap dominance. - With 3.5k TPS and 7% staking yields, Solana's "two ways to win" strategy (price appre

Solana is rapidly gaining traction among institutional investors and advancing its tokenization goals, fundamentally altering the cryptocurrency sector. Bitwise Asset Management now frames Solana as a strategic investment that benefits from both overall market growth and the blockchain’s increasing influence. The debut of the Bitwise

The ETF’s rapid growth highlights Solana’s strength as a platform that combines scalability with attractive yields. BSOL saw $69.5 million in inflows on its first day and stands out by staking 82% of its assets, offering investors an estimated 7% annual return, according to a

Institutional interest is rising quickly. Reliance Global Group has recently included Solana in its Digital Asset Treasury, highlighting its ability to process 65,000 transactions per second and its low transaction fees as major advantages. At the same time, JPMorgan is utilizing Solana’s technology to tokenize private equity funds through its Kinexys platform, with plans to expand into real estate and private credit, according to a

Tokenization is emerging as another key area of growth. Streamex’s partnership with

Market indicators remain positive. Solana’s network handles more than 3,500 transactions per second and supports 3.7 million daily active wallets. Its staking yield of 7% surpasses Ethereum’s 3%, according to

Looking forward, the Alpenglow protocol upgrade—anticipated by early 2026—is set to further improve Solana’s performance, while additional ETF approvals could accelerate adoption. As Bitwise and Grayscale continue to strengthen Solana’s institutional presence, the blockchain’s dual strategy of market expansion and network leadership is gaining momentum, positioning it as a key player in the next phase of the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timing the Cycle: 5 High-Potential Altcoins to Buy Before the Year-End Rally

Canary Capital Sets November 13 Launch for XRP Spot ETF

Canary Capital removes delay clause in updated S-1 filing, confirming XRP Spot ETF launch on November 13.XRP Spot ETF Nears Launch with New S-1 FilingWhy Removing the ‘Delaying Amendment’ MattersGrowing Institutional Interest in XRP

BlockDAG’s $435M+ Presale and Testnet Outshine Filecoin & Chainlink in 2025’s Investing in Crypto Race

See why BlockDAG’s $435M+ presale, verified testnet, and hybrid system make it the top choice for investing in crypto compared to Filecoin and Chainlink.Filecoin’s Gradual Rise Shows Renewed ConfidenceChainlink’s On-Chain Data Reveals Heavy Whale BuyingBlockDAG’s Verified Testnet Redefine Investing in CryptoLooking Ahead: Why BlockDAG Leads the 2025 Market

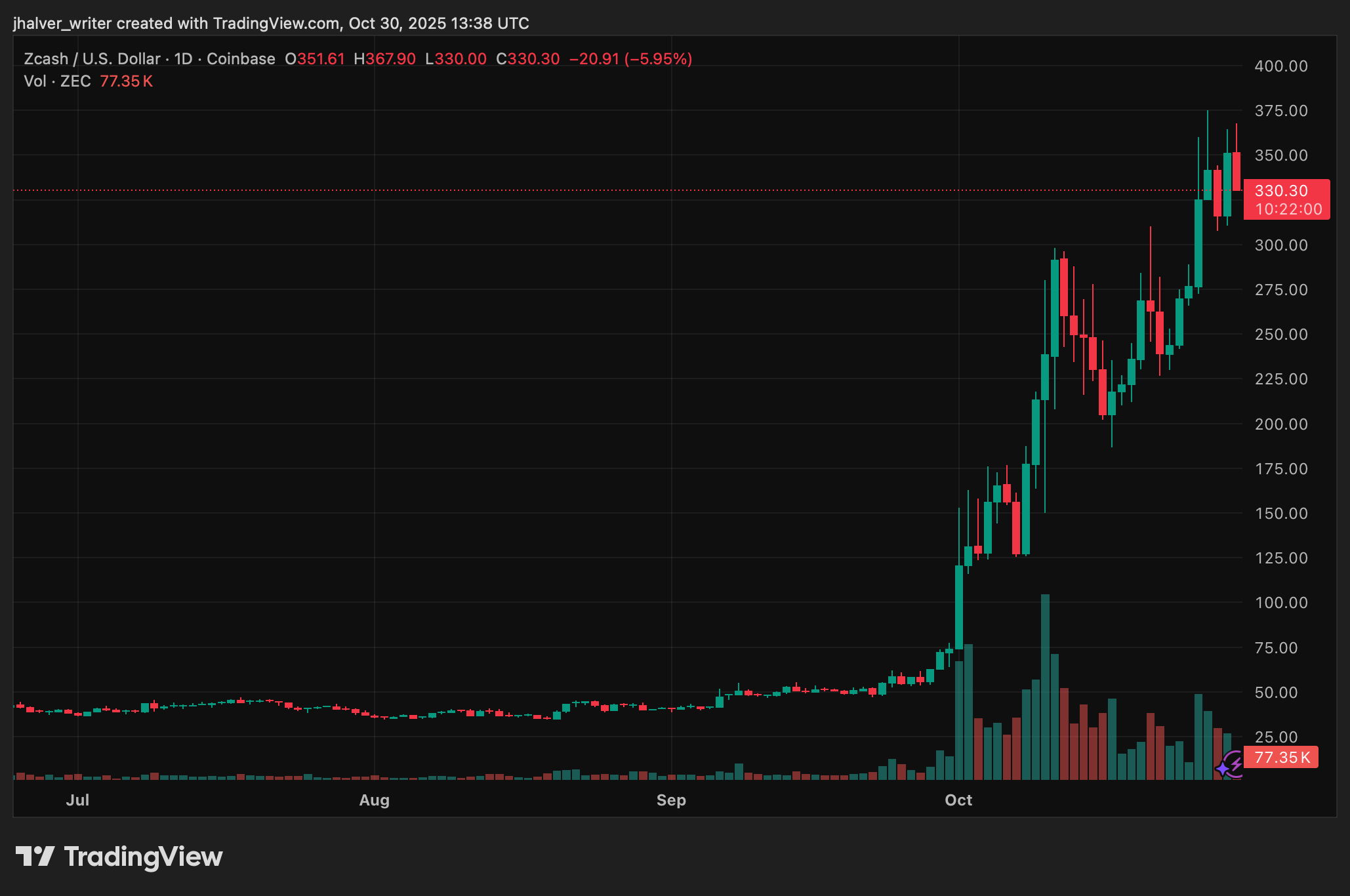

Zcash Rally Gains Steam, Can ZEC’s 4.5M Shielded Supply Push It Back Into the Top 20?