Virtuals Robotics: Why Did We Enter the Embodied Intelligence Field?

Digital intelligence acquires entity, where thought and action converge in the realm of robotics.

Original Title: Introducing Virtual Robotics.

Original Author: Virtuals Protocol

Original Translation: DeepTech TechFlow

Since its inception, Virtuals' core goal has always been to build a society of AI agents—a network where agents can collaborate, transact, and create value.

· Through ACP, we have achieved business transactions between agents.

· Through Butler, we have built a collaboration bridge between humans and agents.

· Through Unicorn, we have addressed the capitalization issue for agents.

Each layer is expanding the boundaries of digital intelligence. And now, this network extends into the physical world through robotics, where intelligence has taken on a tangible presence, and action has become tangible.

Artificial intelligence has automated reasoning, blockchain has empowered large-scale collaboration, and robotics has approached physical execution.

These three forces together form a closed loop, constructing a self-sustaining system where thoughts, actions, and transactions can autonomously propagate.

This fusion defines Agentic GDP (aGDP), the total output generated by the collaboration of humans, agents, and machines in the digital and physical domains.

Our exploration of robotics began within our internal venture capital division, investing in cutting-edge teams at the intersection of perception, control, and automation. These early experiments revealed the two core bottlenecks limiting the materialization of agents:

· Data: Without rich spatial datasets, embodied AI cannot learn to perceive or act effectively.

· Capital: Without scalable funding mechanisms, innovation in robotics will remain slow and fragmented.

Addressing these two issues is key to accelerating the development of physical intelligence.

Virtuals have chosen a "Middle Way" strategy to tackle the challenges of robotics.

We are not directly involved in hardware or model development, but instead focus on the invisible yet pivotal levers, building data and capital infrastructure that supports the ecosystem.

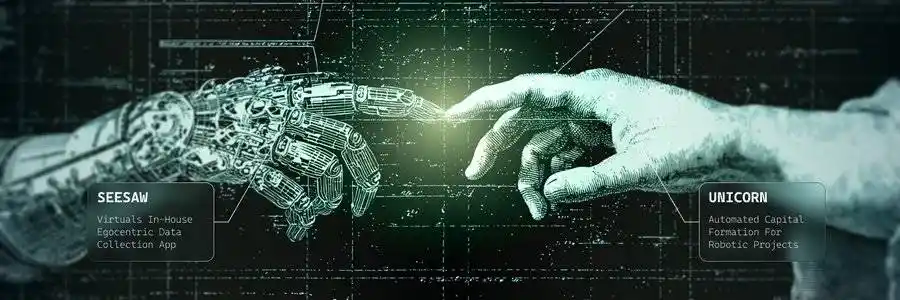

· Through SeeSaw: We have introduced a self-centric data platform that redefines how the world is captured and learned, enabling robots to "see" and understand space through human-recorded experiences.

· Through Unicorn: We have reimagined the funding mechanism for cutting-edge technologies.

With the integration of these systems, Virtuals have evolved from a digital agent platform into a full-stack intelligent engine.

If the past decade was defined by information technology, the next decade will be defined by materialization, representing a moment where ideas take on physical form.

Through robotic technology, the agent's internet extends into the physical world, completing the loop between intelligence, collaboration, and existence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah