Lombard takes over $538m BTC.b in landmark Bitcoin deal

Lombard Finance has acquired the live on-chain infrastructure of BTC.b, a $538M Bitcoin asset on Avalanche. The firm plans to channel this flow across Ethereum, Solana, and other major chains starting next year.

- Lombard Finance acquires BTC.b, a $538M Bitcoin asset on Avalanche, along with its infrastructure and 12,500-address user base.

- The firm plans to migrate BTC.b to its decentralized protocol by Q4 2025, secured by 15 institutional entities.

- BTC.b will expand beyond Avalanche to Ethereum, Solana, and MegaEth, with integration into Lombard’s vault products used by Binance and Bybit.

On Oct. 30, Bitcoin DeFi protocol Lombard Finance announced its acquisition of the core infrastructure behind BTC.b, effectively taking control of the leading Bitcoin representation on the Avalanche network.

The deal sees Lombard absorbing the operational protocol, its user base of over 12,500 addresses, and its established integrations within Avalanche’s DeFi ecosystem, including major platforms like Aave and GMX.

Lombard’s blueprint for Bitcoin capital markets onchain

Lombard’s acquisition of BTC.b goes beyond taking over an existing token, with plans to migrate the bridged Bitcoin asset’s core infrastructure to its own protocol, which is secured by a decentralized consortium of 15 institutional entities.

This transition, slated for completion by Q4 2025, will also integrate Chainlink’s Cross-Chain Interoperability Protocol for bridging and its Proof of Reserve for verifiable backing, marking a substantial security and capability upgrade from its current state.

“Acquiring BTC.b infrastructure is a natural extension of Lombard’s mission to make Bitcoin more usable and accessible onchain. With BTC.b, we are expanding our product suite with a permissionless, non-custodial, and institutionally supported asset that complements LBTC and offers onchain users an alternative to centralized wrapped BTC assets,” Lombard co-founder Jacob Phillips said.

For developers, the value proposition lies in Lombard’s Software Development Kit. The plan is to natively integrate BTC.b into this toolkit, enabling DeFi applications to incorporate the asset with minimal mint and redeem fees.

For the existing BTC.b community and its integrations, Lombard has pledged a seamless transition. The asset’s contract address, name, and current placements within protocols like Aave will remain untouched, ensuring no disruption for current holders.

Lombard also plans to extend BTC.b’s reach well beyond Avalanche. The protocol confirmed plans to introduce the asset to Ethereum Mainnet, Solana, and MegaEth. This cross-chain expansion will be bolstered by incorporating BTC.b into Lombard’s vault products, which are already utilized by major exchanges like Binance and Bybit, signaling a concerted push for institutional and retail distribution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

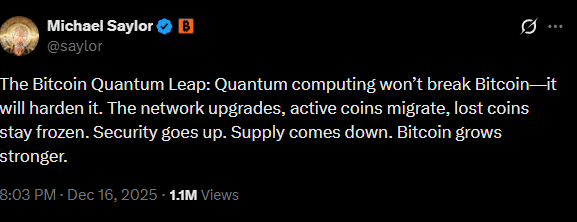

Bitcoin’s quantum future – Saylor plays down risks as experts raise red flags

Japan Rate Hike Looms: What Historical Trends Suggest for Bitcoin and the Broader Crypto Market

Unlock Your Sound: The ARIA Nana Remix Contest Closes for Submissions on January 9