Key Market Insights for October 29th, how much did you miss?

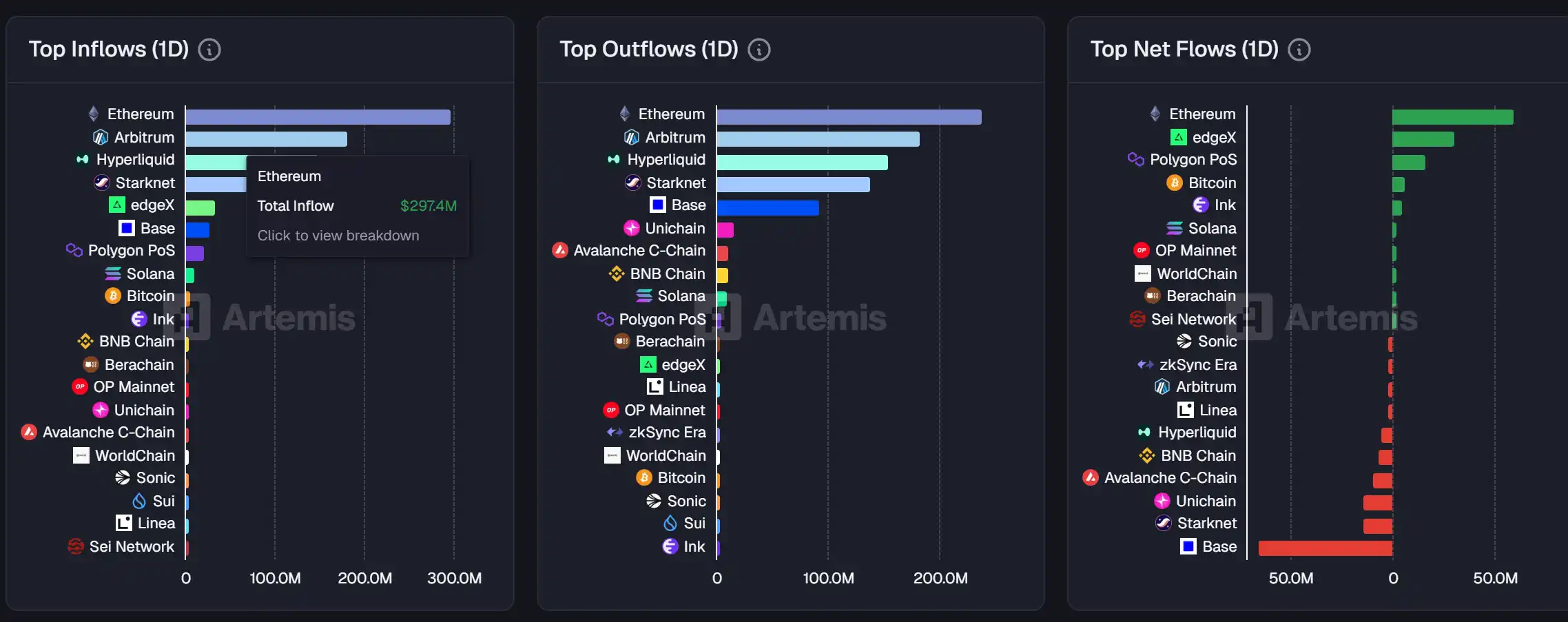

1. On-chain Fund Flow: $59.2M inflow to Ethereum today; $65.1M outflow from Base 2. Largest Price Swings: $FACY, $VULT 3. Top News: Zhihu x Ludong jointly hosted a roundtable on "Stablecoin Transparency" today, with a total view count of 25 million

Top News

1. Zhihu x Eudemonia Co-hosted Roundtable on "Penetrating Stablecoins" is now online today, with a total views of 25 million

2. MegaETH's public sale has raised over $700 million, with an oversubscription of 14.2 times

3. A total of $376 million has been liquidated across the network in the past 12 hours, with long positions being the main liquidations

4. FLM surged over 30% briefly and then retraced, with a market cap currently at $11 million

5. Users with at least 240 points in Binance Alpha can claim 2,688 BOS airdropped tokens

Featured Articles

1. "Chillhouse Leading Alone: The Past and Present of "Web3 Fun People""

The long-lost Solana meme hasn't been as lively for a long time, and it's happening in a way we can hardly imagine—a Solana meme coin "abstraction" involving Jesse Pollak, Base Protocol's lead, well-known crypto KOL Cobie, Solana's founder Toly, and pump.fun's founder alon. Especially with the addition of the Base camp, there is a sense of "breaking the taboo barrier." In the current environment where each chain is enthusiastically competing with each other, it is beyond players' expectations.

2. "The Best Market Performance in the Last Two Months of the Year? Is it Time to Surge or Retreat?"

As October draws to a close, the cryptocurrency market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the cryptocurrency market, especially after experiencing the 10/11 crash. The impact of this major drop is gradually fading, and market sentiment seems not to have further deteriorated but instead gained new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: positive net inflow data, approval of a batch of altcoin ETFs, and increasing rate cut expectations.

On-chain Data

Chain data for the week of October 28th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Brace for Volatility as Traders Await Delayed U.S. Jobs Report

Securitize Leverages Plume’s Nest Protocol to Expand Institutional Real-World Asset Reach and DeFi Footprint

The MMT Token Price Rally: Is This a Shift in Blockchain Functionality?

- Momentum Finance's MMT token surged 224% post-Binance listing, sparking debates over speculative hype versus sustainable blockchain utility . - Strategic Sui blockchain integration and $10M+ institutional backing from Coinbase Ventures/OKX validate MMT's role as a decentralized finance liquidity hub. - Tokenomics allocate 42.72% supply to community, with vesting schedules and ve(3,3) DEX incentives designed to align long-term holder interests. - $265M TVL and LRT integrations highlight utility, though vo

MMT Value Forecast and Changes in Market Sentiment: Evaluating Trustworthiness and Actions of Retail Investors

- MMT's 1,300% Q3 2025 price surge was driven by institutional investments, airdrops, and exchange listings like Binance and Upbit. - Price forecasts remain contentious as technical indicators clash with behavioral biases, while macroeconomic uncertainty from the 2025 government shutdown complicates valuation. - Retail investors face liquidity risks amid FOMO-driven demand, with MMT's volatility highlighting the disconnect between short-term hype and long-term utility requirements. - Analysts stress the ne