Bitcoin News Update: With a Fed Rate Reduction on the Horizon, Bitcoin Approaches $115,000 as Experts Differ on 2025 Projections

- Bitcoin nears $115,000 as Fed’s October 29 rate cut looms, with analysts split on 2025–2026 price targets up to $500,000. - Miners stabilize reserves amid rising hashprice and on-chain activity, easing sell-off risks post-halving and boosting cautious bullish sentiment. - Chainlink (LINK) sees $188M in withdrawals from Binance, with 98.9% holder accumulation ratio signaling long-term investor confidence. - Ethereum consolidates as Bitcoin’s $115k breakout potential and Fed policy remain key drivers for b

Bitcoin is trading close to $115,000 as the possibility of a Federal Reserve rate cut approaches and miners' reserves show signs of stabilization, while

From a technical perspective, Bitcoin’s next move depends on whether it can surpass the $115,000 resistance, which coincides with its 100-day moving average. If Bitcoin manages to close above this level, it could aim for the $120,000–$122,000 range. Conversely, falling below $110,000 may prompt renewed selling by miners and further declines influenced by broader economic conditions, as per the Crypto.news analysis. Miner earnings have improved thanks to rising hashprice metrics and increased on-chain transactions, easing the selling pressure seen after the halving event. This improvement has led to a cautiously optimistic market outlook, with traders closely watching ETF inflows and liquidity ahead of the Fed’s announcement.

At the same time, Chainlink (LINK) has drawn considerable interest as major investors continue to accumulate the token. Blockchain data shows that since October 11, more than $188 million worth of LINK has been withdrawn from Binance, with large holders transferring their tokens to cold wallets, suggesting strong long-term conviction, according to a

Ethereum (ETH) and other leading cryptocurrencies are still consolidating, with no immediate events sparking major price changes. Nevertheless, Bitcoin’s movements are expected to influence the broader crypto market, especially as institutional involvement and macroeconomic trends remain closely linked.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction: Why the $3 December Target Is More Hope Than Reality

“Bitcoin Rodney” Faces Decades in Prison as Feds Expand HyperFund Charges

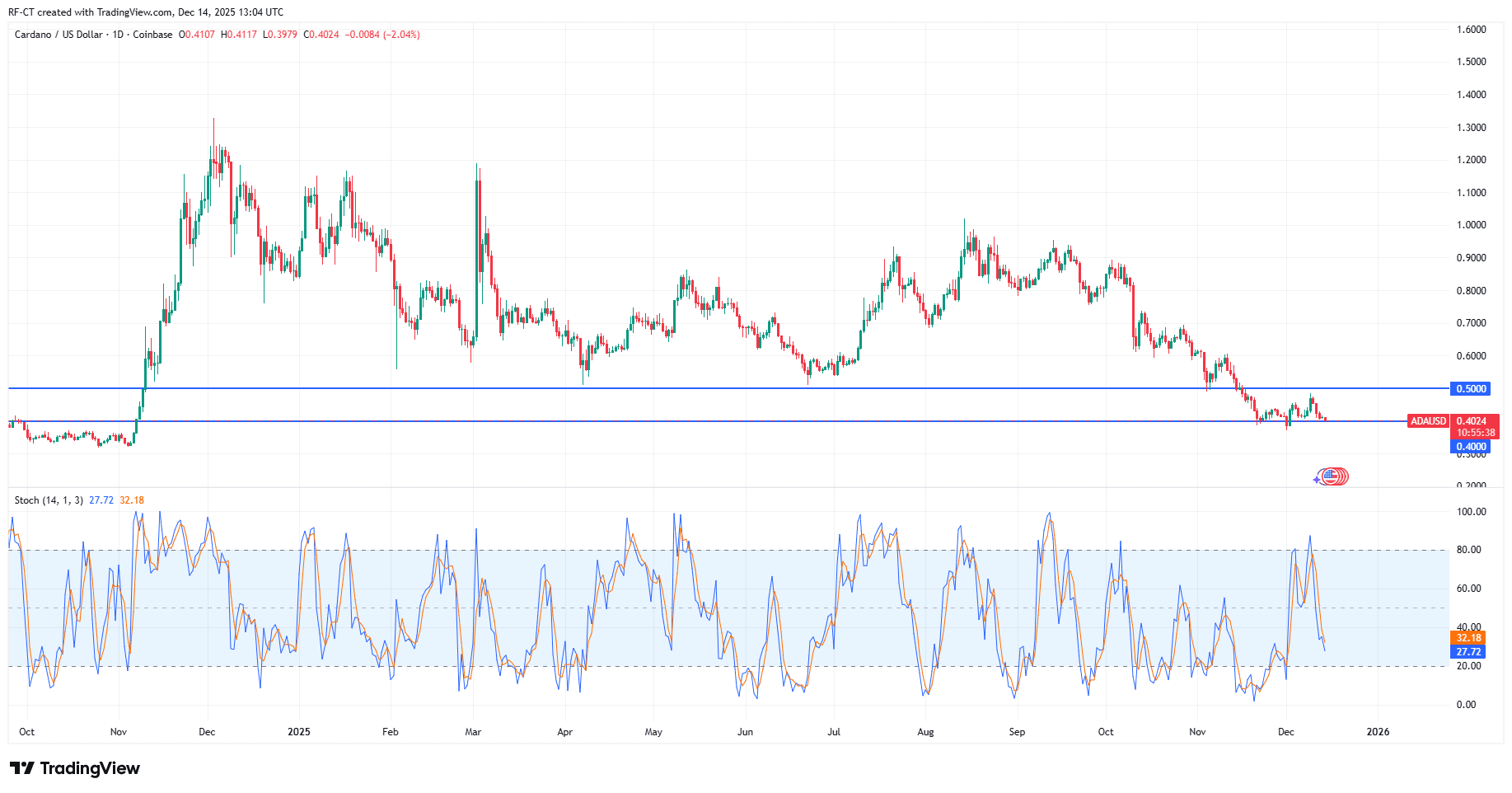

Cardano Price Prediction: Is ADA Forming a Base or Headed for Another Breakdown?

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent