Ethereum Price Prediction — ETH Targets $4,300 Bounce as MAGACOIN FINANCE Presale Surges Past $17M

Ethereum is attempting to recover from a recent pullback that tested the $3,600–$3,700 range. According to market analysts, as long as ETH can recover the lost ground of $4,000, then it will be the first good indication of the revival of strength.

Although there are short-term fluctuations and ETF outflows, investor sentiment is optimistic in the long term. With Ethereum consolidation, market attention has shifted to other trending projects.

Ethereum Attempts a Technical Recovery

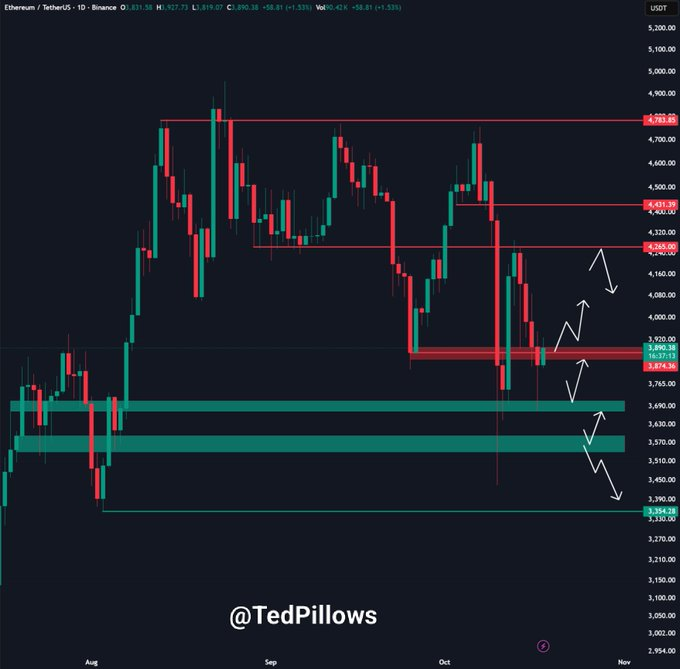

After recovering on the $3,650 support zone in the early part of this week, Ethereum is trading at the area around $3,950. Coingecko data indicates that ETH has gained almost 2% within the last 24 hours with buyers protecting major support levels. Market commentator wrote that ETH experienced a bullish recovery off the $3,600-$3,700 level. In case it retrieves $4,000, it will be an initial message of power.

Source:

X

Meanwhile, ETF data reflect a $232 million outflow by U.S. Ethereum funds, with BlackRock recording a sales level of more than $146 million. Nevertheless, there are analysts who are still optimistic of recovery targets within the medium term.’ This is an Ethereum textbook set-up, Ted added. My wave-5 goal will be $5,200, followed by $6,000 at the end of a year.”

According to market analysts, the psychological barrier is at the $4,000 mark. In case Ethereum continues to stay higher than the 20-day moving average, the next level of resistance will be around $4,300-$4,400. Nevertheless, the inability to re-evaluate above the 3,800 will clear the way to another test of the $3,600 region before another push up.

New Ethereum Treasury Plans Emerge in Asia

According to Bloomberg, a group of influential Asian investors is already planning to roll out a 1 billion Ethereum treasury. The project includes Li Lin, the founder of Huobi and chairman of Avenir Capital, who has become a member of a group of local crypto leaders. Other members of the group are HashKey Group CEO Xiao Feng, co-founder of Fenbushi Capital Shen Bo, and co-founder of Meitu Inc Cai Wensheng.

According to the sources, institutional participants have already made commitments totaling to approximately 1 billion of capital. This is in addition to the $500 million raised by HongShan Capital Group, which was once known as Sequoia China and $200 million raised by the Avenir Capital. Analysts interpret the action as a great act of confidence in the long-term network worth of Ethereum, particularly following the recent market decline.

Market researcher commented that the weekly structure still favors accumulation.“Ethereum is retesting its 20-day moving average for the second time now,” the post read. Such retests are often seen as a healthy stage before renewed growth, suggesting that long-term investors continue to build exposure.

MAGACOIN FINANCE Gains Momentum With $17M Raised

Conclusion

Ethereum’s technical structure remains in a recovery phase as buyers defend the $3,600–$3,800 zone. With large investors preparing a $1 billion Ethereum treasury, broader sentiment is slowly turning positive again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How PENGU USDT Sell Signals Influence Sentiment in the Crypto Market

- PENGU USDT's 2025 volatility exposed algorithmic stablecoin fragility, triggering DeFi sell-offs and reshaping trading strategies. - Contradictory technical indicators highlighted instability in algorithmic rebalancing mechanisms, while $66.6M team wallet outflows raised liquidity concerns. - Retail investors shifted to fiat-backed stablecoins post-UST collapse, accelerating USDC's market share growth amid regulatory ambiguity. - Market correlations (42-46% crypto-equity linkages) and macroeconomic press

Evaluating the Recent PENGU Price Rally: Could This Signal the Next Major Digital Asset Surge?

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be