Stablecoin Market Surges to $15.6 Trillion in Transfers and $300B Supply in Q3 2025

The third quarter of 2025 marked a major milestone for the stablecoin market, reflecting growing global adoption and institutional use. Fueled by record DeFi activity and greater regulatory clarity, stablecoins reached historic highs in both supply and transaction volume, solidifying their role as a core pillar of the digital asset economy.

In brief

- Stablecoin transfer volume hit $15.6T in Q3 2025, the strongest quarter on record for digital assets.

- Total stablecoin supply expanded by $45B, pushing the market above $300B for the first time in history.

- Ethereum reclaimed dominance with 69% of new issuances, while Tron’s supply saw a rare decline.

- USDT led DEX trading with over $100B monthly volume as stablecoins power global DeFi and payments.

Ethereum Reclaims Dominance as Tron Sees Rare Supply Dip

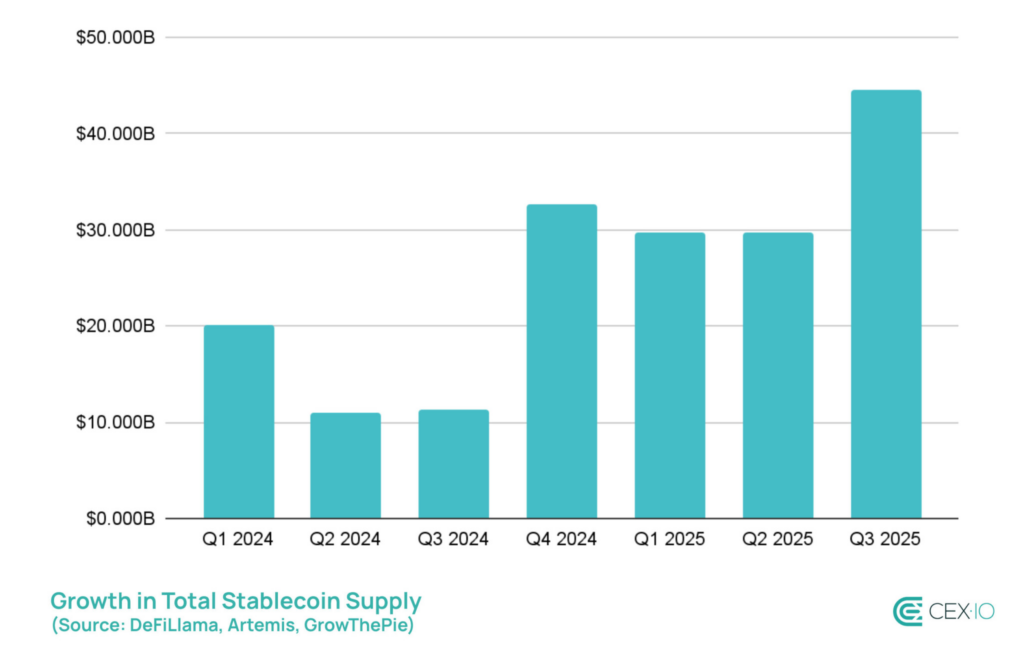

Stablecoins recorded their strongest quarter on record in Q3 2025, with transfer volumes exceeding $15.6 trillion and total supply expanding by $45 billion. The 18% quarterly growth pushed the stablecoin market above $300 billion , according to a report by CEX.IO.

USDT, USDC, and USDe drove most of the growth, making up 84% of all new stablecoin issuance. Even with U.S. limits on yield-bearing tokens under the Genius Act, USDe and PayPal’s PYUSD saw the fastest expansion, jumping 173% and 152%. The surge was fueled by strong DeFi activity and growing use across cross-chain platforms like LayerZero’s Stargate Hydra.

On-chain activity also reached new highs, with several notable developments:

- Total stablecoin transfers in Q3 2025 exceeded $15.6 trillion , marking a new record.

- Automated bots accounted for 71% of all on-chain transactions.

- Retail activity strengthened, with sub-$250 transfers reaching all-time highs in September.

- Small-value transactions are projected to exceed $60 billion by the end of 2025.

- Ethereum regained market dominance, hosting 69% of new stablecoin issuances, while Tron experienced a rare supply decline.

Layer 2 networks such as Arbitrum also gained traction, driven by demand from perpetual trading platforms and liquidity migration. As a result, USDC’s market share on Arbitrum rose from 44% to 58%, strengthening the network’s role as a hub for trading and DeFi activity.

Stablecoin Ecosystem Reaches New Heights as Final Quarter Kicks Off

Trading volumes across all stablecoins soared to $10.3 trillion, the highest level since 2021. USDT extended its dominance, surpassing $100 billion in monthly decentralized exchange (DEX) volume for the first time.

It overtook USDC as the most used trading pair on decentralized exchanges, boosted by rapid growth in activity on Binance Smart Chain (BSC). By the end of Q3, USDT’s share of total trading volume rose from 77.2% to 82.5%, while USDC declined to 10.5%. Other stablecoins collectively fell to a combined 7% share of the market.

Stablecoins cemented their central role in digital asset markets during the third quarter of 2025. Once viewed mainly as liquidity tools, they are now essential for settlement , payments, and retail adoption. With stablecoin usage historically rising in Q4, the sector may be poised for another strong quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Algo Falls by 0.69% as Market Fluctuations and Ongoing Downtrend Persist

- Algo (ALGO) fell 0.69% in 24 hours to $0.1434, contrasting with 5.52% weekly gains but a 57.16% annual decline amid crypto market uncertainty. - Switzerland delayed CARF crypto reporting rules until 2027, citing stalled international data-sharing talks, hindering global regulatory alignment. - Bonk (BONK) launched Europe's first ETP on SIX Swiss Exchange, enabling traditional investors to access memecoins without digital wallets. - Ethereum prepares December 3 gas limit upgrade to 60M, enhancing layer-2

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c