Melania Trump and Milei Reportedly Exploited as Tools in $57 Million Memecoin Fraud

- A $57M memecoin fraud lawsuit accuses Meteora founder Benjamin Chow of using Melania Trump and Javier Milei as "props" to manipulate token prices via fake endorsements. - The scheme allegedly created artificial demand through insider-controlled liquidity pools, causing tokens like $LIBRA and $MELANIA to surge then collapse, wiping out investor funds. - Plaintiffs seek triple damages under RICO laws, naming co-conspirators including Kelsier Ventures CEO Hayden Davis and Jupiter co-founder Ng Ming Yeow in

A

The operation, referred to as the "Meteora-Kelsier Enterprise," allegedly used insider-controlled liquidity pools and fake endorsements. The complaint states that wallets associated with the group provided liquidity and made early trades to create the illusion of demand, enabling insiders to sell tokens at inflated prices. For instance, the $LIBRA token—marketed as a means to help small businesses in Argentina—soared after Milei’s verified X post, but plummeted within hours when deployer wallets removed $110 million in liquidity, as reported by

The lawsuit demands full restitution and triple damages under U.S. RICO statutes, citing allegations of fraud, conspiracy, and deceptive conduct. It also names Kelsier Ventures CEO Hayden Davis,

The case has attracted attention due to its political connections. Although Milei’s anti-corruption office cleared him of any ethics breaches, his initial endorsement of $LIBRA and the later removal of his post have raised questions. The updated complaint asserts that these figures “were used as props,” as noted in a

The downfall of these tokens highlights the risks within the memecoin sector, where celebrity backing can conceal manipulative tactics. Experts point out that Solana’s fast deployment features made the scheme possible, allowing insiders to control both trading and liquidity. As the legal proceedings continue, the case could lead to tighter regulations on DeFi projects and memecoins, especially those that use prominent public figures for promotion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE drops 1.47% amid Aave’s overhaul of its multichain approach

- Aave's multichain strategy shift caused AAVE to drop 1.47% despite 7.08% weekly gains. - Governance proposal aims to consolidate operations on high-revenue chains like Ethereum , phasing out low-performing deployments. - Strategy prioritizes capital efficiency and risk management by focusing liquidity on core networks with stronger revenue potential. - Unanimous DAO support signals industry trend toward quality-focused chain selection over maximalist expansion in DeFi.

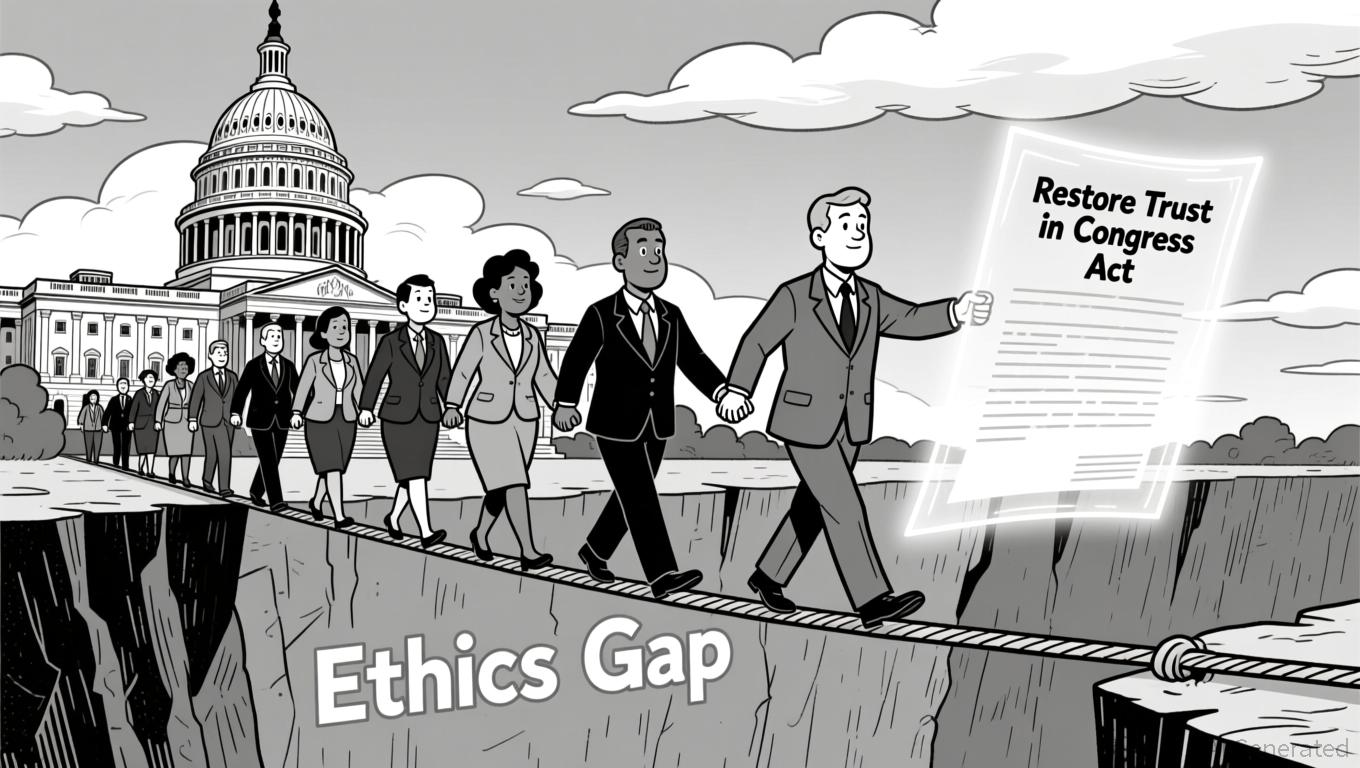

LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv

ZEC Value Increases by 4.82% Following Recent Exchange Listing

- Zcash (ZEC) surged 4.82% in 24 hours after Bitget listed it for spot trading on Dec 3, 2025, boosting short-term liquidity and visibility. - Zcash’s zero-knowledge proof technology enables encrypted transactions while maintaining blockchain integrity, distinguishing it as a privacy-focused asset. - Bitget’s UEX model supports multi-chain access, aligning with Zcash’s goal to balance transparency and privacy, though recent 7-day and 1-month declines highlight market volatility risks.