Legendary Trader Peter Brandt Warns Bitcoin Flashing Bearish Signal That Could Trigger Massive Meltdown – Here’s His Target

Veteran trader Peter Brandt says Bitcoin ( BTC ) may plummet by about 50% from its current value – based on another commodity’s historic pattern.

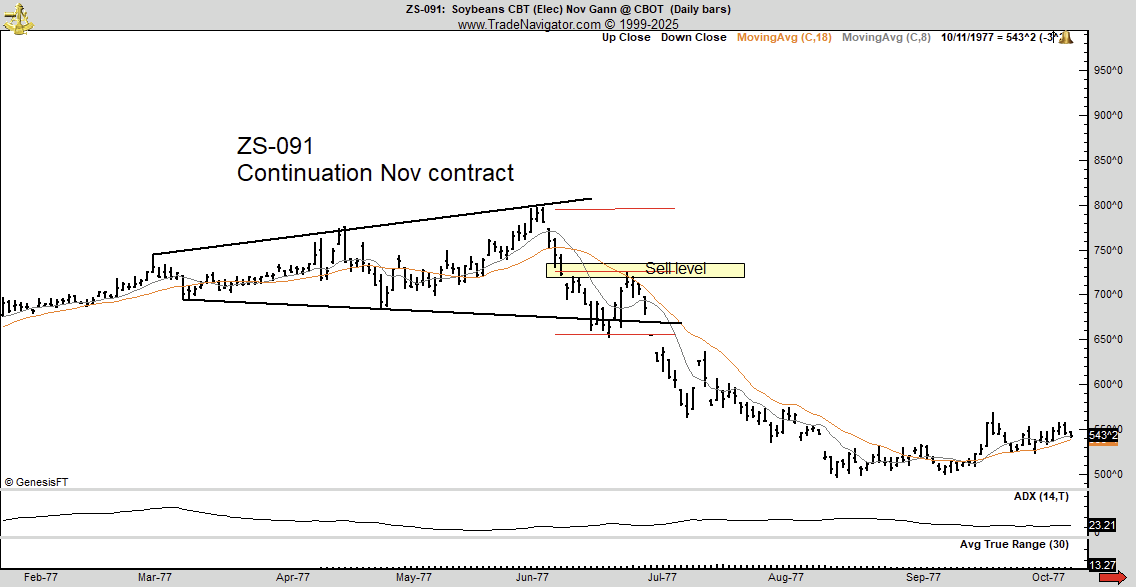

The legendary trader tells his 816,800 followers on X that Bitcoin may be printing a bearish broadening formation similar to the price of soybeans in 1977.

In technical analysis, a broadening formation is characterized by two diverging trend lines, one rising and one falling, leading to price volatility.

“In 1977 Soybeans formed a broadening top and then declined 50% in value. Bitcoin today is forming a similar pattern. A 50% decline in BTC will put [Strategy] MSTR underwater Whether I am right or wrong, you have to admit this old guy has the gonads to make big calls.”

Source: Peter Brandt/X

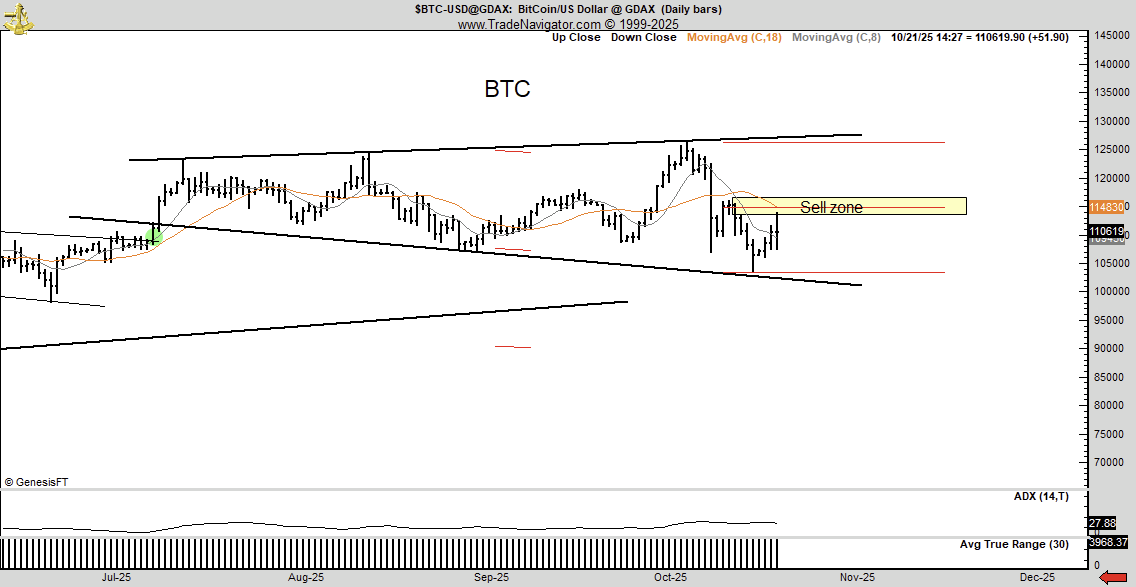

Source: Peter Brandt/X

Source: Peter Brandt/X

Source: Peter Brandt/X

Meanwhile, pseudonymous crypto trader Bluntz tells his 329,900 followers on X that Bitcoin is not done rallying this cycle.

“Same deal with BTC, one more all-time high then top, the current doomers are too early.”

Source: Bluntz/X

Source: Bluntz/X

Bluntz practices the Elliott Wave theory, which states that a bullish asset tends to exhibit a five-wave rally, with waves one, three and five acting as upward moves and waves two and four serving as corrective periods.

Looking at his chart, the analyst suggests that Bitcoin is forming a fifth wave that may send the flagship crypto asset to about $140,000.

Bitcoin is trading for $108,132 at time of writing, down 4.2% on the day.

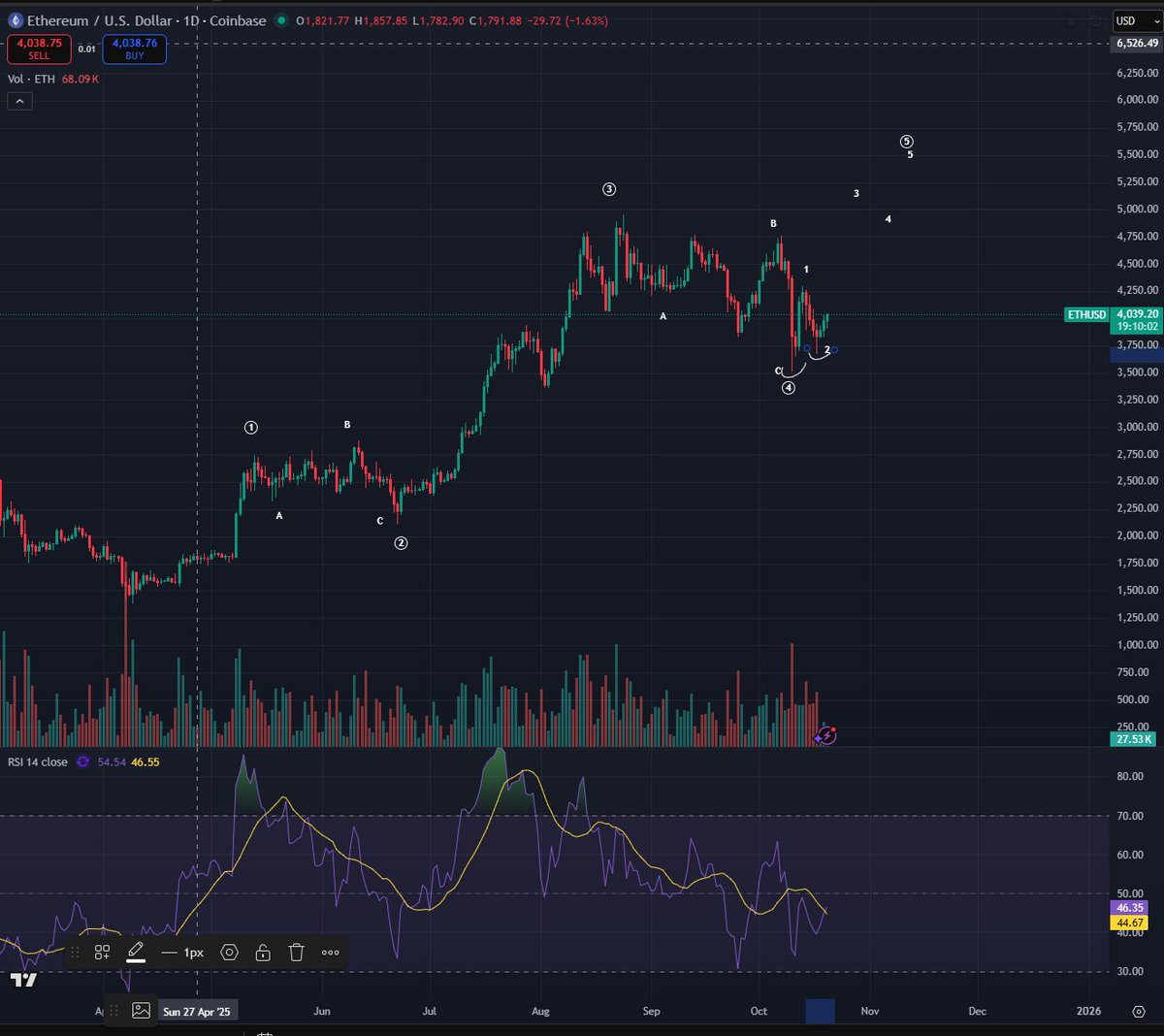

Bluntz also believes that Ethereum ( ETH ) will hit new all-time highs this cycle.

“Nice higher low [price] printed on ETH over the weekend, the doomers are a leg too early in my opinion. One more high and then top.”

Source: Bluntz/X

Source: Bluntz/X

Looking at his chart, the analyst suggests ETH is forming the third wave of a five-wave rally. He predicts ETH will hit a high of about $5,500 before the end of the year.

ETH is trading for $3,841 at time of writing, down 4.6% on the day.

Featured Image: Shutterstock/Zaleman/PurpleRender

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah