Date: Thu, Oct 30, 2025 | 05:40 AM GMT

The cryptocurrency market has seen heightened volatility over the past 24 hours, following the Federal Reserve’s rate cut decision and the high-profile meeting between Donald Trump and Chinese President Xi Jinping. These events sparked a wave of $813 million in total liquidations , with $613 million coming from long positions, as both Bitcoin (BTC) and Ethereum (ETH) dropped over 3%, putting added pressure on major altcoins — including Monero (XMR).

Currently, XMR is trading in the red, testing a critical support zone that could determine whether the privacy-focused token rebounds or slides further.

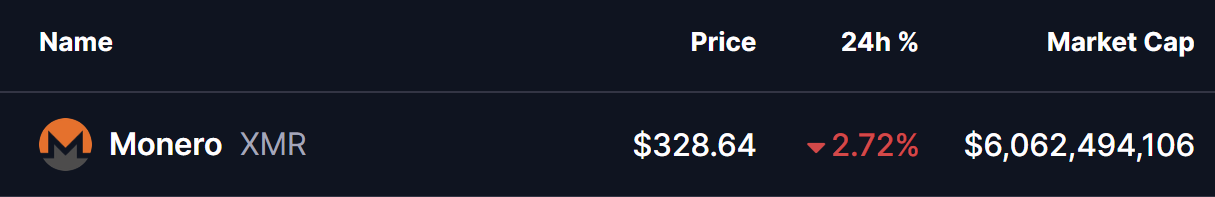

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge in Play

On the 4-hour chart, XMR continues to trade within a descending broadening wedge — a bullish reversal pattern that typically forms during corrective downtrends. This structure represents a market phase where volatility expands while selling pressure starts to weaken, often leading to a trend reversal once buyers regain momentum.

Recently, XMR faced rejection near the wedge’s upper boundary around $345.90, triggering a pullback to the lower trendline near $322. Encouragingly, buyers have shown early signs of defending this level, as XMR now trades near $327, hovering just above both the support line and the 100-hour moving average (MA) at $320.71.

This area has acted as dynamic support several times before — making it a key zone for bulls to protect in order to preserve the bullish reversal structure.

What’s Next for XMR?

If buyers successfully defend the lower wedge boundary and reclaim the 50-hour MA near $331.73, XMR could build short-term momentum for a rebound toward the wedge’s upper resistance area around $342.

A breakout above $342 would confirm a bullish continuation pattern, potentially paving the way for a stronger recovery phase in the coming days.

However, if XMR breaks below the support trendline, it would signal a bearish breakdown, opening the door for deeper losses as sellers gain control.