"Exonerated after 43 years, now deportation over 1983 drug plea"

- Subu Vedam, exonerated after 43 years in prison for a murder conviction, now faces deportation over a 1983 drug plea. - His lawyers argue decades of wrongful imprisonment qualify him for immigration waivers under U.S. law. - DHS contends Vedam failed to promptly address his immigration status, rejecting claims of exceptional hardship. - The case highlights tensions in Trump-era immigration enforcement and the intersection of criminal justice errors with deportation policies.

Subramanyam "Subu" Vedam, who spent 43 years incarcerated in Pennsylvania for a murder conviction that was ultimately overturned, now faces the threat of deportation after a 1999 removal order resurfaced following his release in August 2025. Vedam, 64, who came to the United States from India as a baby, was taken into custody by U.S. Immigration and Customs Enforcement (ICE) on October 3, 2025, just days after a judge threw out his murder conviction based on new ballistics evidence,

Vedam’s legal challenges began in 1980 when he was accused of killing his friend Thomas Kinser, a fellow student at Penn State. Despite the absence of witnesses or a clear motive, Vedam was convicted twice, the last time in 1988, NBC News stated. His defense team later uncovered an FBI document showing the fatal bullet did not match the .25-caliber firearm Vedam had bought, a fact prosecutors withheld, ABC News noted. After a review in 2023, Centre County Judge David Stockinger overturned the conviction, and prosecutors opted not to pursue a new trial, NBC News reported.

Yet, Vedam’s reprieve was brief. Federal immigration officials pointed to a 1999 deportation order linked to a drug conviction—he had pleaded no contest to selling LSD in 1983—as grounds for his detention, NBC News said. Vedam’s attorney, Ava Benach, argues that the extraordinary injustice he endured should make him eligible for relief under immigration law. “Spending forty-three years wrongfully imprisoned more than compensates for a drug offense committed at age 20,” she told ABC News.

The Department of Homeland Security, however, maintains that Vedam did not act quickly enough to protect his immigration status. Assistant chief counsel Katherine Frisch wrote in a brief that “he has not provided any evidence or arguments demonstrating diligence in pursuing his immigration rights,” NBC News reported. ICE has resisted reopening his case, maintaining that “the deadline passed years ago,” according to ABC News.

Supporters of Vedam emphasize the positive changes he made while incarcerated. He obtained several academic degrees, tutored other prisoners, and maintained an exemplary record except for a minor incident involving rice, NBC News reported. His sister, Saraswathi Vedam, a midwifery professor in Vancouver, described him as “patient” in the face of adversity. “He understands better than anyone that sometimes life is illogical. You just have to persist and trust that truth, justice, compassion, and kindness will ultimately prevail,” she told ABC News.

This case highlights ongoing debates over U.S. immigration policy, especially under the Trump administration’s focus on deportation. While Vedam’s legal team seeks a hearing before the Board of Immigration Appeals, his future remains uncertain. For now, he is being held at an ICE facility in central Pennsylvania, awaiting a decision that will shape what comes next, NBC News reported.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: K33 Indicates Long-Term Holder Selling Nears Saturation as 1.6 Million BTC Reactivated

Securitize to Launch Compliant On-chain Trading for Tokenized Public Stocks in 2026

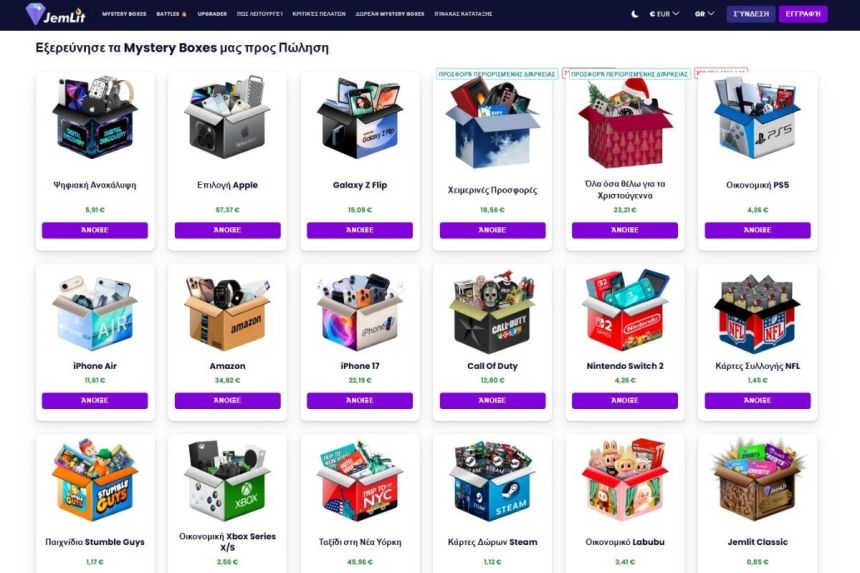

Πώς τα mystery boxes αλλάζουν τον τρόπο που ψωνίζουμε