Record-Breaking Flows Define 2025 ETF Boom | US Crypto News

ETF inflows have smashed $1 trillion in 2025, underscoring a historic shift toward transparent, cost-efficient investing. With crypto and Asia-based ETFs accelerating, a new global fund era is unfolding.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and take a breath as the markets just hit another milestone that few saw coming. A record $1 trillion has poured into ETFs this year, and beneath the headline lies a quiet revolution reshaping how investors move money, from Wall Street to Web3.

Crypto News of the Day: ETF Flows Hit $1 Trillion at Record Speed as Crypto Funds Surge

US ETFs (exchange-traded funds) have surpassed $1 trillion in inflows in 2025. This milestone sets a new record pace and signals an accelerating shift away from traditional mutual funds.

According to State Street Investment Management, the surge puts the industry on track to hit as much as $1.4 trillion by year-end. If this happens, the asset class would surpass last year’s record and cement ETFs as the dominant force in US investing.

ONE TRILLION and with 2.5 months to go.. 🔥 pic.twitter.com/KPRTlSiHeP

— Eric Balchunas (@EricBalchunas) October 15, 2025

ETFGI data shows total US ETF assets at $12.7 trillion by the end of September, marking 41 consecutive months of net inflows and a 23% year-to-date growth rate.

“Any market correction might slow the pace, but it wouldn’t halt the trend,” Reuters reported, citing State Street’s global head of research, Matt Bartolini.

Bond and gold ETFs have been standout performers, recording $39 billion in fixed-income ETF inflows last month alone. Meanwhile, SPDR Gold Trust ETF recorded $15.97 billion in new funds as gold prices broke records above $4,100 per ounce. It points to a risk-on environment and persistent inflation as tailwinds.

Meanwhile, BlackRock’s iShares, the largest ETF issuer, and Tidal Financial Group both say inflows are likely to keep rising as mutual fund outflows reached $481 billion this year.

The numbers suggest investors are embracing ETFs not just for cost efficiency but also for transparency, liquidity, and diversification, key themes reshaping global investing behavior.

Crypto ETFs and Asia’s Role in the Next Growth Wave

As US ETFs roar to new highs, a parallel boom is emerging in crypto-linked funds and Asian ETF markets, where adoption is expected to accelerate sharply.

“I don’t think most people really understand just how expensive crypto native services are. With ETFs, I can get exposure for 25 basis points and two basis points to trade. Crypto ETFs are going to be a massive growth area in Asia in the next five years—could be 10–20% of all assets,” Aleksey Mironenko, a fee-based advisor, said at a Bloomberg event in Hong Kong.

His remarks mirror a broader sentiment across the industry that crypto ETFs are bridging traditional finance and digital assets, offering institutional-grade exposure without the friction of self-custody or on-chain fees.

The arrival of spot Bitcoin and Ethereum ETFs earlier this year helped normalize crypto allocation within mainstream portfolios. Meanwhile, next-generation tokenized products are beginning to attract global capital.

In its ETF Monitor, JPMorgan reported that active ETFs now represent 37% of total flows, with fixed-income and crypto products leading innovation.

Asia’s regulatory advances, especially in Hong Kong, Singapore, and South Korea, could fuel this growth, creating a new frontier where ETFs serve as a gateway for digital asset exposure.

The global ETF race is also accelerating competition among issuers. ETFGI data shows 428 providers now operate in the US alone, with iShares, Vanguard, and SPDR controlling 72% of total assets.

Yet the emerging crypto-ETF and tokenized fund ecosystem could define the next era, as the efficiency and accessibility of these financial instruments progressively meet the crypto generation halfway.

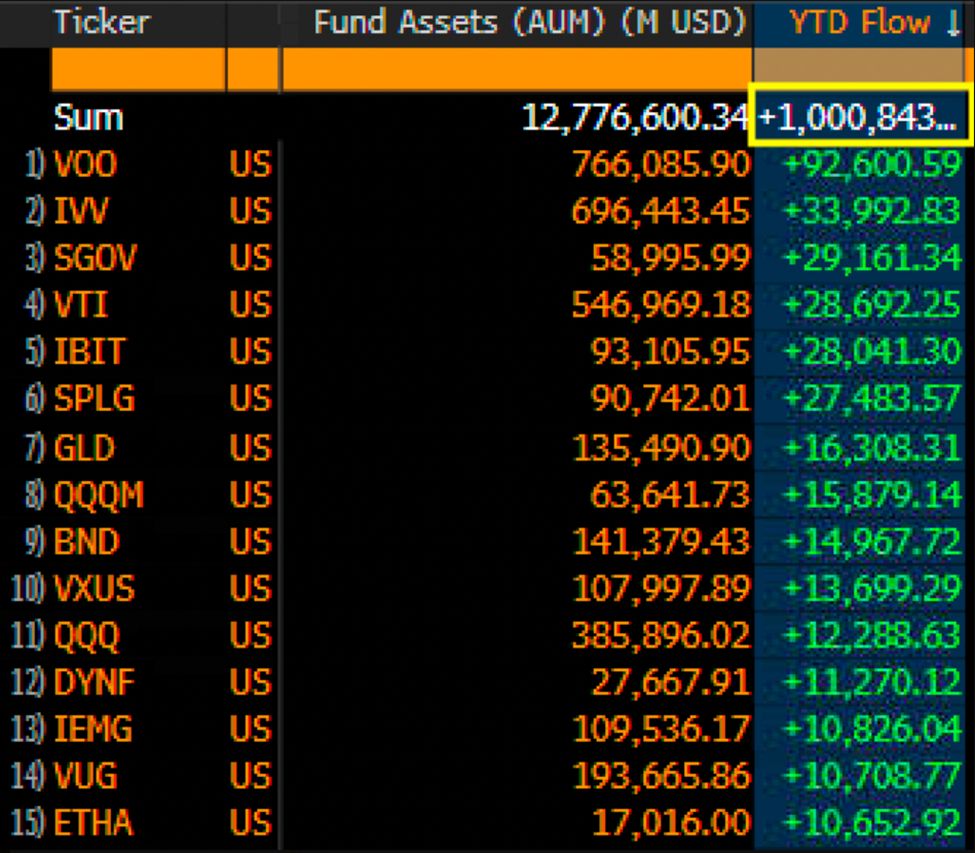

Chart of the Day

US ETF YTD Inflows Hit $1 Trillion as of October 15, 2025. Source:

Balchunas on X

US ETF YTD Inflows Hit $1 Trillion as of October 15, 2025. Source:

Balchunas on X

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Powell signals QT may end — Is this the liquidity boost crypto needs?

- Grayscale hails Solana as “crypto’s financial bazaar” with analysts targeting $300 SOL.

- Did Binance demand tokens for listings? CEO’s claim sparks industry uproar.

- Sam Bankman-Fried alleges political targeting as FTX payout debate grows.

- Coinbase to woo India’s 100 million crypto owners with CoinDCX investment.

- US seizes $15 billion in Bitcoin, charges Cambodian tycoon in crypto fraud case.

- Former UK leaders warn of Britain’s missed crypto opportunities at Coinbase forum.

- BNB’s big rally looks shaky: Are quick sellers lining up?

- Global Pi market surges past 200,000 users, but allegations of crime spell doubt.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 14 | Pre-Market Overview |

| Strategy (MSTR) | $300.67 | $303.29 (+0.87%) |

| Coinbase (COIN) | $341.55 | $346.50 (+1.45%) |

| Galaxy Digital Holdings (GLXY) | $41.14 | $41.73 (+1.44%) |

| MARA Holdings (MARA) | $22.24 | $22.85 (+2.74%) |

| Riot Platforms (RIOT) | $22.19 | $22.68 (+2.21%) |

| Core Scientific (CORZ) | $18.94 | $19.50 (+2.96%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol