Pi Coin Holders Attempt to Recover From Painful 33% Price Collapse

Pi Coin investors regain confidence as technical indicators turn bullish. Holding above $0.200 could spark recovery toward $0.256 in the short term.

Pi Coin investors are finally seeing signs of relief after enduring one of the steepest declines in recent weeks. The cryptocurrency fell to a new all-time low last week following a 33% crash, but is now attempting a recovery.

Encouraging technical signals suggest that the downward pressure may soon ease as investors re-enter the market.

Pi Coin Holders Show Optimism

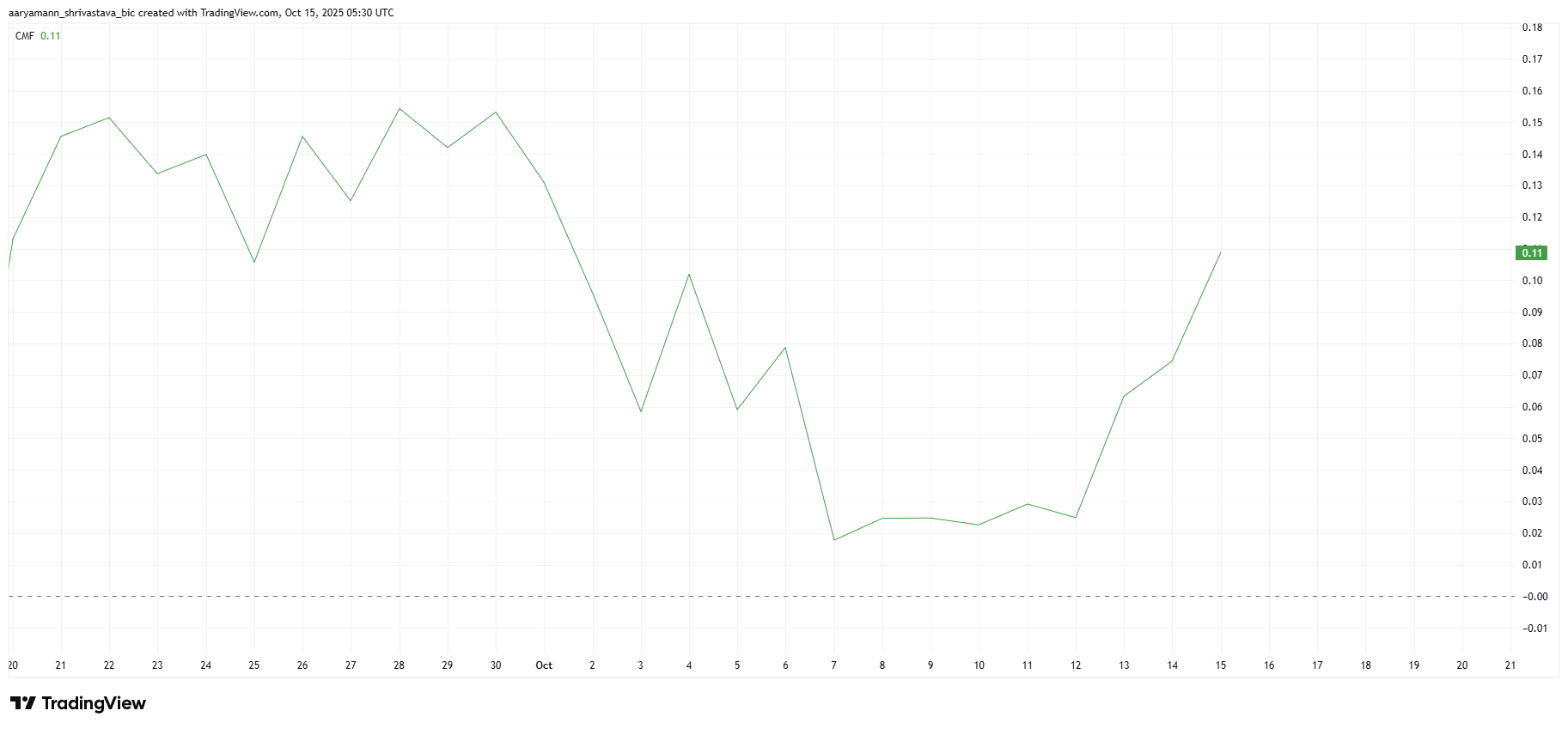

The Chaikin Money Flow (CMF) indicator is showing a strong uptick this week, reflecting renewed investor confidence. Capital inflows are rising quickly as traders take advantage of lower prices, pushing Pi Coin toward a potential reversal.

The surge in buying interest suggests that accumulation is underway, reinforcing bullish sentiment in the short term. This increase in inflows is crucial for Pi Coin’s recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

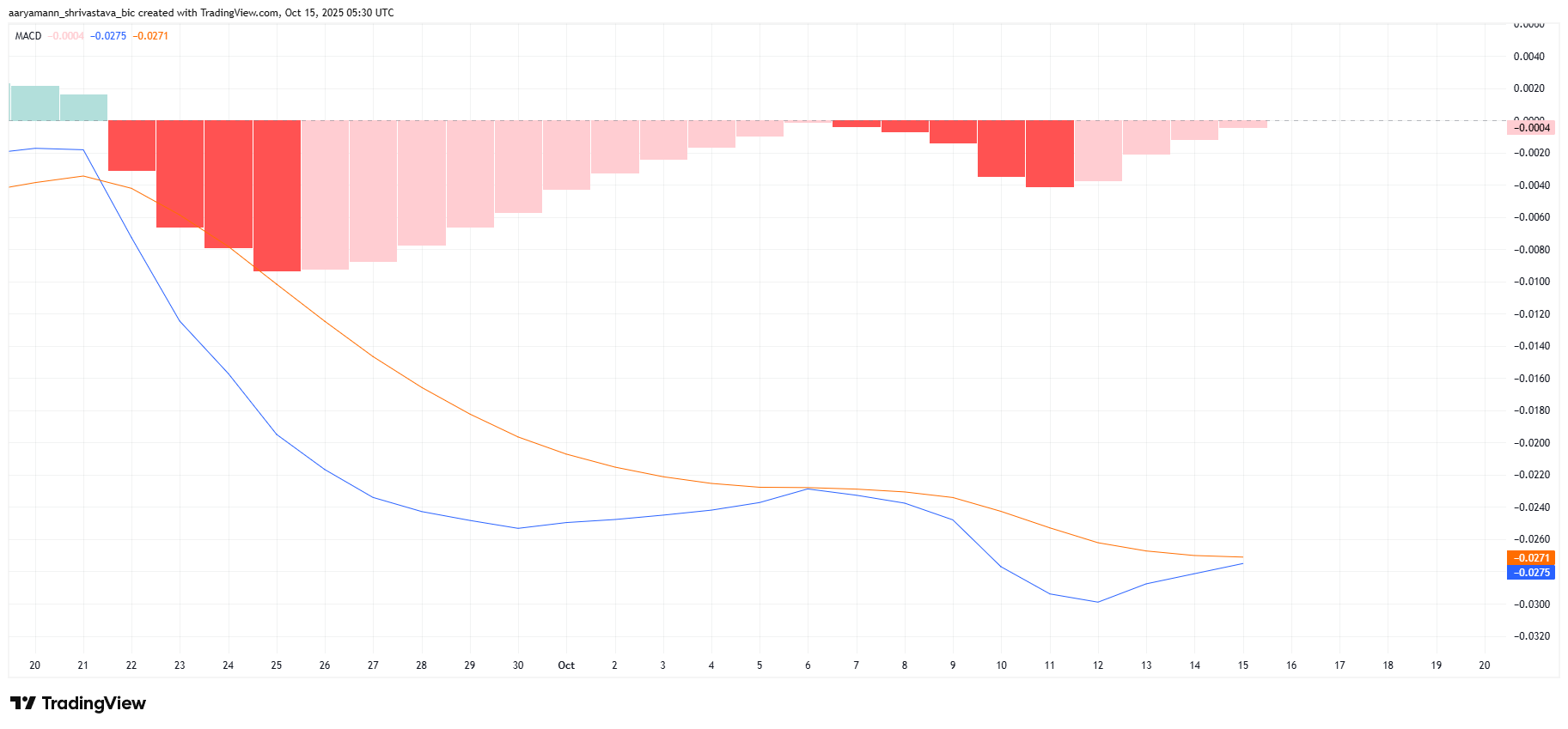

From a technical perspective, Pi Coin’s Moving Average Convergence Divergence (MACD) indicator is on the verge of a bullish crossover. This would mark the second attempt this month, indicating that buying momentum is returning.

A successful crossover could validate the renewed optimism and set the tone for a potential trend reversal after a month of bearish pressure. This would likely attract additional market participants, increasing both liquidity and trading activity.

Pi Coin MACD. Source:

TradingView

Pi Coin MACD. Source:

TradingView

PI Price Needs A Boost

At the time of writing, Pi Coin’s price stands at $0.214, slightly below the $0.229 resistance level. The altcoin is holding firmly above its $0.200 support, which serves as a critical base for recovery.

While Pi Coin has rebounded from its all-time low of $0.153, it still needs to reclaim significant ground to reverse the 33% crash. A decisive move above $0.229, supported by bullish technical indicators and investor confidence, could push the price to $0.256.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, losing the $0.200 support would expose Pi Coin to renewed selling pressure. If that happens, the price could drop toward $0.180 or lower. This would invalidate the bullish outlook and signal continued vulnerability in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monero (XMR) Dips to Test Key Support — Could This Pattern Trigger a Bounce Back?

Can CBDCs Replace Cryptocurrencies? TON Founder: Decentralization Is the Future

TON Society co-founder Jack Booth discussed the future of decentralization, the impact of central bank digital currencies (CBDCs), and the path to mass adoption of cryptocurrencies in an interview with Cointelegraph. He believes that promoting the decentralization of The Open Network (TON) is crucial, emphasizing that decentralized networks allow users to have better control over their data and finances. Booth warned that CBDCs could undermine the principles of decentralization, but supports a hybrid solution combining CBDCs and decentralized networks. He also pointed out that decentralized technologies must offer high availability and user-friendliness in order to achieve mass adoption. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Crypto update: Bitcoin tumbles below $111K as Powell dashes December rate cut hopes

The Federal Reserve launches a combination move: continues to cut interest rates by 25 basis points and ends balance sheet reduction in December, with two committee members opposing the rate decision.

Trump-appointed governor Milan, as before, advocates a 50 basis point rate cut, while another voting member, Schmid, supports holding rates steady.