Dash to $100 in October? 4 Key Drivers Behind the Privacy Coin’s Breakout Potential

Dash (DASH) is gaining traction as privacy coins rebound, with whales accumulating and a key technical breakout signaling potential for a surge toward $100.

As privacy concerns surge in October, Dash (DASH) emerges as a strong contender for a major breakout alongside Zcash (ZEC), the leading privacy coin.

Many analysts believe DASH could soon return to the $100 mark, or even go higher. What supports this prediction? The following analysis explores four main drivers behind this potential move.

1. Rising Interest in Privacy Coins

According to a recent report from Milkroad, only two sectors remained profitable over the past month: exchange tokens and privacy coins. The report highlights Zcash, Dash, and Monero as key representatives of the privacy coin resurgence.

Only 2 crypto sectors made money this month.Privacy Coins and Exchange Tokens, everything else bled out.That tells you a lot about where capital hides when markets turn risk off.If you’re building a portfolio for the next leg, don’t just chase hype sectors. pic.twitter.com/UZ60jXane1

— Milk Road (@MilkRoadDaily) October 14, 2025

The growing public interest in privacy has become the first major catalyst behind Dash’s rebound. Analysts note that privacy coins have been the best-performing group in the market, posting an average gain of more than 60%.

Search interest and media coverage for privacy-focused cryptocurrencies have also reached their highest levels since 2017, suggesting that the “privacy culture” within blockchain is awakening once again.

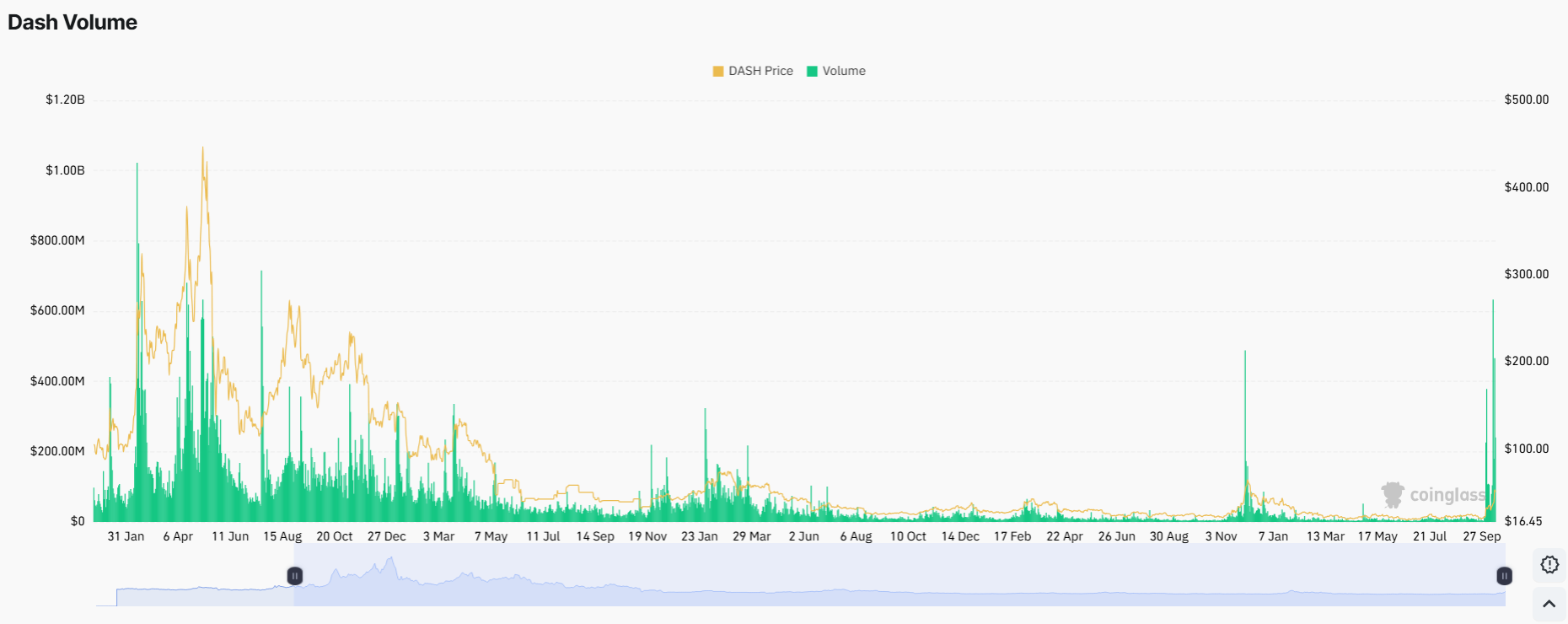

2. Explosive Trading Volume

Dash’s daily trading volume in October reached a record high of over $600 million. Data from CoinGecko shows that the current daily volume remains in the $200–$300 million range, 10 times higher than at the beginning of the month.

Dash Volume. Source:

Coinglass

Dash Volume. Source:

Coinglass

The last time DASH saw such strong volume was in early 2021, when the surge in activity fueled a rally to $400.

This renewed trading activity signals growing investor confidence in the altcoin and could provide the foundation for another bullish move, potentially mirroring the rally seen in 2021.

3. Whale Accumulation

Another bullish sign comes from the accumulation pattern among top DASH wallets.

Data from BitInfoCharts shows that the top 100 addresses have increased their DASH holdings from 25% of the total supply in early 2025 to more than 36%, marking a 10-year high.

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

TOP 100 DASH Richest Addresses. Source:

BitInfoCharts

The concentration of supply among large holders has not decreased, even after DASH rose over 100% in October. This stability indicates that whales are not taking profits yet, suggesting continued confidence and readiness for another leg up.

4. Technical Breakout

From a technical perspective, DASH has confirmed a breakout from a multi-year descending wedge pattern during October’s volatile price action.

This breakout is a classic bullish signal that often precedes major upward momentum. Analysts believe it could propel DASH to $100 or beyond in the coming weeks.

$DASH is trying to escape this (almost) 3000 days long falling wedge. If #DASH closes this week above (approx) $40 and then next week as well, this thing could shoot for a breakout target of $1K (ish) After that we can reach all the way up to the extensions from 2017 highs at… pic.twitter.com/GhoFGBOxTG

— Vuori Trading (@VuoriTrading) October 12, 2025

“Dash may soon reach $100, and if things heat up, it could jump past $200,” Joao Wedson, Founder & CEO ofAlphractal, predicted.

Despite these positive signs, these catalysts are short-term in nature. If market interest cools, trading volume declines, or whales begin distributing their holdings, DASH’s ability to sustain its growth will depend on how widely it achieves real-world adoption.

Ultimately, lasting growth for DASH will require more than market excitement—it will depend on whether the coin can demonstrate genuine utility and continued demand in the broader crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum’s $4,000 Recovery Remains Uncertain Amid Geopolitical Hopes and Ongoing Market Volatility

- Ethereum briefly hit $4,000 on October 26 amid optimism over Trump's Asia tour and U.S.-China trade talks, aligning with broader crypto market gains. - Bearish traders amassed $650M in leverage near $4,100, while institutional firms now hold 3.2M ETH (0.40% of supply), surpassing Bitcoin's corporate holdings. - A crypto whale earned $17M from Bitcoin/Ethereum trades, yet Ethereum defied "Uptober" expectations amid geopolitical uncertainty and liquidation waves. - Bitcoin's $113,800 recovery contrasted wi

Hyperliquid News Today: OpenAI's Ambitious $1T IPO—Is the AGI Dream Enough to Support the Buzz?

- OpenAI plans a $1T IPO by 2027, seeking $60B+ to fund AGI goals. - Restructured as a PBC, with Microsoft holding 27% stake and IP rights until 2032. - Aims to balance profit and public benefit, with nonprofit foundation retaining 26% control. - IPO could boost tech stocks and crypto, as AI demand drives semiconductor and blockchain sectors. - Regulators and investors monitor PBC model's success amid high valuation and financial risks.

Bitcoin Updates: Litecoin Enhances Privacy as ETF Excitement Fuels Breakout Prospects

- Litecoin (LTC) rebounds near $100.37, showing potential for a $119–$120 breakout via a bullish ascending triangle pattern. - Strong RSI/MACD momentum and $96–$101.50 support suggest a critical $102 threshold could trigger a $112–$120 rally. - MWEB privacy upgrades and ETF speculation bolster confidence, mirroring Bitcoin's 2024 institutional adoption narrative. - Bitcoin's $113k rebound and U.S.-China trade dynamics provide tailwinds, though macro risks like rate shifts remain concerns. - Analysts cautio

XNL Plummets 70%: Liquidity Crisis Derails RWA Bridge Plans

- Novastro's XNL token fell 70% from its public sale price due to liquidity constraints and lack of major exchange listings. - As a multi-chain RWA bridge token, XNL enables governance and yield generation but struggles with limited investor access and downward price pressure. - The project's modular ledger aims to enhance DeFi interoperability, yet sluggish adoption and unlisted status hinder its ability to attract capital or test market resilience. - Analysts emphasize that XNL's long-term potential depe