Aave freezes PYUSD markets after unprecedented 300T mint and burn

Blockchain data showed stablecoin issuer Paxos both minted and burned about $300 trillion worth of the PayPal USD stablecoin within 30 minutes, leaving many crypto users scratching their heads.

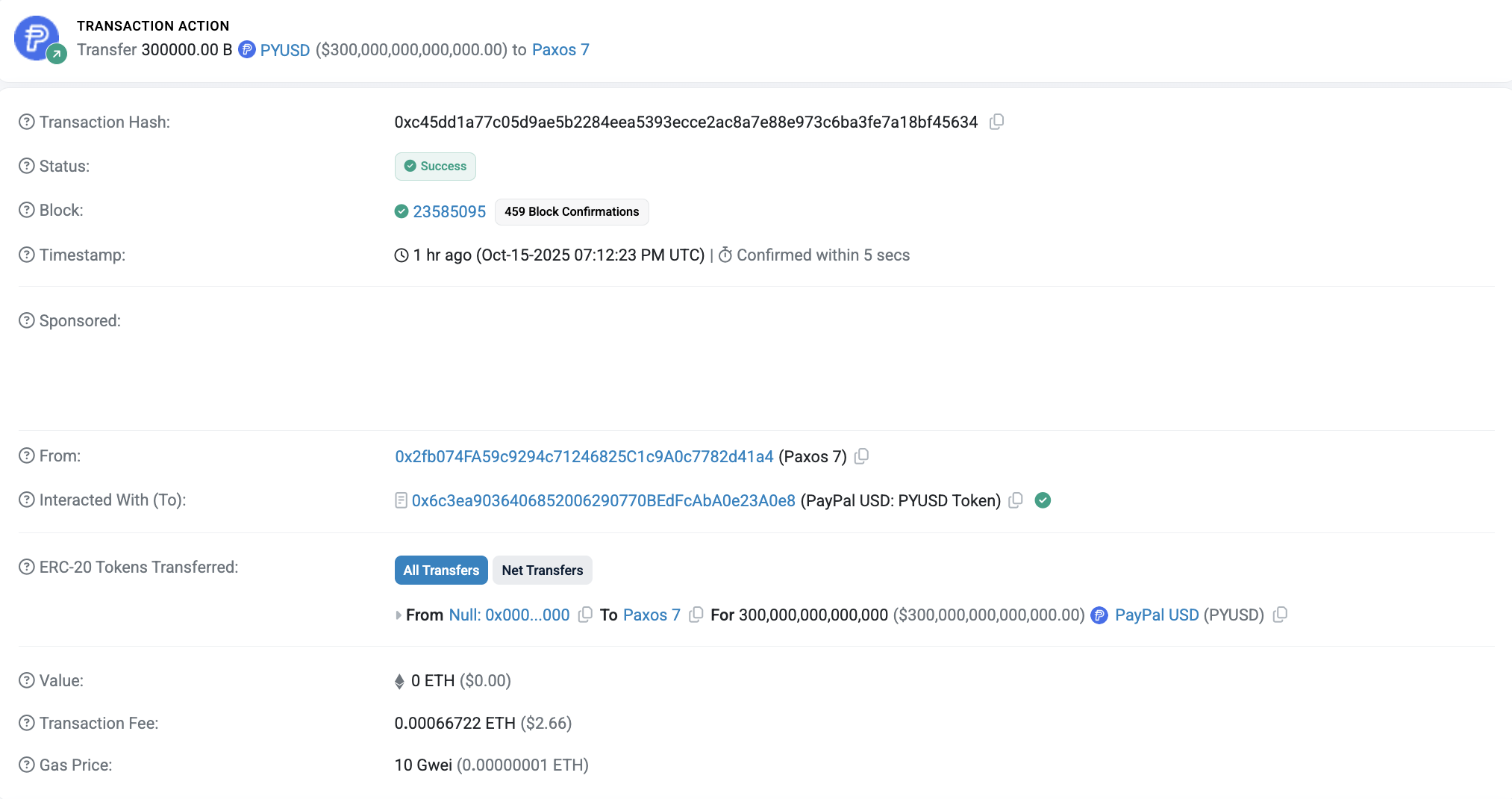

In a Wednesday X post following the mint and burn, Chaos Labs founder Omer Goldberg said Aave would be temporarily freezing trades for PayPal USD (PYUSD) after an “unexpected high-magnitude transaction” of minting and burning the stablecoin. Ethereum blockchain data showed Paxos minting 300 trillion of the US dollar-pegged stablecoin at 7:12 pm UTC and then burning the entire amount 22 minutes later by sending it to an inaccessible wallet.

Reporting from The Defiant suggested that it had been an “accidental mint” given the timing. Others online have speculated that such a large mint and burn may have been some kind of test or simulation authorized by Paxos.

Cointelegraph reached out to the stablecoin issuer for comment but had not received a response at the time of publication, nor had Paxos or PayPal publicly commented on the move.

$300 trillion is more than twice the Gross Domestic Product for every country on earth, according to data from the International Monetary Fund.

This is a developing story, and further information will be added as it becomes available.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ONDO Price Eyes 120% December Rally as Falling Wedge Pattern Strengthens

Crypto News Today: SEC Stops ProShares From Launching XRP and Other Leveraged Crypto ETFs

Bitcoin Leverage Liquidation and Potential Dangers of Excessive Exposure in 2025

- 2025 crypto market saw $1B+ leveraged liquidations as Bitcoin fell from $126k to $92k amid Fed policy uncertainty and geopolitical tensions. - Retail traders suffered disproportionately from 10x-20x leverage during price corrections, while institutions used ETFs and hedging to mitigate risks. - Derivatives market vulnerabilities exposed include liquidity crunches, algorithmic feedback loops, and cross-market contagion risks via crypto-treasury overlaps. - Post-2025 lessons emphasize 3x-5x leverage caps,

The Recent Fluctuations in the Solana Network and What They Mean for Blockchain Investors

- Solana's 2025 volatility highlights risks for blockchain investors from market psychology and infrastructure flaws. - November 2025 saw 6.1% price drops driven by leverage, Fed rate uncertainty, and plummeting on-chain activity metrics. - $3.1B in DeFi losses from smart contract exploits and AWS outage risks exposed technical vulnerabilities despite decentralization gains. - Investors must balance sentiment indicators (fear/greed index) with technical metrics (TVL, DEX volume) to navigate Solana's instab