Institutional traders now drive 80% of Bitget’s volume: Report

Singapore-based crypto exchange Bitget has seen an uptick in institutional participation, with institutional traders now accounting for roughly 80% of total volume as of September, according to a report by Bitget in collaboration with blockchain analytics platform Nansen.

The report noted that institutional activity on Bitget’s spot markets climbed from 39.4% of total volume on Jan. 1 to 72.6% by July 30. Futures trading saw an even more dramatic shift, with institutional market makers growing from just 3% of activity at the start of 2025 to 56.6% by late July.

The study identified liquidity as the key measure of institutional adoption in crypto, noting that Bitget’s order-book depth, spreads and execution quality now match peers such as Binance and OKX across major trading pairs.

In financial markets, liquidity refers to how quickly and easily an asset can be traded without causing a significant change in its price.

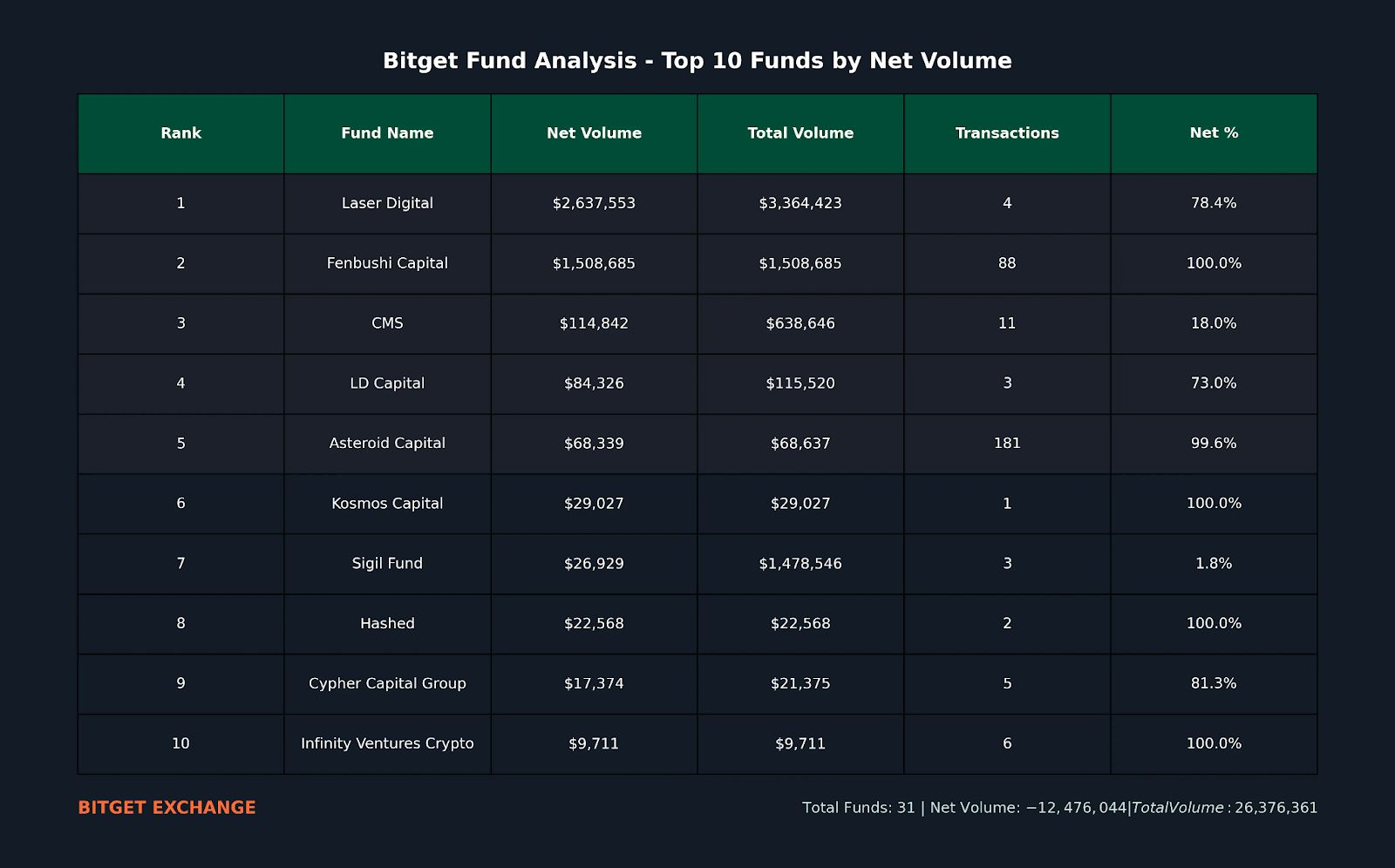

Laser Digital and Fenbushi Capital led institutional inflows on Bitget, accounting for the majority of positive net flows to the exchange, according to onchain data from Nansen.

During the first half of the year, Bitget averaged around $750 billion in monthly trading volume, with derivatives accounting for about 90%. According to the report, institutions make up roughly half of derivatives activity.

In comparison, Binance, the world’s largest centralized crypto exchange, saw its spot trading volume climb to $698.3 billion in July from $432.6 billion in June, an increase of 61% month over month, data from Coingecko shows.

Related: Binance Wallet partners with Bubblemaps to help fight insider crypto trading

Exchanges cater to institutional investors

As institutional adoption of crypto has surged throughout 2025, crypto exchanges are competing for market share in a variety of ways.

In January, Crypto.com announced an institutional trading platform featuring over 300 trading pairs and support for advanced trading strategies tailored to institutional investors, signaling the company’s deeper push into Wall Street.

In September, Binance unveiled a “crypto-as-a-service” platform for licensed banks, stock exchanges and brokerages, giving traditional finance institutions direct access to its liquidity, futures and custody infrastructure.

OKX announced in October a partnership with Standard Chartered to launch a collateral-mirroring program in the European Economic Area, enabling institutional clients to store their crypto assets directly with Standard Chartered’s custody arm.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tech Industry Relieved as U.S.-China Agreement Temporarily Halts Rare Earth Export Restrictions

- U.S. and China agree to a one-year trade framework suspending key tariffs and rare earth export controls to ease tensions. - The deal avoids a 100% U.S. tariff on Chinese goods and delays China's rare earth restrictions critical to tech and defense sectors. - China resumes soybean purchases, benefiting U.S. farmers, while U.S. reduces fentanyl-related tariffs from 20% to 10%. - Success hinges on China's enforcement of rare earth policies and U.S. adherence to export controls, per analysts.

BCH Facing a Turning Point: Upward Drive Meets Key Resistance

- Bitcoin Cash (BCH) approaches $565.1 resistance with technical indicators and derivatives data signaling bullish momentum. - Whale activity and positive funding rates (0.0007%) suggest growing long positions, historically preceding BCH rallies. - A successful breakout could target $651, but failure risks retesting $542.3 support amid 3.5% price volatility. - Derivatives sentiment (1.14 long/short ratio) and expanding MACD histogram reinforce cautious optimism for near-term accumulation.

Bitcoin News Update: Crypto Whale’s Bold Leverage Strategy: Unbroken Winning Run Challenges Market Volatility

- A crypto whale (0xc2a) has achieved 14 consecutive profitable trades, amassing $320M in gains via leveraged BTC/ETH/SOL positions. - Its $366M ETH long position (5x leverage) shows $8.87M unrealized gains, contrasting with profit-taking by other whales like BTC OG. - The whale's $234M BTC exposure (2,041.54 BTC) and $114M 13x leveraged long highlight aggressive institutional-grade strategies in volatile markets. - Market uncertainty around Fed rate decisions and geopolitical risks sees traders split betw

Bitcoin News Update: U.S. and China Reach Trade Agreement, Preventing Tariff Increase and Calming Global Market Concerns

- U.S. and China agree to delay 100% tariffs and suspend rare earth export restrictions, easing global supply chain pressures. - The deal includes resuming U.S. soybean purchases and canceling "fentanyl tariffs," stabilizing bilateral trade ahead of Trump-Xi APEC meeting. - Cryptocurrency markets react with mixed signals, as Bitcoin rises 1.8% amid safe-haven demand, but a $11B whale opens a leveraged short risking $2.6M losses. - Analysts warn long-term success depends on resolving issues like Jimmy Lai's