Nobel laureate: The US economy is in an abnormal state, and development in key areas is hindered

on October 22 local time, Nobel laureate in economics Paul Krugman wrote on the American subscription platform Substack, "At present, the U.S. economy is in an abnormal state on multiple levels.

The most direct problem is that the government shutdown has delayed the release of the September employment report, and policymakers are in a state of 'partial blind judgment'." He said that the U.S. economic data seems acceptable on the surface, but a deeper analysis will reveal that many objective indicators show that the U.S. economy is flashing red lights.

He said that this "abnormal" state is first reflected in the severe differentiation of the economy: the field of artificial intelligence is booming, while other fields are stagnant.

Secondly, the economy is in a "frozen" state in many aspects: although there has not yet been massive layoffs, it is difficult for the unemployed or those who have just entered the labor market to find new jobs.

Third, although investment in the field of artificial intelligence is driving economic growth, this growth is showing "K-shaped differentiation," and the signal that middle- and low-income consumers are in distress is already very clear.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TMGM Raises the Bar With Its Largest-Ever Global Competition Prize Pool of $671,500

TRUMP Price Rises Amid Doubled DeFi Activity: Can It Finally Recover?

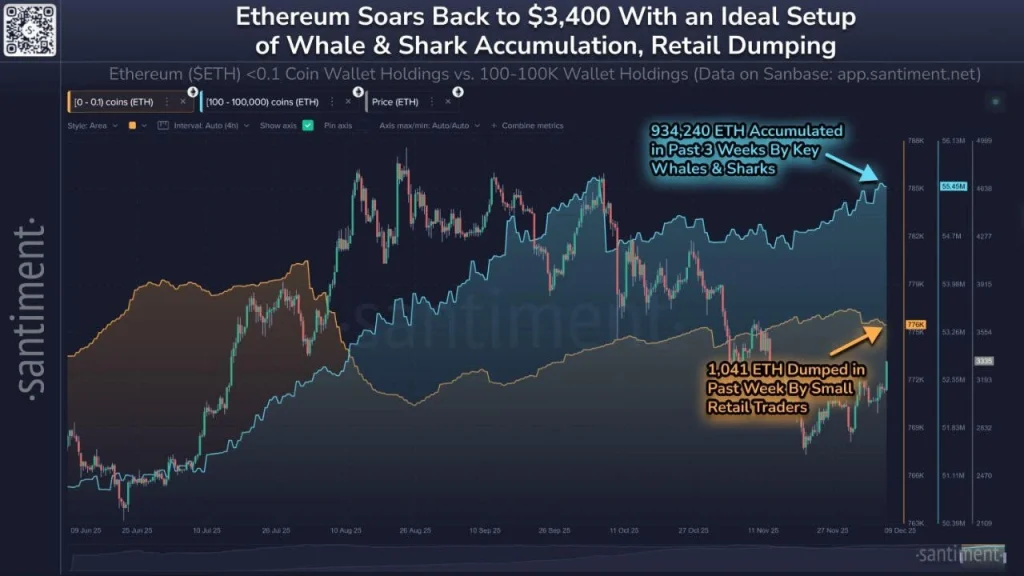

ETH Strengthens Against BTC Amid Its Renewed Whales Demand: Is Altseason Next?

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.