XLM Price Struggles Despite Steller’s On-Chain Growth – What’s Next?

Stellar (XLM) price has shown small signs of recovery, but charts hint at weakness beneath the surface. A new bearish divergence and heavy resistance in its channel suggest sellers still dominate. Traders are watching one key breakout zone that could decide whether XLM’s next move is recovery or rejection.

Stellar (XLM) price has shown small signs of recovery (up 2.8% in seven days). But the broader trend still leans bearish. Over the past three months, XLM has dropped nearly 29%, struggling to build momentum despite brief bounces.

Now, traders are watching one crucial level. That level could decide whether this rebound evolves into a full recovery or fades into another leg down.

Bearish Divergence Returns as Social Buzz Peaks

Even as the project posts strong on-chain growth and rising chatter across social platforms, its chart continues to show signs of weakness.

The Relative Strength Index (RSI), which measures buying versus selling strength, is flashing a hidden bearish divergence — a setup that often appears when momentum weakens during a short-term bounce.

Between October 20 and 25, XLM made a lower high, while RSI made a higher high, showing that the upward push is losing energy even as price edges higher.

This could be due to broader selling pressure continuing to weigh on buyers. A similar setup appeared between September 13 and October 6, followed by a sharp 32% correction. With the same divergence forming again, traders are watching closely for another dip.

XLM Flashes Divergence:

TradingView

XLM Flashes Divergence:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Interestingly, the market narrative looks very different outside the chart. Stellar’s tokenized real-world asset (RWA) value — or the total worth of real-world assets on its network — has jumped 26.51% in 30 days to $638.8 million.

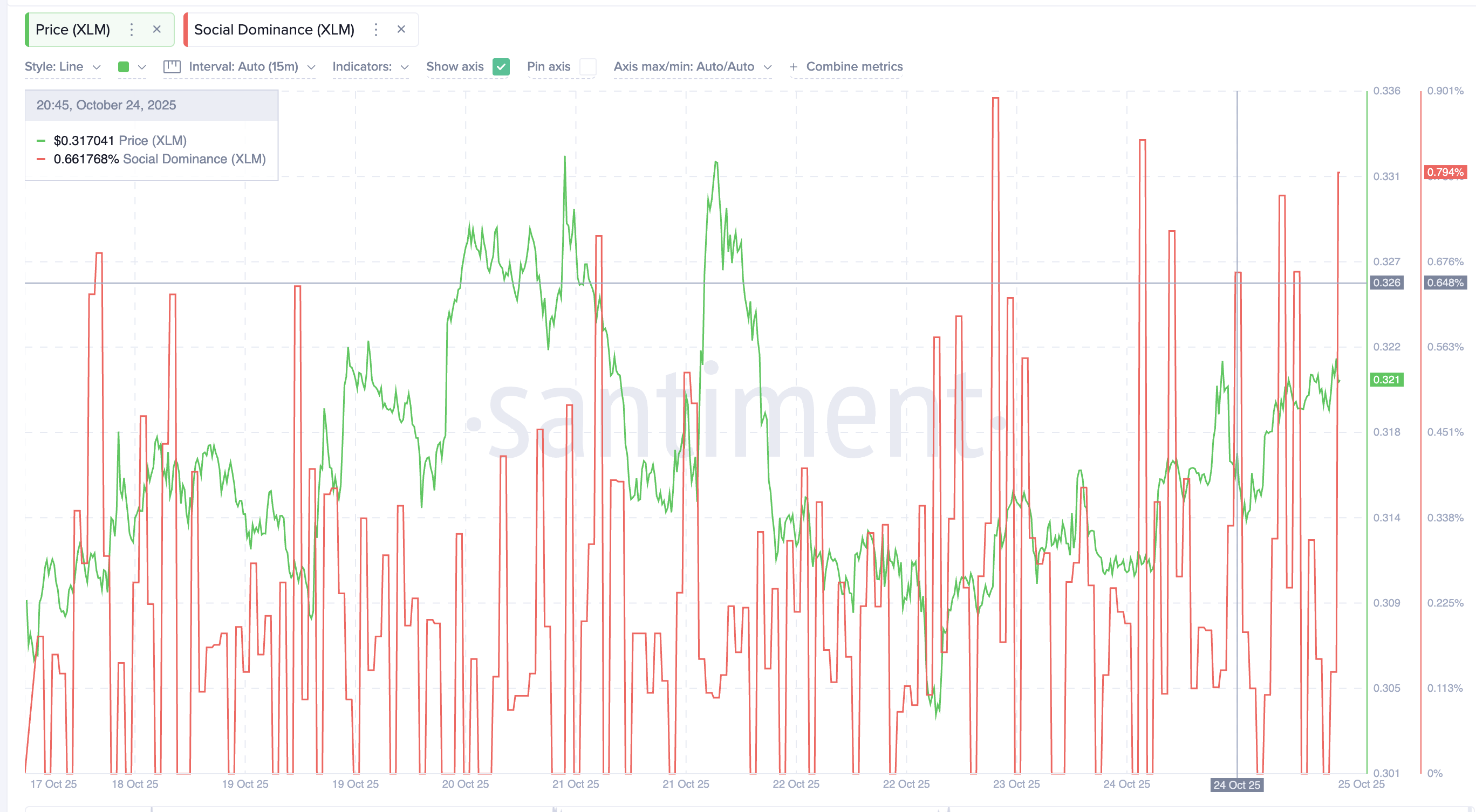

The growth has fueled a sharp increase in social dominance in October. The metric even climbed from 0.648% to 0.794% over the past 24 hours.

Stellar’s Social Dominance Remains Strong Through October:

Santiment

Stellar’s Social Dominance Remains Strong Through October:

Santiment

This means more people are talking about Stellar, but the data shows they’re not buying aggressively yet. The divergence between attention and action reflects the gap between fundamentals and XLM price performance.

Bearish Pattern Holds XLM Price Back Below $0.38

On the daily chart, XLM remains trapped inside a descending channel, where every move higher gets met with renewed selling. The bearish structure confirms that bears still dominate, and short-lived rallies are yet to shift the broader trend.

For the XLM price to show strength, it needs a clean breakout above $0.38, the upper boundary of the channel. That would mark at least a 20% rise from current levels and could flip short-term sentiment neutral to bullish, from bearish.

A further move above $0.41 — a key zone that’s blocked several Stellar rally attempts since September — would confirm a possible trend reversal.

XLM Price Analysis:

TradingView

XLM Price Analysis:

TradingView

On the downside, support lies near $0.30. Failure to hold it could drag the token toward $0.23, the next strong demand zone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know