Bitcoin’s Hashrate Hits the Stratosphere: Miners Flex 1.164 Zettahash of Pure Power

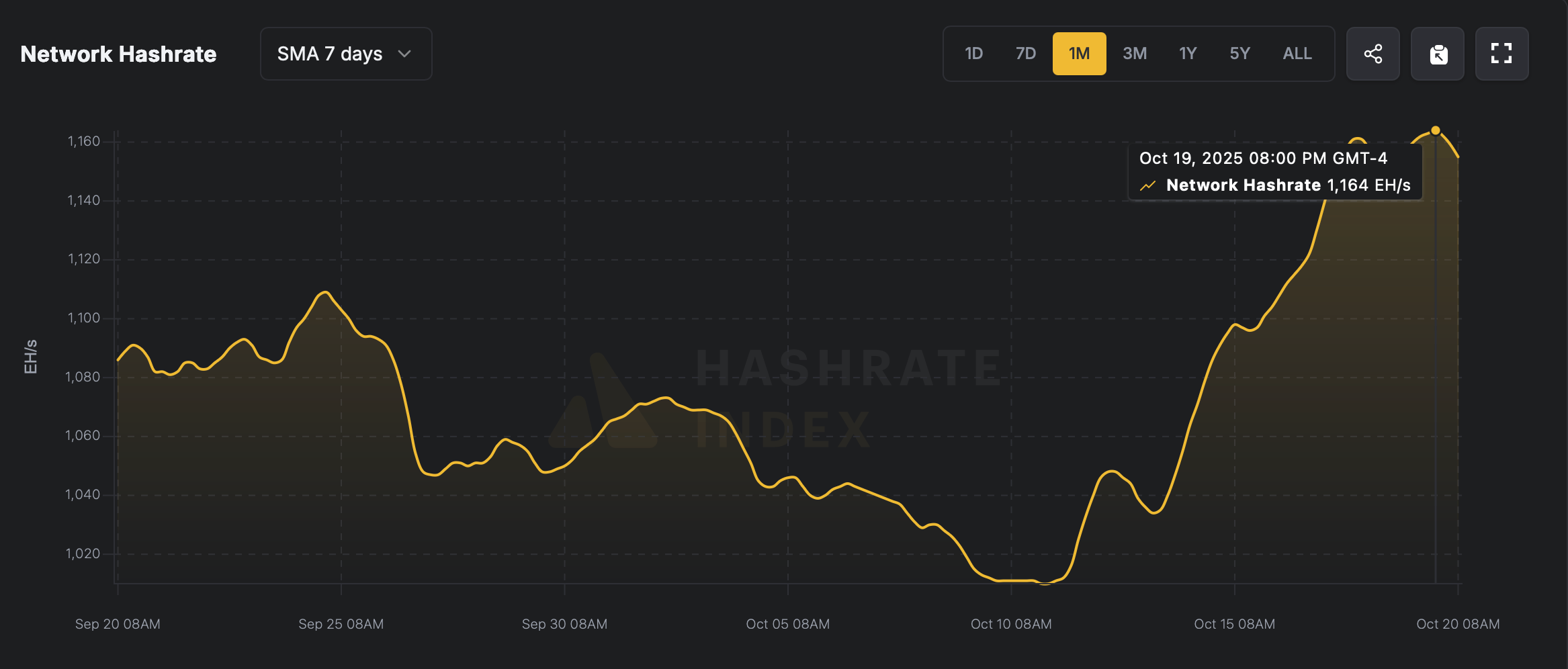

Bitcoin’s hashrate just cranked things up another notch, blasting to 1,164 exahash per second (EH/s) on Sunday at 2:40 p.m. Eastern time.

Bitcoin’s Hashrate Rockets While Revenue Improves

Fresh off its 1,157 EH/s high just two days back, Bitcoin’s hashrate has casually leveled up—adding another 7 EH/s to hit 1,164 EH/s, or for those who love big numbers, a cool 1.164 zettahash per second (ZH/s).

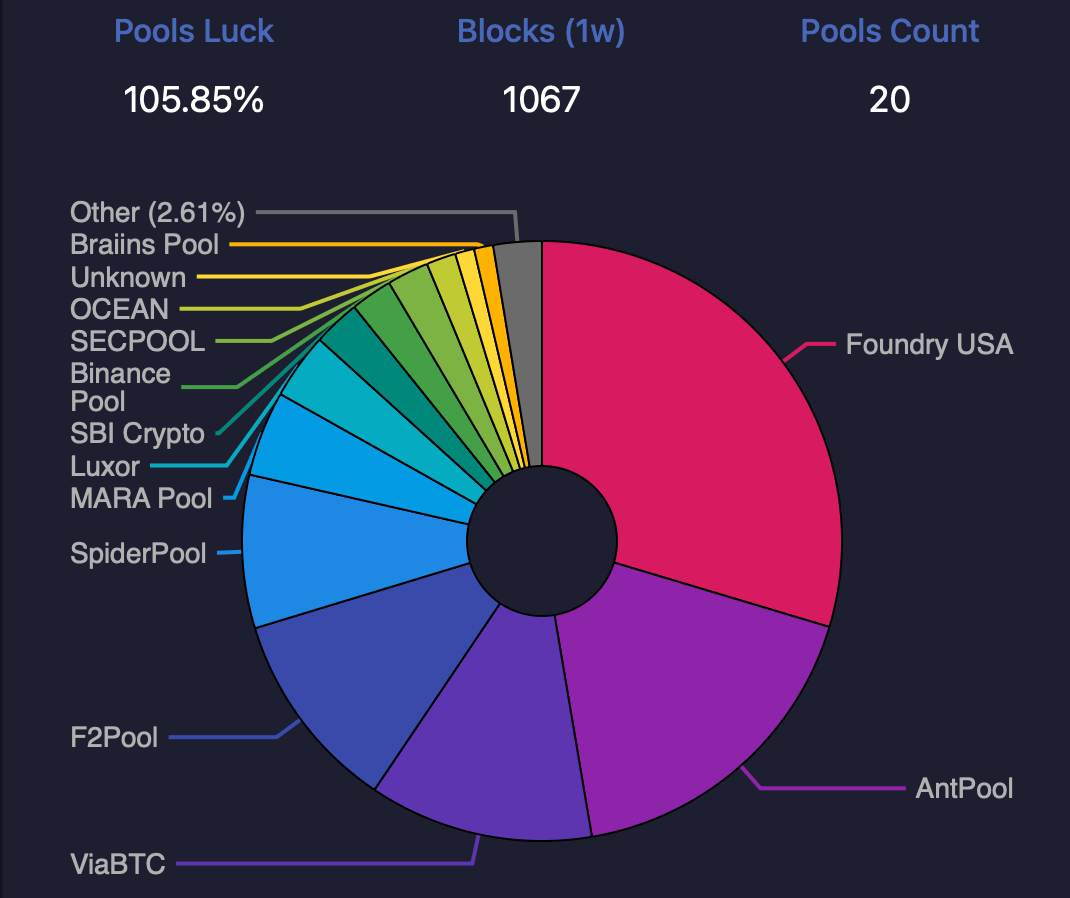

According to current hashrate stats, as of 11:45 a.m. on Oct. 20, Bitcoin’s hashrate is cruising at 1,154.16 EH/s. Leading the charge is Foundry USA, mempool.space metrics show, flexing 334.18 EH/s—roughly 28.96% of the entire network’s muscle.

Antpool’s holding steady with about 199.24 EH/s, making up 17.26% of Bitcoin’s total hashrate. Together with Foundry, this powerhouse duo controls a hefty 46.22% of the network.

Coming in third is ViaBTC with 135.99 EH/s, roughly 11.78% of the total, while F2pool and Spiderpool round out the top five at 122.29 EH/s and 92.77 EH/s, respectively. With BTC’s price on the upswing, hashprice—the estimated value of one petahash per second (PH/s)—has inched higher too.

In just 24 hours, the hashprice climbed 3.14%, rising from $46.51 to $47.97 per PH/s. Even so, the hashprice remains 6.89% below its Sept. 20, 2025 level. Over the past day, miners have been raking in an average of 3.14 BTC per block—though just 0.60% of that comes from onchain fees.

Bitcoin’s mining game is firing on all cylinders, with hashrate milestones stacking up and hashprice ticking higher in step with BTC’s price climb. Foundry and Antpool continue to dominate the charts, while 84 distinct smaller pools keep the competition lively.

Despite hashprice trailing its Sept. 20 level, miners remain locked in and laser-focused, proving once again that Bitcoin’s network isn’t just strong—it’s relentlessly pushing the limits of digital grit and computational endurance.

FAQ 🧭

- What is Bitcoin’s current hashrate?

As of Oct. 20, Bitcoin’s hashrate is cruising near 1,154 EH/s after recently touching 1.164 zettahash per second (ZH/s). - Which mining pools dominate the Bitcoin network?

Foundry and Antpool lead the pack, jointly controlling about 46% of Bitcoin’s total SHA256 hashrate. - How has Bitcoin’s hashprice changed recently?

The hashprice climbed 3.14% in 24 hours, rising from $46.51 to $47.97 per PH/s. - Are miners earning more from block rewards?

Miners earned an average of 3.14 BTC per block over the past day, which means only 0.60% stemmed from onchain fees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH drops 4.37% within 24 hours following Australian wage agreement

- DoorDash's stock fell 4.37% in 24 hours amid a 25% wage hike agreement for Australian delivery workers, including mandatory accident insurance. - The deal raises near-term cost concerns as operating margins stand at 5.5%, but reflects improved labor standards and regional commitment. - Institutional ownership rose to 90.64% with major investors increasing stakes, signaling long-term confidence despite recent volatility. - Analysts maintain a "Moderate Buy" rating ($275.62 target) as DoorDash shows strong

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.