Printr, a cross-chain memecoin launchpad platform, raises $4.5 million

first project supported and incubated by Bybit Venture Studio, Printr, has raised a total of $4.5 million in funding. The startup is preparing to officially launch its chain abstract token Launchpad platform. It is reported that Printr is built on cross-chain communication protocols such as Axelar and LayerZero, allowing users to issue Meme coins on multiple blockchains such as Base, BNB Chain, Ethereum, Mantle, Solana, etc. The project aims to address the issue of fragmented liquidity and help token creators access a diverse crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold and Silver RSI Claims 50-Year Peak, Historic Warning with Key Implications for Crypto

40% of Ethereum Supply Slips Into Loss as Whales Take Opposing Positions

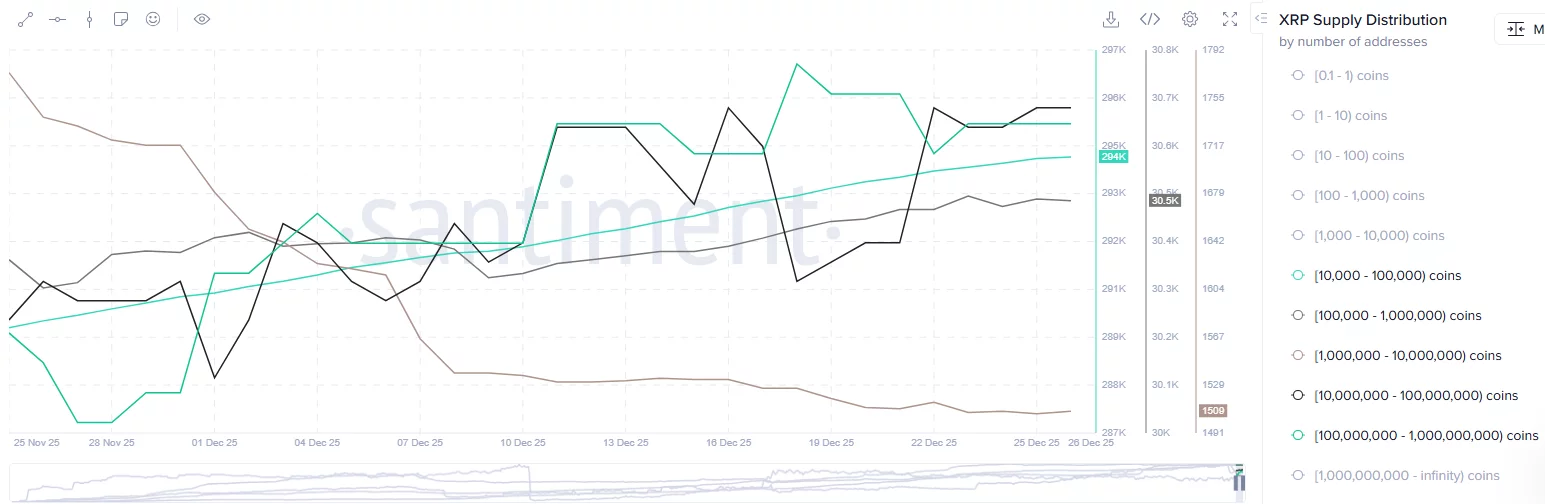

XRP price targets 27% rebound as bullish wedge forms and whales buy in