Key Market Information Discrepancy on October 29th, a Must-See! | Alpha Morning Report

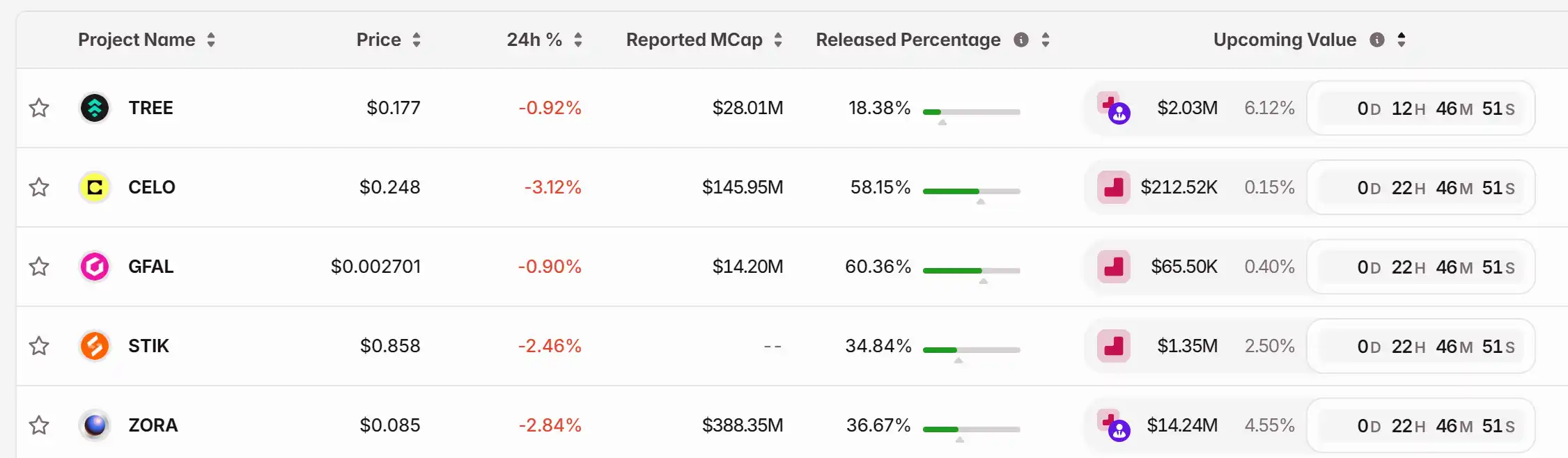

1. Top News: BSC On-Chain Chinese Narrative Meme Trading Slumps, 'Binance Life' Holds the Fort Alone, 'Hakimi' Heat Stable 2. Token Unlocking: $TREE, $CELO, $GFAL, $STIK, $ZORA

Featured News

1. BSC On-chain Chinese Narrative Meme Trading Sluggish, "Binance Life" Solo Holding the Flag, "Hakimi" Heat Stable

2. Monad MON Airdrop Distribution Results Now Available for Query

3. U.S. Stock Market Continues to Hit New Highs, Crypto Market Slightly Down Against the Trend

4. Visa to Accept Four Stablecoins on Four Blockchains, Support Currency Exchange

5. OpenAl Announces Completion of Capital Restructuring, May Prepare for Listing

Articles & Threads

1. "Why Didn't the x402 Protocol Flash in the Pan?"

It's been almost a week since the x402 Protocol ignited the market enthusiasm with the meme coin $PING. So far, the majority of market views are positive, with optimistic expectations for the future development of the x402 Protocol and discussions on various projects. However, some voices also believe that the rapid rise of x402 may not be able to sustain the overheated market expectations in the short term, leading to a lack of follow-up strength. So, what changes have occurred in the x402 Protocol ecosystem in this nearly week-long period?

2. "After Speculating on Coins for a Year, My Earnings Are Lower Than My Mom's Stock Speculation"

This is a year of "everything rising," but the crypto circle is widely recognized as a "very difficult year to make money." Compared to the past few years, 2025 seems like a rare "leap year." The U.S. stock market hits new highs again, A-shares' core assets rebound, gold hits historical highs, commodities rebound collectively, and almost all markets are rising. However, in the crypto circle, even though Bitcoin hit a new all-time high of $120,000, many are complaining that this is the "hardest year to make money in the crypto circle." When friends talk about their family's investment operations this year, they say, "In terms of ROI from speculating on coins this year, it is completely lower than my mom's stock speculation."

Market Data

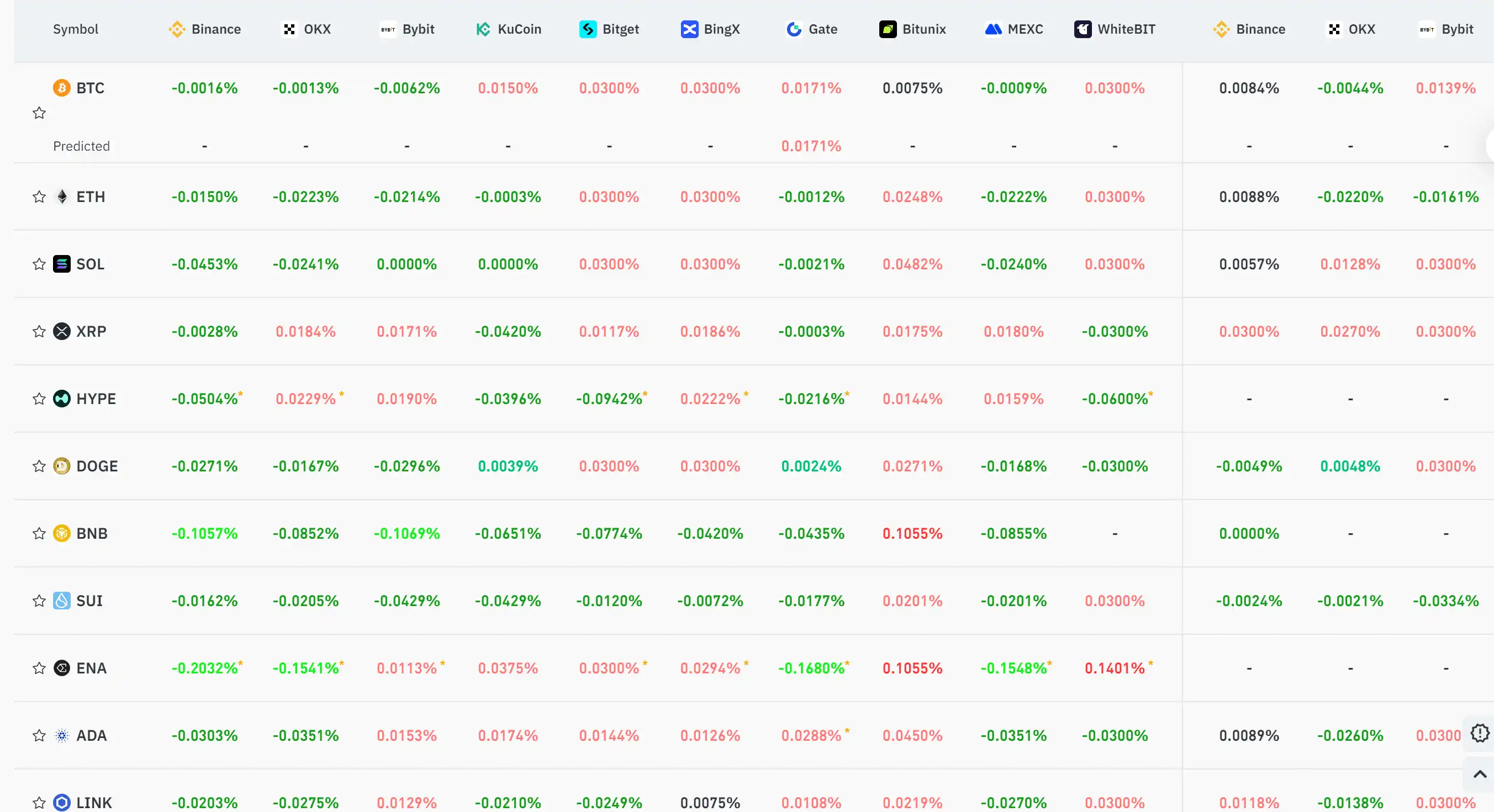

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Institutional Momentum Propels Bitget to Become Crypto’s Second Major Player

- Bitget became the second-largest crypto exchange in 2025 with $23.1B volume, driven by 80% institutional trading activity. - Institutional spot trading on Bitget surged from 39.4% to 72.6% by July 2025, improving liquidity metrics and order book depth. - The exchange expanded institutional services like USDT-backed loans and custody partnerships with Fireblocks, attracting $2.6M from Laser Digital. - Regulatory shifts (U.S. SAB 121 repeal, MiCA) and BlackRock's $88B Bitcoin ETF accelerated institutional

Bitcoin News Update: Powell's Ambiguity Triggers Market Drop, Bitcoin Dips Under $110K

- Fed’s 25-basis-point rate cut and Powell’s uncertainty over a December cut triggered Bitcoin’s 5% drop below $110,000. - Markets reacted sharply, with the Dow falling 200 points and $261M in Bitcoin futures liquidations. - Analysts highlight macroeconomic risks and U.S.-China trade talks as key factors influencing Bitcoin’s range-bound action.

Tech's investment in AI and geopolitical advantages drive up stocks and digital currencies

- Meta's $51.2B Q3 revenue beat estimates but EPS fell short, yet its AI/cloud investments bolster Wall Street optimism and 27% stock gains in 2025. - Intel's TSMC executive recruitment rumors and NVIDIA's $1B Nokia investment highlight AI talent/resource wars driving tech stock surges. - Trump-Xi trade talks and $36.2B Boeing deal boost Bitcoin 1.6% as investors anticipate eased tensions stabilizing crypto markets. - Magnificent Seven's 34% S&P 500 dominance reflects AI-driven tech consolidation, with hyp

Quack AI Introduces x402 BNB on BNB Chain