Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Market Review

This week, the US Dollar Index rose first and then fell. At the beginning of the week, it edged higher on expectations of a "hawkish rate cut" by the Federal Reserve. The Fed did indeed cut rates by 25 basis points and launched a short-term US Treasury purchase program, but the market considered Powell "not hawkish enough", causing the dollar to accelerate its decline.

Spot gold overall fluctuated and strengthened, recording gains for four consecutive trading days. On Friday, driven by a weaker dollar and risk aversion, it once broke through the $4,330/oz mark, reaching a more than one-month high. Silver performed even more strongly, refreshing its historical high for four consecutive days this week amid tight supply.

Since January, silver prices have doubled. According to a report by the World Silver Association, the global silver market will see a supply deficit for the fifth consecutive year in 2025, with a gap of about 117 million ounces. The supply-demand imbalance, combined with a loose interest rate environment, has driven silver prices sharply higher. Analysts even predict that silver prices may break the $100 mark next year.

For non-US currencies, USD/JPY experienced an inverted V-shaped trend this week, rising first due to a stronger dollar, then erasing most of its gains on expectations of subsequent rate hikes by the Bank of Japan. The euro, pound, and AUD/USD all rose overall. The market believes that the easing cycles of these central banks are about to end, and some may even turn to rate hikes.

International oil prices showed a generally weak and volatile pattern, due to factors including market attention on India's prospects for buying Russian oil, Iraq's production recovery, and a sharp drop in refined oil dragging prices down. On Wednesday, the US seizure of an oil tanker off the coast of Venezuela sparked supply concerns and a short-term rebound in oil prices; on Thursday, prices fell again under pressure from potential progress in Russia-Ukraine peace talks.

This week, US stocks were generally strong but showed significant internal divergence. At the beginning of the week, with the Fed meeting approaching and large tech stocks under pressure, major indexes were relatively volatile. On Wednesday, cyclical sectors such as bank stocks strengthened, driving rebounds in the Dow and S&P 500. By Thursday, the Dow and S&P 500 continued to rise and hit record highs.

Selected Investment Bank Views

The "new bond king" Gundlach predicts that this may be Powell's last rate cut during his tenure. Goldman Sachs believes that the hawkish camp at the Fed has been appeased, and the degree of future easing depends on the labor market. ING still expects that the Fed will cut rates twice in 2026.

The co-founder of Oaktree Capital stated that further rate cuts by the Fed are of little significance. Big short Michael Burry warned that the Fed's RMP is intended to cover up the fragility of the banking system, essentially restarting QE.

Deutsche Bank, Goldman Sachs, and other investment banks predict that the US dollar will resume its decline in 2026 due to continued Fed rate cuts and policy divergence from other central banks, with the US Dollar Index expected to fall by about 3% by the end of 2026.

RBC expects that the average gold price next year will be $4,600. A report by the Bank for International Settlements shows that retail investors have driven the recent surge in gold prices, increasing the speculative nature of gold.

Goldman Sachs, Citi, and other Wall Street giants believe that the sell-off in crude oil is far from over, and prices will continue to fall next year due to oversupply.

Major Events of the Week

1. Fed cuts rates by 25 basis points, launches short-term bond purchase program

At its December meeting, the Fed decided to cut rates by 25 basis points to 3.50%-3.75% and launched a short-term US Treasury purchase program. The decision was passed by a vote of 9-3, with 2 members supporting keeping rates unchanged and 1 supporting a 50 basis point cut.

Powell stated that the current rate is within a broad range of neutral rate estimates, allowing the Fed to wait patiently and observe how the economy evolves further. He emphasized that rate hikes are not anyone's baseline assumption.

Regarding short-term bond purchases, the initial scale will reach $40 billion in the first month and may remain high in the coming months. Powell emphasized that this decision is to maintain an adequate supply of reserves, ensuring the Fed can effectively control policy rates, and does not represent a change in monetary policy stance.

Several Wall Street banks urgently revised their 2026 Treasury supply forecasts, expecting the Fed to become the main buyer, pushing borrowing costs lower. Barclays expects the Fed's bond purchases in 2026 to reach $525 billion, far exceeding the previous forecast of $345 billion. JPMorgan and Wells Fargo also raised their purchase expectations.

Powell also admitted that nonfarm payroll data has a "systematic overestimation," with monthly figures possibly overstated by 60,000 jobs, and the actual job market may have fallen into a "monthly decrease of 20,000" negative growth. This finding has tilted the Fed's policy balance toward "job preservation," and the market expects further rate cuts in the future.

However, US President Trump remains dissatisfied with the magnitude of the rate cut, calling the 25 basis point cut "quite small" and saying it could have been doubled. He also said that an immediate rate cut is a "touchstone" for choosing a new Fed chair.

Before the rate cut was implemented, popular Fed chair candidate Hassett stated that it would be irresponsible for the Fed to set a rate adjustment plan for the next six months, and that closely following economic data is crucial. He also said that the Fed has ample room for significant rate cuts and will make rate decisions based on its own judgment.

In addition, on Thursday, the Fed Board of Governors announced that it unanimously approved the reappointment of 11 regional Fed presidents for five years, effective March 1, 2026. The only exception is Atlanta Fed President Raphael Bostic, who had previously announced his retirement. This decision eliminates key uncertainty about the future composition of the decision-making body and temporarily resolves the "immediate threat" faced by regional presidents. The three board members appointed by Trump also supported these reappointments.

This week, US employment data showed that US job openings in October rose to the highest level in five months, but reduced hiring and increased layoffs indicate that the labor market continues to slow. In addition, US employment cost growth in the third quarter hit its lowest level in more than four years, reflecting that a cooling job market helps curb inflationary pressures. Last week, the number of initial jobless claims in the US saw the largest increase since the outbreak of the pandemic, reversing the sharp drop in claims during Thanksgiving week.

2. Will central banks in multiple countries turn to rate hikes? Is Japan's rate hike next week just the beginning?

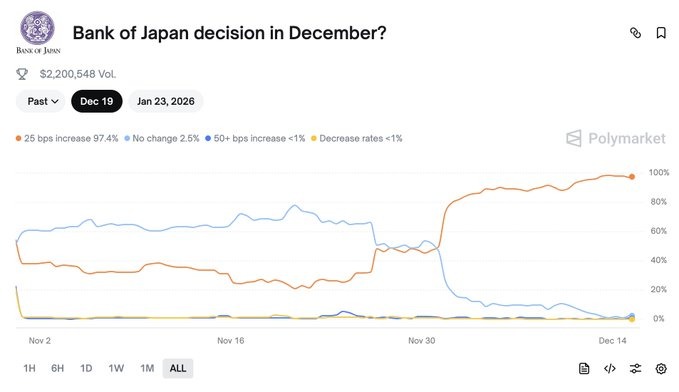

Bank of Japan Governor Kazuo Ueda said this week that Japan is gradually approaching its sustained 2% inflation target. He hinted that future rate hikes would not be limited to just one, sending a clear signal of a possible policy shift next week.

In an interview, Ueda made it clear that the central bank will continue to gradually adjust the degree of monetary easing until the inflation rate remains above 2% and the policy rate returns to its natural level. He said that even if the central bank raises rates this month, the process of normalizing monetary policy will continue.

Market expectations for a rate hike at next week's policy meeting in Japan have been raised. Based on overnight swap trading data, investors currently see about a 90% probability of a 25 basis point hike. If the central bank raises rates to 0.75%, it will be Japan's highest borrowing cost level since 1995.

Some central bank watchers believe that the continued weakness of the yen is one of the factors supporting a December rate hike. However, Ueda said the central bank usually avoids making explicit comments on fiscal policy and emphasized that achieving medium- and long-term fiscal sustainability is the government's job.

On Friday, sources revealed that the Bank of Japan will maintain its commitment to further rate hikes at next week's policy meeting, but will emphasize that the pace of further hikes will depend on the economy's response to each hike.

In addition to Japan, central banks in many countries around the world are expected to turn to rate hikes in 2026, with the European Central Bank, Reserve Bank of Australia, and Bank of Canada all expected to raise rates, while the Fed may continue to cut rates, becoming an "outlier." The market expects the probability of a rate hike by the ECB to rise next year, the Reserve Bank of Australia to raise rates twice, and the Bank of England to end its rate cut cycle.

Expectations for ECB rate hikes are heating up, with market traders almost ruling out further rate cuts and expecting about a 30% probability of a rate hike by the end of 2026. Hawkish comments from ECB Executive Board member Schnabel have further reinforced this expectation.

Meanwhile, Reserve Bank of Australia Governor Bullock has explicitly ruled out further easing, and the market expects the RBA to raise rates nearly twice by the end of next year, with each hike of about 25 basis points.

The Bank of Canada is also being driven by economic recovery, and the market expects a small rate hike early next year. The Bank of England is expected to end its rate cut cycle, and the OECD expects its rate cuts to stop in the first half of 2026.

3. Russia-Ukraine peace agreement "stalled"? Zelensky's "reciprocal withdrawal" proposal sparks US-Ukraine differences

Regarding the 20-point framework agreement for a "peace plan" proposed by the US to resolve the Russia-Ukraine conflict, Ukrainian President Zelensky has submitted a revised version to the US side, with core differences still focused on territorial and security arrangements.

Zelensky made it clear that the US still requires Ukraine to make major concessions on territorial issues, especially regarding the Donetsk region, while Ukraine insists that Russia and Ukraine must withdraw troops simultaneously on a reciprocal basis and opposes any unilateral concessions. The key unresolved issues between Ukraine and the US include the ownership and arrangements for the Donetsk region and the "joint management" mechanism for the Zaporizhzhia nuclear power plant. Ukraine believes that some of the proposals conveyed by the US essentially originate from Russia's position and clearly undermine Ukraine's interests.

According to disclosures, the US side suggested that Ukrainian troops withdraw from some controlled areas and establish so-called "free economic zones" or "demilitarized zones," but the management entities are vague, and there is a risk of Russia infiltrating and actually controlling the area under the guise of "civilians." Zelensky emphasized that any buffer zone arrangement must be reciprocal, Russian troops must withdraw simultaneously, territorial compromise can only be a fair compromise, and the final decision should be made by the Ukrainian people through elections or referendums.

On the military and security front, US-Ukraine discussions also involve the withdrawal of Russian troops from parts of Kharkiv, Sumy, and Dnipropetrovsk, as well as "freezing" the contact line in the Zaporizhzhia and Kherson directions. The US side also agreed that Ukraine could retain a post-war army of about 800,000 troops.

Russia, on the other hand, reiterated that Ukraine's neutrality, non-alignment, and denuclearization are the starting points for resolving the issue and warned that it would respond to European military deployments in Ukraine or the confiscation of Russian assets.

While supporting the peace process, European countries remain cautious about some US proposals, emphasizing that territorial issues must be decided independently by Ukraine and that any agreement must not come at the expense of European security or the unity of the EU and NATO. On Friday, the Financial Times reported that the UK and US are mediating a fast-track proposal under which Ukraine could join the EU on January 1, 2027, which would upend the EU's "performance-based" accession process.

4. US seizes Venezuelan oil tanker, Venezuela: "International piracy"

The US Coast Guard recently seized a supertanker carrying Venezuelan crude oil for export, marking the first time the US has seized oil cargo from Venezuela. Since 2019, Venezuela has been under US sanctions, and this action marks further US suppression of Venezuelan oil trade.

The Venezuelan government strongly condemned the US seizure, calling it "international piracy" and stating it would "defend its sovereignty, natural resources, and national dignity with absolute determination," while also planning to denounce the US action before international institutions.

The White House press secretary said the tanker would be taken to a US port, and the US plans to confiscate its oil. Levitt said the tanker was involved in oil activities subject to US sanctions, and the US is following legal procedures for confiscation, including questioning the crew and collecting evidence.

It is understood that the tanker carried oil worth about $80 million, equivalent to about 5% of Venezuela's monthly import spending.

Levitt also mentioned that the oil on the tanker was originally intended for delivery to Iran's Islamic Revolutionary Guard Corps, which the US designated as a "terrorist organization" in 2019. On the same day, the US Treasury Department announced on its website an update to the sanctions list for Venezuelan individuals and entities, adding six more tankers as targets of sanctions.

5. US to allow Nvidia to sell H200 chips to China, Foreign Ministry responds

The US government has adjusted its chip export policy. On Monday, Trump stated that the US would allow Nvidia to sell H200 artificial intelligence chips to "approved customers" in China, but 25% of the chip sales revenue would need to be handed over to the US government.

A similar approach will also apply to other US companies such as AMD and Intel. Trump said this move would create jobs and help maintain the US's leading position in the field of artificial intelligence.

In response, Foreign Ministry spokesperson Guo Jiakun said that China has noted the relevant reports and has always advocated that China and the US achieve mutual benefit and win-win results through cooperation.

6. SpaceX plans to go public next year? Musk: It's true

Musk confirmed on social media that SpaceX plans to conduct its initial public offering (IPO) in 2026.

Previously, sources revealed that SpaceX's target valuation for this IPO is about $1.5 trillion. If it sells 5% of its shares as planned, the fundraising scale will reach about $40 billion, surpassing the previous record for the world's largest IPO set by Saudi Aramco.

It is understood that Musk holds about 42% of SpaceX shares, and the value of his stake in SpaceX will rise from about $136 billion to more than $625 billion, with his total wealth expected to increase from $460.6 billion to $952 billion.

SpaceX's IPO plan is partly due to the strong growth of its Starlink business. The company expects revenue of about $15 billion in 2025 and $22-24 billion in 2026, most of which will come from Starlink. In addition, the progress in the development of the Starship rocket has also provided strong support for the company's listing.

Musk previously denied reports of an $800 billion company valuation and stated that commercial Starlink is SpaceX's largest source of revenue. He also emphasized that although NASA is an important partner for the company, its share of revenue will gradually decrease, and it is expected to account for less than 5% of total revenue next year. Looking ahead, SpaceX is expected to receive stronger support in US government space programs.

7. Moore Threads issues risk warning after surge, stock price pulls back

As the "first domestic GPU stock," Moore Threads' share price once soared more than 700% after listing. On Thursday night, the company issued a risk warning announcement, and its share price fell sharply on Friday.

The announcement stated that Moore Threads warned that the company's stock may face risks of overheated market sentiment and irrational speculation, reminding investors to pay attention to trading risks and invest rationally. The announcement pointed out that the company's current production and operations are normal, the internal and external business environment has not undergone major changes, and there are no major matters affecting the company's stock price fluctuations, nor is there any major information that should be disclosed but has not been disclosed.

Moore Threads mentioned in the announcement that the company's current new products and new architectures are still under development, and new products have not yet generated revenue. Product sales still need to go through product certification, customer introduction, mass production and supply, and other processes, all of which are uncertain. In addition, the company will soon hold its first MUSA Developer Conference, but it is expected that there will be no significant impact on the company's operating performance in the short term.

8. Meta shifts strategy: from open source to closed source, Zuckerberg bets on AI commercialization

US tech giant Meta Platforms is reportedly using Alibaba's open-source AI model Qwen to revitalize its AI projects. Meta's new model is named "Avocado" and is expected to be released next spring, possibly as a closed-source model. This shift marks a significant change from Meta's long-standing open-source strategy, bringing its approach closer to competitors such as Google and OpenAI.

In addition, AI has reportedly been established as Meta's top strategic priority. Zuckerberg has pledged to invest $600 billion in infrastructure in the US over the next three years, most of which will directly support AI development. To support this massive capital plan, Meta is reallocating internal resources, significantly reducing investment in virtual reality and metaverse businesses, and instead focusing funds on the development of AI glasses and related hardware. However, Wall Street remains cautious about Meta's aggressive spending plans.

9. Netflix makes a move, Paramount "intercepts": $100 billion M&A battle tears Hollywood apart

Over the past week, the battle for control of Warner Bros. Discovery (WBD) has rapidly escalated, with the bidding war between Netflix and Paramount becoming the focus of the global media industry.

On December 5, Netflix announced that it had reached a framework agreement to acquire WBD, planning to acquire its film and television studios and core streaming assets such as HBO/HBO Max for about $72 billion. The transaction structure is a combination of cash and stock, to be completed after WBD spins off its linear TV business.

However, Netflix's lead was quickly challenged. On December 8, Paramount, backed by Skydance, suddenly launched a hostile takeover of WBD, offering $30 per share, totaling about $108.4 billion, and as an all-cash deal, covering all of WBD's businesses, including CNN, Discovery, and other linear TV networks.

Paramount emphasized that its offer is superior to Netflix's in both value and certainty, and bypassed WBD management to put direct pressure on shareholders.

Interestingly, Trump has shown great interest in this acquisition battle. On December 10, Trump stated that regardless of which company acquires Warner Bros., CNN's ownership should change.

According to sources, Trump has repeatedly told his allies that CNN should either be sold or have its leadership changed, linking CNN's future to the Warner Bros. sale negotiations. The Paramount CEO has brought Trump's son-in-law Kushner into its acquisition plan and praised Trump on television programs.

10. OpenAI launches ChatGPT-5.2, plans to lift red code alert in January

OpenAI has launched its most advanced AI model to date, GPT-5.2, and plans to end the previously issued "red code" warning in January. OpenAI also reported a surge in enterprise AI applications, with ChatGPT weekly users surpassing 800 million.

It is understood that GPT-5.2 outperforms previous versions in generating spreadsheets, creating presentations, image perception, coding, and long-context understanding. GPT-5.2 ranks among the top in multiple industry benchmark tests, including SWE-Bench Pro for evaluating agent-based programming capabilities and GPQA Diamond for graduate-level scientific reasoning. In OpenAI's GDPval evaluation system released earlier this year, GPT-5.2 beat or matched top industry professionals in 70.9% of explicit tasks.

In addition, Disney announced a $1 billion investment in OpenAI and reached an agreement allowing OpenAI to use more than 200 Disney animated characters on its video generation platform Sora. The agreement also allows OpenAI's ChatGPT chatbot to generate images based on Disney characters.

11. The first litmus test for the AI bubble: Oracle's stock price can't hold up?

Oracle's stock price plunged more than 10% on Thursday due to quarterly revenue falling short of expectations. Despite strong demand for its AI infrastructure, the company's revenue of $16.06 billion was below analysts' expectations of $16.21 billion. In addition, Oracle's recent aggressive expansion of AI infrastructure and issuance of massive bonds has raised investor concerns about returns.

In contrast, Broadcom released its 2025 fiscal year report, with fourth-quarter revenue of $18.015 billion, up 28% year-on-year, and net profit of $8.518 billion, up 97% year-on-year. AI semiconductor revenue grew 74%, driving overall performance above expectations. The company holds $73 billion in AI orders, with future growth expected. However, as the CEO refused to provide clear guidance on AI revenue for fiscal 2026, the stock price rose and then fell after hours. The market has doubts about its high valuation and customer dependence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says