The government’s failure to secure enough votes for a bill to end the shutdown leaves markets on edge. Meanwhile, Bitcoin $111,990 remains over $111,000, and developments between China and the U.S. suggest potential movement this week. Today’s declarations hint at upcoming progress, raising questions about the current status of SEI, XPL, DOGE , and SOL coins.

SEI and XPL Coin Insights

Altcoins have experienced significant declines, yet seasoned investors are viewing these drops as buying opportunities. This year has witnessed Trump’s tendency to escalate tensions “after hours” and then stabilize by Friday. Therefore, Trump’s actions are more crucial than his words. He opts for grand statements to achieve larger goals while settling for less, aligning with his usual approach.

Ali Martinez analyzed the present position of SEI Coin after a support test and shared his insights.

“SEI seems poised for a leap here! If it exceeds $0.31, an increase to $0.65 is possible.”

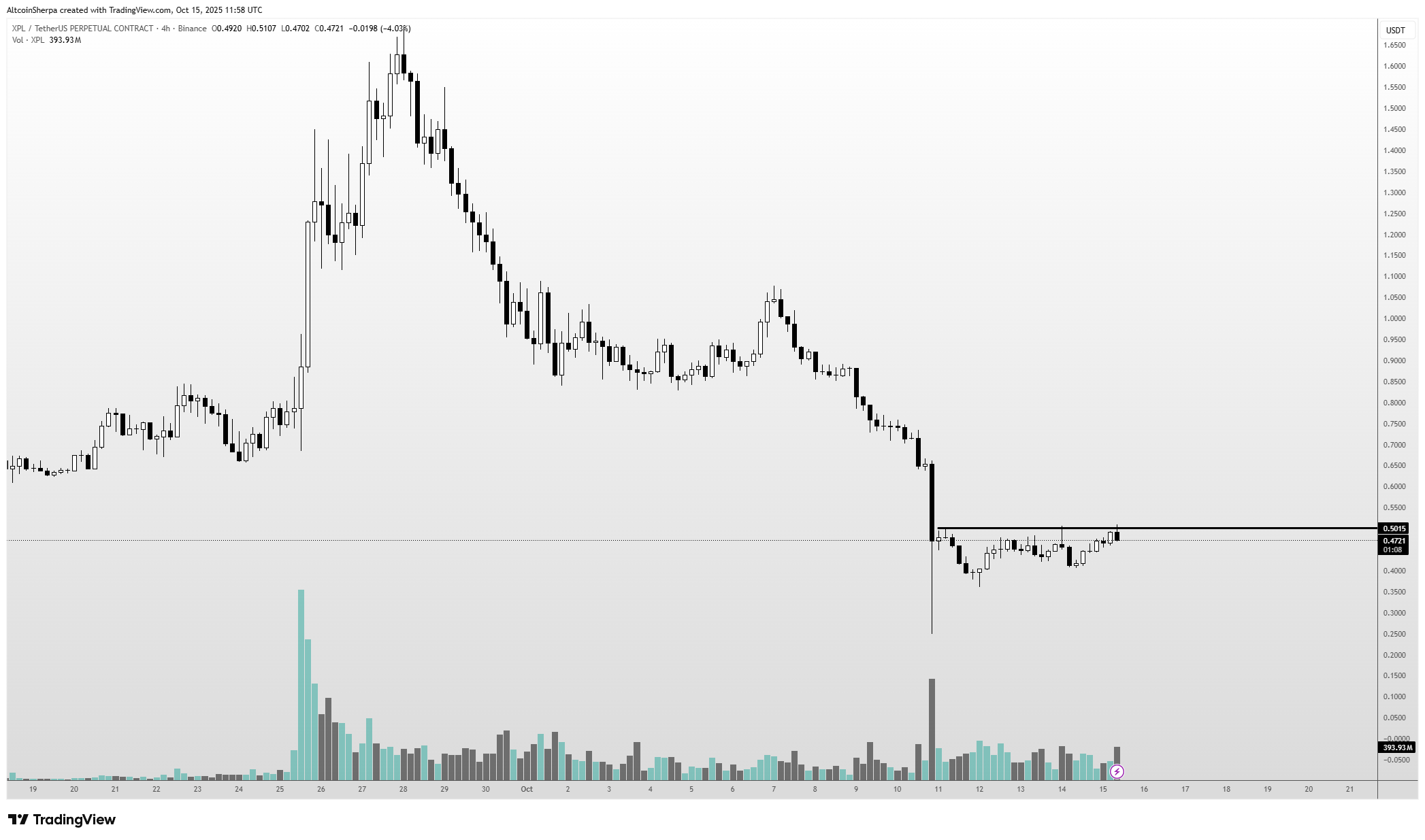

Sherpa places focus on XPL, suggesting it’s a promising purchase during this chaotic period.

“XPL presents a good buying opportunity now. Wait a bit for fluctuations, but I’m optimistic about a long-term bottom. (I said this before and was wrong.)”

DOGE, SOL, SHIB Analysis

Dogecoin $0.202515 (DOGE) plummeted to $0.096 during the October 10 crash, offering a rare buying chance not seen in 339 days. Buyers at the bottom have already realized 104% gains. The $0.214 level currently acts as resistance, and if clarity on the Chinese situation improves, a swift return to the $0.255 threshold is anticipated.

With ongoing expectations for ETF approval, SOL Coin may have witnessed its last chance to trade below $170. The $192 support was quickly reestablished, yet overcoming the $209 barrier proved unsuccessful. Should BTC reclaim its $117,000 mark, SOL Coin might achieve closures above $235.

Finally, SHIB , which dipped below $0.00001151 and pinned at a base of $0.00000696, surged 50% from the bottom.

SHIB has been unable to achieve substantial gains for months and continues to linger below key support. If market sentiment improves, $0.00001288 could be tested again.