Modest Solana Investment Can Double Portfolio Returns, Study Finds

The new Capital Markets report attributes this edge to Solana’s robust ecosystem growth, efficiency, and increasing institutional adoption.

Bitcoin may dominate institutional attention as the cornerstone of digital assets. However, new research suggests that modest exposure to Solana (SOL) could significantly improve portfolio efficiency.

A study by Capital Markets, drawing on Bitwise data, found that even a small Solana allocation enhances risk-adjusted returns in a traditional 60/40 portfolio of equities and bonds.

How Solana Allocations Produce Strong Returns

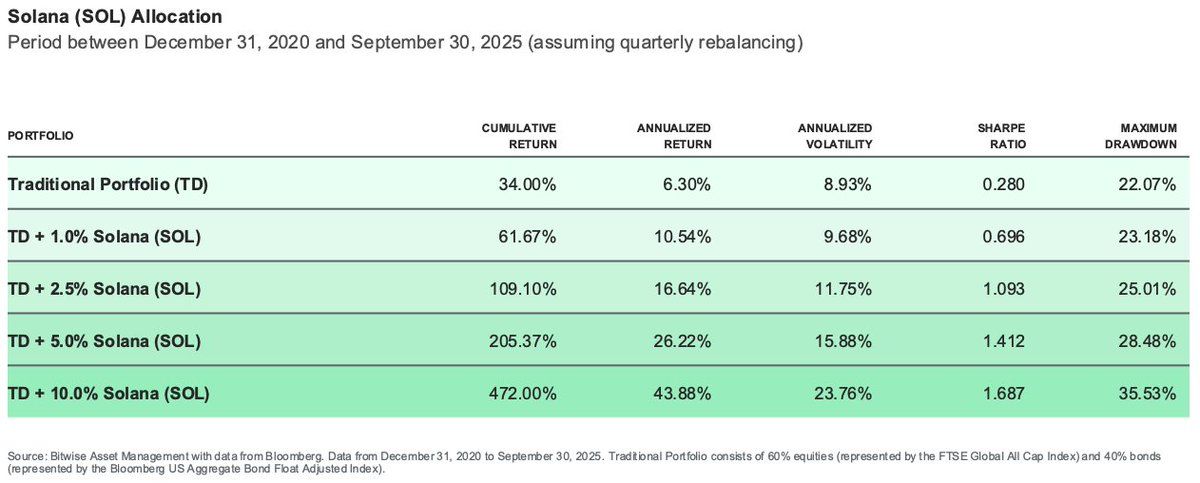

The analysis revealed that adding just 1% SOL exposure lifted annualized returns to 10.54%, with a Sharpe ratio of 0.696.

According to the report, increasing that share to 2.5% boosted returns to 16.64% and produced a Sharpe ratio of 1.093. A 5% weighting, meanwhile, generated 26.22% returns with a Sharpe ratio of 1.412.

Solana Portfolio Allocation. Source:

Capital Markets

Solana Portfolio Allocation. Source:

Capital Markets

Capital Markets also pointed out that a 10% higher-risk allocation will push the portfolio’s annualized returns to 43.88%, with a Sharpe ratio of 1.687.

Capital Markets said these results demonstrate how measured SOL exposure can strengthen long-term portfolio performance. However, diversification altered the outcome.

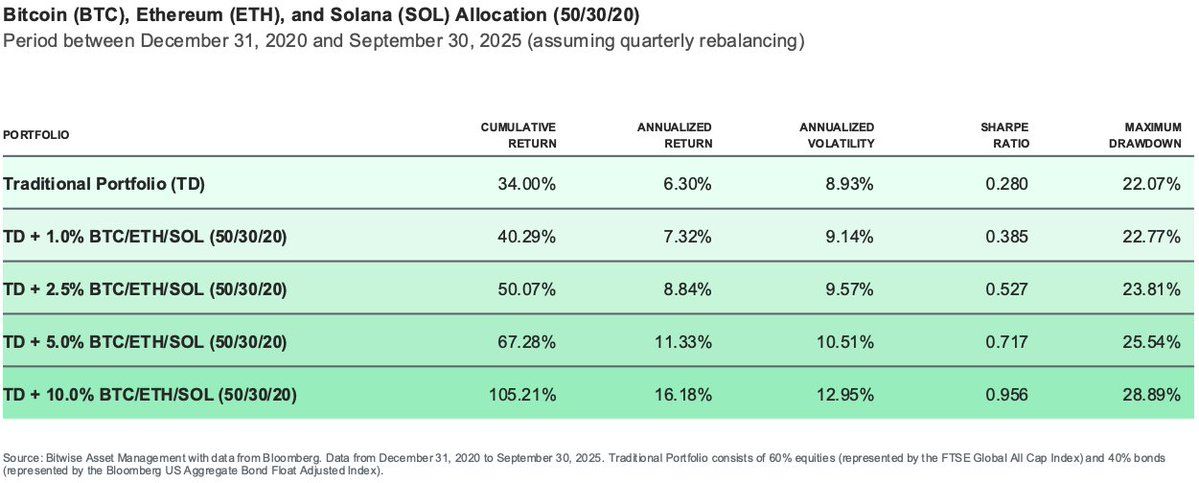

When a 10% crypto allocation was split equally among Bitcoin, Ethereum, and Solana, annualized returns dropped to 19.87%. Notably, this is significantly less than half of Solana’s solo performance.

Meanwhile, a 50:30:20 split between Bitcoin, Ethereum, and Solana yielded 16.18% returns. Smaller allocations of 5% and 2.5% produced steady but moderate improvements of 11.33% and 8.84%, respectively.

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

Bitcoin, Ethereum, and Solana Allocation. Source: Capital Market

“Maximum drawdowns remained relatively contained across allocations, even as returns increased sharply,” Capital Markets stated.

Considering this, the firm concluded that a concentrated Solana exposure delivered higher gains. However, a diversified portfolio offered smoother, more consistent growth.

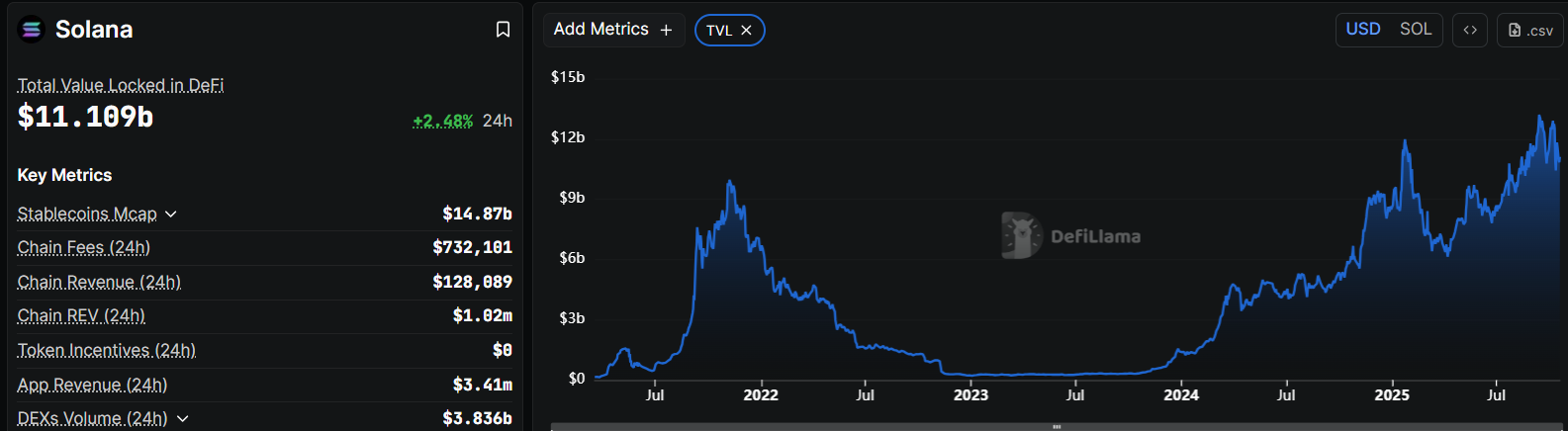

Solana’s on-chain fundamentals help explain its performance edge.

The network, known for low transaction fees and high throughput, processed roughly 96 million daily transactions in the first quarter of 2025 amid the fervor for meme coins.

At the same time, the blockchain network has scored significant institutional adoption and user growth across payments, gaming, and consumer applications. Notably, Solana is the second-largest decentralized finance ecosystem with more than $11 billion in value locked.

Solan DeFi Ecosystem. Source:

DeFiLlama

Solan DeFi Ecosystem. Source:

DeFiLlama

This expanding ecosystem continues to reinforce SOL’s investment appeal. Its efficiency and scalability position it as a credible next-generation blockchain for decentralized applications.

Moreover, with speculation growing around a potential US spot Solana ETF, the asset now dominates discussions about crypto’s evolving role in modern portfolio theory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol