NFT sales plunge 42% to $93m, Pudgy Penguins sales nosedive 76%

According to CryptoSlam data, NFT (non-fungible token) sales volume has plunged by 42.42% to $93.18 million, down from last week’s $161.7 million.

- NFT sales fell 42% to $93M, while buyers surged 33% and sellers rose 21%.

- DMarket topped sales at $9.05M as Pudgy Penguins plunged over 76%.

- Ethereum led with $35M in NFT sales despite a 65% drop from last week.

Despite the sales collapse, market participation has improved, with NFT buyers climbing by 33.09% to 509,668 and sellers rising by 21.04% to 413,225. NFT transactions dropped by 7.63% to 1,543,392.

At the same time, Bitcoin ( BTC ) price has bounced back to the $111,000 level following recent weakness.

Ethereum ( ETH ) has reclaimed the $3,900 level as the overall crypto market shows renewed strength.

The global crypto market cap now stands at $3.75 trillion, up from last week’s $3.62 trillion. However, the NFT sector has experienced a sharp reversal.

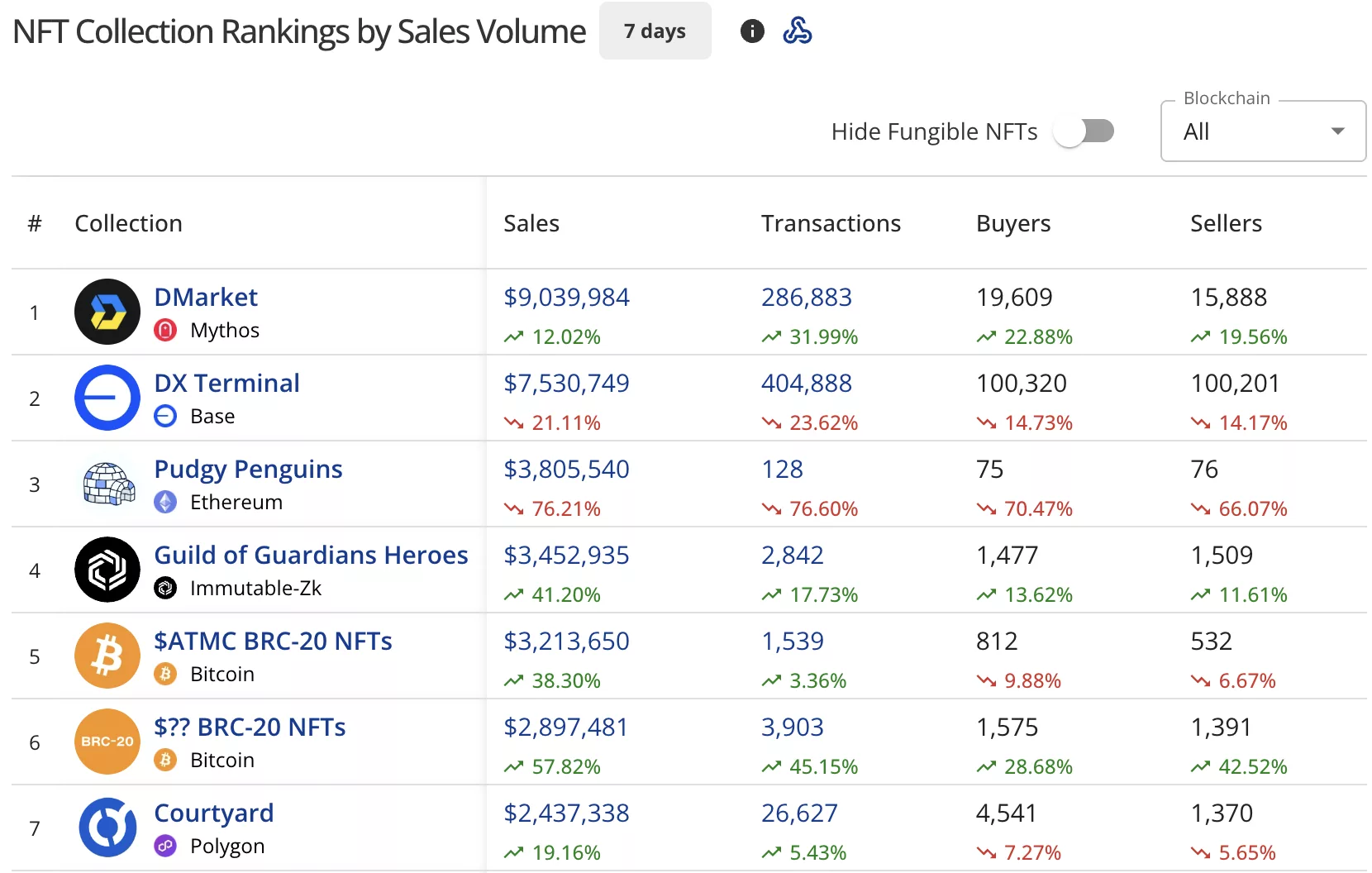

DMarket takes top spot as Pudgy Penguins collapse

DMarket on the Mythos blockchain has claimed first place with $9.05 million in sales, up 12.11% from last week’s $8.07 million.

The collection processed 286,645 transactions and attracted 19,577 buyers and 15,873 sellers.

DX Terminal on Base fell to second with $7.56 million, down 20.58% from last week’s $9.99 million. The collection recorded 406,415 transactions with 100,205 buyers and 100,091 sellers.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Pudgy Penguins suffered a significant fall to third place. The collection garnered $3.8 million, plummeting 76.27% from last week’s $15.61 million. The Ethereum collection saw just 128 transactions, with 73 buyers and 77 sellers.

Guild of Guardians Heroes on Immutable-Zk entered the rankings at fourth with $3.45 million, surging 41.06%. The collection had 2,837 transactions.

Two Bitcoin BRC-20 NFT collections made the top seven. $ATMC BRC-20 NFTs placed fifth at $3.21 million, up 38.3%, while $?? BRC-20 NFTs landed in sixth at $2.9 million, up 57.5%.

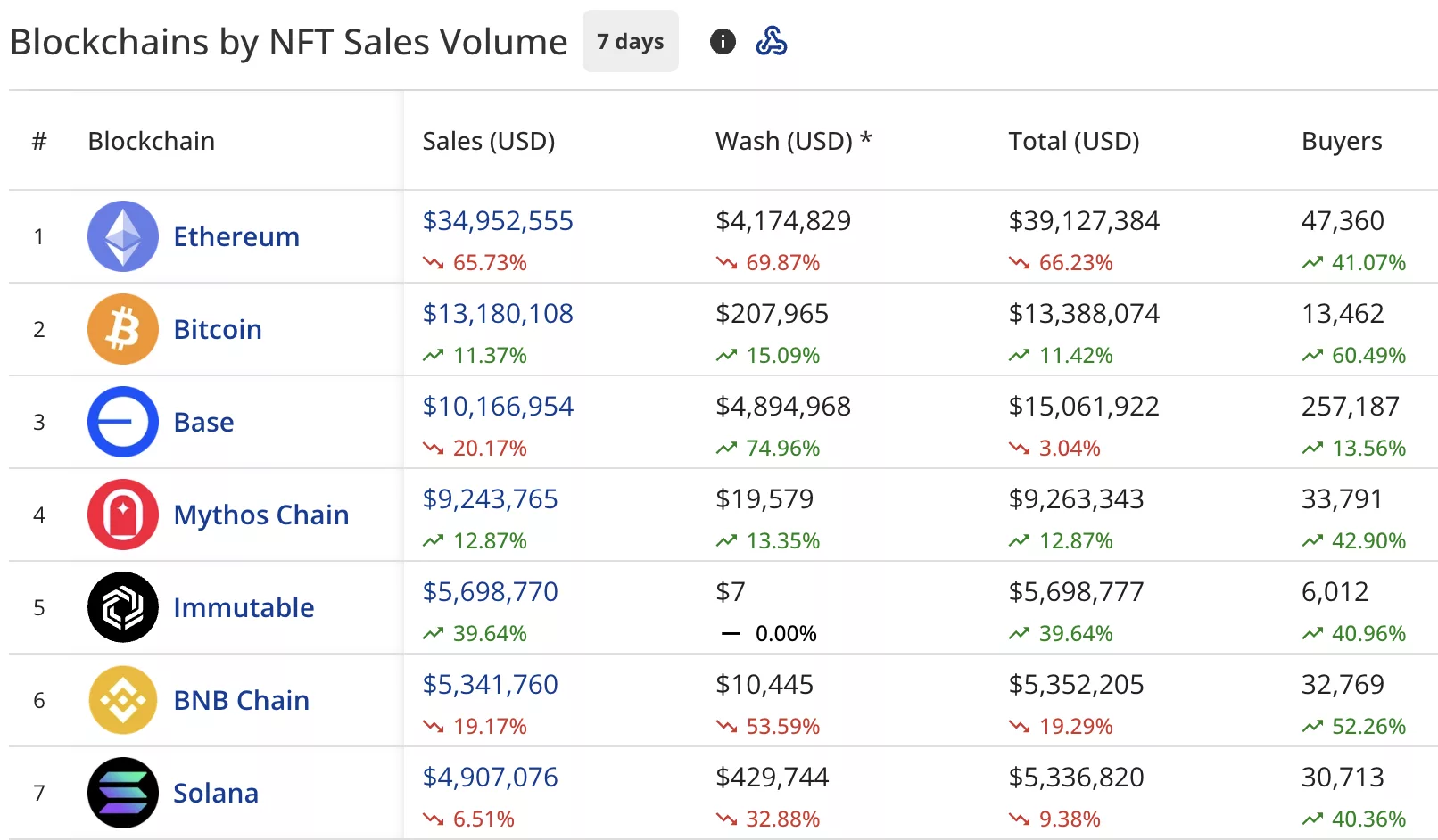

Ethereum maintains lead despite steep decline

Ethereum held first position with $35.04 million in sales, down 65.64% from last week’s $102.67 million. The network recorded $4.06 million in wash trading, bringing its total to $39.10 million.

Despite the sales drop, buyers increased by 41.05% to 47,352.

Bitcoin jumped to second place with $13.17 million, up 11.14% from last week’s $10.11 million. The network saw 13,462 buyers, up 60.49%.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Base dropped to third with $10.19 million, down 19.8% from last week’s $13.20 million.

The blockchain recorded $4.90 million in wash trading, with buyers rising 13.56% to 257,187.

Mythos Chain climbed to fourth at $9.27 million, up 13.52% from last week’s $8.23 million. The blockchain attracted 33,791 buyers, up 42.9%.

Immutable ( IMX ) secured fifth position with $5.73 million and surged 41.05%. The network had 6,012 buyers, up 40.96%.

BNB Chain ( BNB ) placed sixth at $5.33 million, down 19.62% from last week’s $6.51 million. Buyers jumped 52.26% to 32,769.

Solana ( SOL ) landed in seventh with $4.92 million, down 6.23% from last week’s $5.40 million. The network recorded 30,713 buyers, up 40.36%.

Record-breaking Good deed NFT sale

A Good deed NFT shattered records with a $44.89 million sale (70,200,565.5751 ADA), transacted a day ago. This is one of the highest-value NFT sales in recent months.

Known Origin #264609 sold for $246,984.31 (63.8 ETH) six days ago.

Three CryptoPunks completed the top five:

- CryptoPunks #7839 sold for $174,846.97 (44.99 ETH) six days ago

- CryptoPunks #7378 sold for $173,119.61 (45 ETH) two days ago

- CryptoPunks #7461 sold for $167,646.53 (42 ETH) five days ago

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AVAX Shows $0.636 Short-Term Bubble Risk as Traders Track New Cycles

Fresh Market Shift: Key SMA–EMA Cross Points to New Altcoin Cycle and Five December Picks

Memecoin Recovery Hits 40% Boost as 5 Coins Stand Out for Aggressive Traders

$SOL Stuck Between $124 and $145 as Markets Track This Price Box