Prediction market Limitless completes $10 million seed round, LMTS token to be launched soon

By lowering the barriers to trading, Limitless is attracting both crypto-native users and regular traders, driving prediction markets toward mainstream adoption.

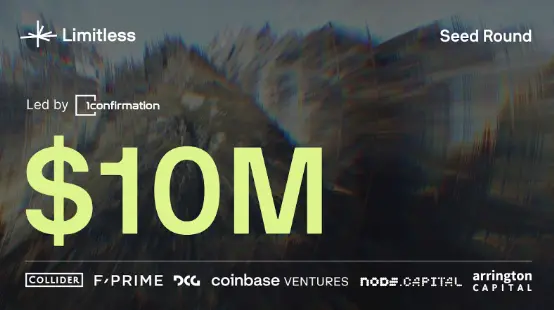

Prediction market platform Limitless Exchange announced the completion of a $10 million seed round of financing, led by 1confirmation, with participation from Collider, F-Prime, DCG, Coinbase Ventures, Node Capital, and Arrington Capital.

This round of financing comes at a time of strong growth for Limitless—the platform's total trading volume has surpassed $500 million, firmly establishing it as the largest prediction market on the Base chain. Previously, Flyer One Ventures and SID Venture Partners participated in Limitless's strategic round, further solidifying its investor base.

Explosive Growth on the Eve of Token Generation

Limitless's growth trajectory demonstrates the superiority and user-friendliness of its market model: between August and September, trading volume increased 25-fold, and by mid-October, nominal trading volume had surpassed $100 million, exceeding the entire September data in just half a month.

In September, Limitless conducted a $1 million fundraising event through Kaito Launchpad, which received over $200 million in subscription demand, setting a record for oversubscription and fully reflecting the market's strong anticipation for the LMTS token.

This rapid growth indicates that Limitless is attracting both crypto-native users and ordinary traders by lowering the trading threshold, driving prediction markets toward mainstream adoption.

The Simplest Way to Trade Crypto Assets and Stocks

Limitless has become the most convenient crypto asset and stock trading platform in fast markets. Users can enter 30- or 60-minute markets in just one minute, enjoying instant settlement, no liquidation risk, and zero hidden fees.

This minimalist design attracts both novice users and provides high-leverage opportunities for professional traders. The new funding will accelerate product iteration, expand into shorter cycle markets (such as 15 minutes, 10 minutes, and 1 minute), and broaden user growth plans.

At the same time, Limitless is exploring compliance license applications to ensure the sustainable development of its global business and consolidate its unique position at the intersection of finance and prediction markets.

Limitless Labs CEO CJ Hetherington stated: “We appreciate the continued support from early investors and welcome industry giants such as F-Prime, DCG, and Arrington Capital. Most excitingly, both investors and users have recognized Limitless as the world's simplest high-leverage trading gateway. Prediction markets are going mainstream and evolving into a new trillion-dollar derivatives category—the future is limitless.”

About Limitless.Exchange

Limitless Exchange is a prediction market platform based on the Base chain, dedicated to providing the simplest crypto asset and stock trading experience. Its short-term fast price markets support instant settlement, with no liquidation risk or hidden fees.

The platform is backed by top institutions including 1confirmation, Collider, F-Prime, DCG, Coinbase Ventures, Node Capital, and Arrington Capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s back above $94K: Is the BTC bull run back on?

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.