BTQ Technologies partners with Bonsol Labs for quantum cryptography breakthrough on Solana

Key Takeaways

- BTQ Technologies, a leader in quantum security, is collaborating with Bonsol Labs to bring NIST-approved post-quantum cryptography to the Solana blockchain ecosystem.

- Bonsol Labs enhances Solana's infrastructure with verifiable compute and zero-knowledge proofs, supporting the integration of quantum-resilient cryptographic primitives.

Share this article

BTQ Technologies, a Nasdaq-listed firm specializing in quantum security solutions for blockchain applications, has partnered with Bonsol Labs to integrate NIST-approved post-quantum signatures directly into Solana’s ecosystem.

The collaboration between BTQ and Bonsol Labs, a developer-focused project integrating verifiable compute and zero-knowledge proofs into Solana’s infrastructure, marks a key advancement in quantum-resistant blockchain technology.

NIST, a US standards body playing a leading role in developing and advancing post-quantum cryptography standards to counter emerging quantum threats, has standardized the ML-DSA algorithm (FIPS 204) used in the partnership to counter emerging quantum threats.

Bonsol Labs has been actively demonstrating verifiable compute frameworks on Solana, including tools for efficient proof generation and verification that align with high-performance needs like those in quantum security applications.

Growing interest in quantum-resistant cryptography has prompted blockchain projects like Solana to explore defenses against potential quantum computing threats, with recent examples highlighting verifiable proofs for real-world use cases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

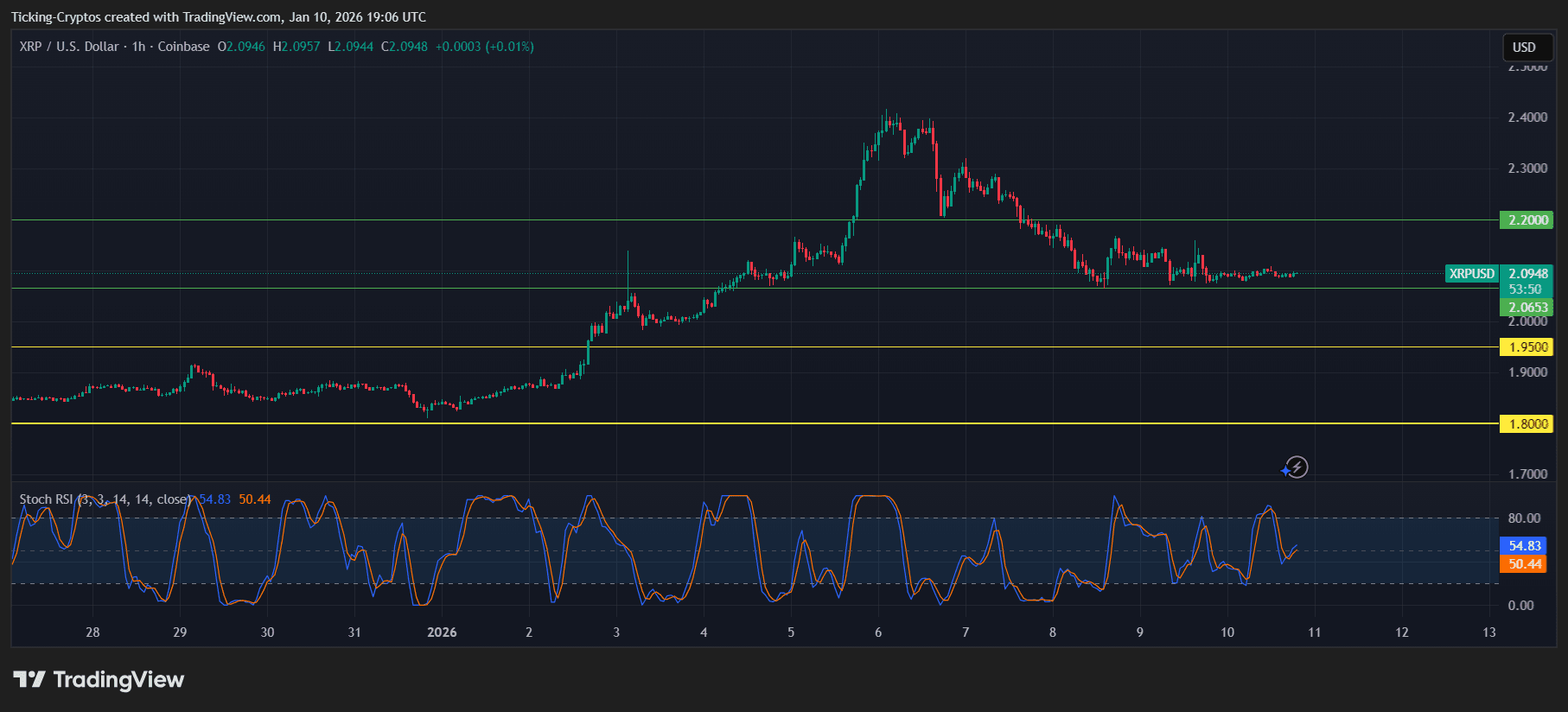

XRP Price Prediction: Bulls Defend $2.06 Support as 1H Charts Reset

Lower volatility lifts investor confidence in risk assets, Wells Fargo’s Schumacher says

The Senate advances toward a decision on market structure: Crypto Update

Solana ETF Flows and Whale Moves Hint at Bullish Potential