- SEI price breaks above key resistance at $0.2050, signaling potential momentum toward a $0.30 target in the near term.

- The bullish setup indicates rising confidence among traders as volume increases and structure improves following the breakout formation.

- Short-term holders are monitoring the $0.1908 support zone, which now acts as a strong base for possible continuation.

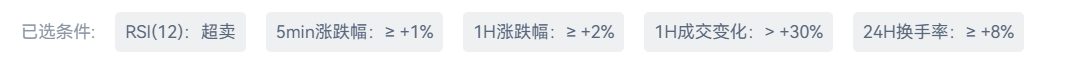

SEI (SEI/USDT) is gaining market attention following a breakout pattern that could signal a major upside. According to data from TradingView shared on October 26, 2025, SEI is currently trading at $0.2050, marking a slight 0.63% decline in the last session. However, analysts believe the breakout above a descending trendline could trigger a 49.81% rally, pushing prices toward the $0.30 level if momentum holds.

The chart illustrates a clean breakout from a downtrend line after multiple attempts. The move was confirmed when SEI closed above the resistance zone near $0.1908, which now acts as support. This zone also marks the stop-loss area, suggesting traders are eyeing risk-managed entries for a potential continuation rally. The short-term market structure remains bullish, with increasing trading volume supporting the move.

The post accompanying the chart questioned whether SEI could “pump 50% after this breakout,” hinting at growing optimism in the SEI community. The setup is being closely monitored by short-term traders, who are watching for confirmation above the $0.21 resistance.

Traders Target $0.30 if Momentum Sustains

Technical projections point to a strong bullish case if SEI sustains momentum above its breakout zone. The measured move target stands at approximately $0.30, aligning with the upper horizontal resistance drawn on the chart. This represents a gain of nearly $0.0970, or 49.81%, from the breakout point.

Short-term indicators are showing strength, while SEI’s trading volume on Bybit reached 11.16 million units, reflecting active participation from buyers. Market observers note that the coin’s breakout is part of a broader bullish pattern seen across select altcoins in late October. Many traders now view SEI’s breakout as a possible start of a new mini uptrend if buying pressure persists through the weekend.

The chart clearly shows how the breakout occurred with a clean retest, forming a strong technical base. The stop-loss level below $0.1908 provides traders with a defined risk area. This disciplined setup is appealing to short-term participants who prioritize structure and clear invalidation levels.

Yet, the pivotal question remains — can SEI sustain its breakout momentum long enough to reach $0.30, or will sellers return before then?

Market Sentiment and Technical Outlook

Community engagement on X (formerly Twitter) reveals an active conversation around SEI’s price trajectory. The original post featuring the chart had over 5,900 views within hours, with traders sharing mixed reactions. Some highlighted the bullish structure, while others urged caution due to possible profit-taking zones near $0.21 and $0.29.

Despite the uncertainty, the short-term trend appears constructive. The breakout zone between $0.1908 and $0.2050 is viewed as a key accumulation range. Holding above this band could keep bulls in control, while a drop below it might invalidate the setup.

Technical traders are particularly focused on the 3-hour timeframe, where SEI’s structure exhibits sequential higher lows following the breakout. This formation often indicates renewed buying interest and a gradual shift in market sentiment from bearish to neutral or bullish—additionally, the reduction in selling volume following the breakout points toward a fading downward pressure.

The upper resistance near $0.2918 marks the central price ceiling that could define SEI’s next directional move. If the token breaches that mark, traders may see follow-through momentum that propels SEI closer to the $0.30 target projected in the chart.

Social Interest and Market Context

Social traction continues to grow around SEI as traders discuss potential catalysts that could reinforce this breakout. With over 233 reposts and 26 comments, the discussion highlights the growing speculative interest in SEI’s short-term prospects. While no external catalysts were cited, chart-based strategies are currently guiding market sentiment.

The breakout scenario has drawn attention for its technical precision rather than fundamental developments. Many participants are applying classic breakout-retarget logic, using the measured height of the pattern to project potential upside. Given the proximity to key support, traders consider this setup to be low-risk relative to the possible return.

At press time, SEI’s bullish short-term outlook depends heavily on holding the $0.2050 price zone. Sustained buying pressure above that level could drive momentum toward the $0.2918 to $0.30 resistance zone in the coming sessions, according to the chart’s technical parameters.