Ethereum Updates Today: Ethereum ETFs Surge While Major Investors Anticipate a Downturn: The Cryptocurrency Market's Risky Comeback

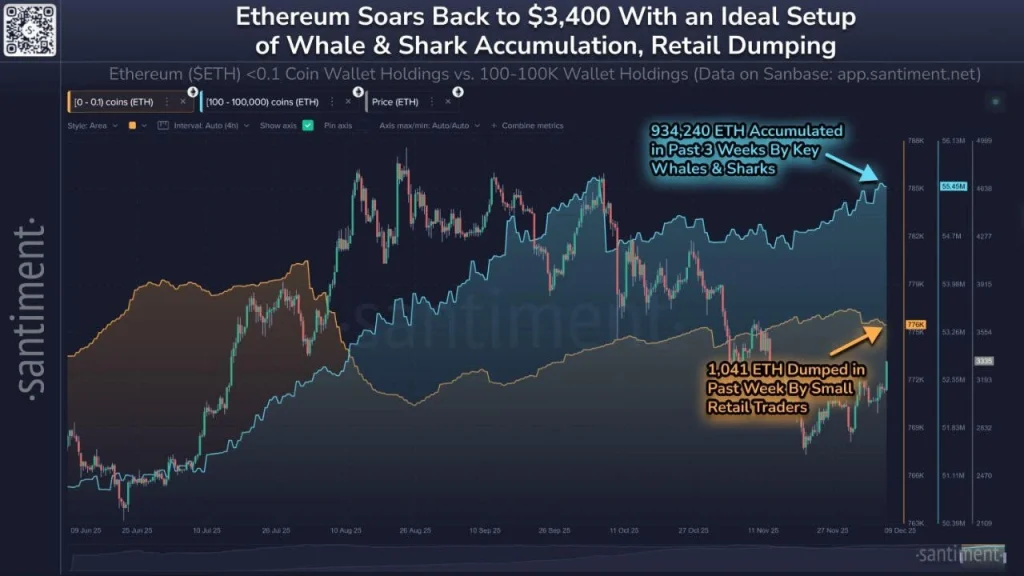

- Ethereum ETFs saw $141.6M inflows on Oct 21, reversing three-day outflows as institutional demand stabilizes for the second-largest crypto asset. - The Fusaka upgrade (Dec 3, 2025) aims to improve network efficiency via gas cap mechanisms, boosting long-term holder optimism. - Bitcoin whales like "BitcoinOG(1011)" and the "Trump Insider Whale" executed massive short positions, generating $150M profits during the Oct 10 crash. - Ethereum trades near $3,857 with key support/resistance levels, while open in

Ethereum (ETH) is beginning to show signs of a rebound as investor sentiment improves in response to evolving market conditions. Following a turbulent week, U.S. spot

The recent ETF inflows are happening against a backdrop of broader market uncertainty, largely due to

Adding to the market’s turbulence, another major player referred to as the "Trump Insider Whale" placed a $1.1 billion leveraged short across both Bitcoin and Ethereum, perfectly timed just before former President Donald Trump’s October 10 announcement of a 100% tariff on Chinese goods. This position quickly generated $150 million in profit after the market crash, sparking concerns about potential access to privileged information. Blockchain analysts caution that if retail investors begin to mimic these precisely timed strategies, it could intensify selling pressure and create a self-reinforcing cycle, according to

Despite these challenges, Ethereum’s technical signals point to a possible recovery. The cryptocurrency is trading close to $3,857, with significant support at $3,800 and resistance around $4,500. Open interest in Ethereum derivatives has increased by 0.6% to $43.8 billion, reflecting cautious optimism as traders rebuild positions after the recent downturn, crypto.news reports. Nevertheless, the outlook remains uncertain, with market participants closely monitoring the Federal Reserve’s rate decision on October 28–29. A dovish policy could improve liquidity for riskier assets like cryptocurrencies, while a more hawkish approach might renew economic headwinds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TMGM Raises the Bar With Its Largest-Ever Global Competition Prize Pool of $671,500

TRUMP Price Rises Amid Doubled DeFi Activity: Can It Finally Recover?

ETH Strengthens Against BTC Amid Its Renewed Whales Demand: Is Altseason Next?

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.