Global Pi Market Surges Past 200,000 Users, But Allegations of Crime Spell Doubt

The Global Pi Market’s rapid rise highlights Pi’s real-world potential, but allegations of illegal car sales now threaten its credibility just as it prepares key upgrades for Hackathon 25.

The Global Pi Market (GPM), one of the largest decentralized marketplaces within the Pi Network ecosystem, has surpassed 208,000 registered users this October.

However, even as its growth cements GPM’s role as a flagship example of Pi’s real-world utility, allegations of illegal sales involving stolen vehicles have ignited controversy around the project’s rapid expansion.

Decentralization Through Franchising Pays Off For Pi Network’s GPM

Founded by Alhaurin1968 and Ron123Cash, GPM began as a peer-to-peer trading platform inside the Pi Browser, allowing users (Pioneers) to buy, sell, and offer services using Pi tokens directly.

“Create a real marketplace where Pi is not theory—but daily practice,” PiNewsZone quoted GPM’s mission.

In less than two years, that idea grew into a vast, decentralized trading ecosystem boasting over 17,000 live ads, 22,000 Telegram members, and real transactions in Pi occurring daily across the globe.

Users trade everything from digital services and electronics to cars and property listings, creating what GPM calls a “100% Pi-based economy.”

To secure trades, the marketplace employs MultiSig Wallets, escrow protection, and a dispute resolution system, all managed through GPM’s built-in infrastructure.

GPM already delivers what Pi Network stands for — real utility, decentralization, and community impact. Unlike conceptual projects, GPM is a live and fully functional ecosystem inside the Pi Browser, trusted by over 208,000 registered users and processing… pic.twitter.com/CmZLh9JTPV

— GPM GlobalPiMarket (@globalpimarket) October 14, 2025

The platform also promotes an environmental initiative under its “Pioneer Forest” project, to plant five trees for every 100 successful trades.

One of GPM’s most notable innovations is its Franchise Model, which allows local entrepreneurs to operate regional GPM branches while earning commissions on transactions within their markets.

Each franchise partner acts as a local ambassador, helping onboard users, manage listings, and build trust within their community.

With franchise earnings set at 2% per transaction and headquarters taking 1%, the system merges decentralized governance with entrepreneurial opportunity.

GPM has already expanded to multiple regions. It describes itself as a network of connected Pi marketplaces, a decentralized ecosystem with real-world business roots.

Allegations of Illegal Sales Surface Against GPM

Despite these milestones, recent claims have cast a shadow over GPM’s legitimacy. A verified Pi Network community account on X (Twitter) suggested that certain “foreign used” cars listed on the platform may actually be stolen vehicles exported to Africa.

I can't help thinking those "foreign used" cars on GPM means stolen and shipped to Africa pic.twitter.com/dLE5QFxHtr

— r/PiNetwork (@PiNetworkUpdate) October 14, 2025

The post linked to Interpol’s stolen vehicle database, raising the possibility of transnational criminal activity infiltrating the otherwise community-driven platform. GPM has not yet issued an official statement regarding the allegations.

Prices on the platform are determined by minimum floor values rather than the debated Global Consensus Value (GCV) of Pi. This can lead to wide discrepancies in asset pricing, especially for high-value items like vehicles.

A Critical Moment Before Hackathon 25

As the Pi Network gears up for Hackathon 25, GPM plans to present new features such as integration with Pi DEX, tokenization tools, and an expanded multi-tenant architecture.

“We’ve shown that Pi works. The next step is connecting every local market to a global chain of trust,” read the announcement, citing co-founder Alhaurin1968.

However, as questions around compliance and transparency mount, GPM faces a pivotal test. It needs to prove that real utility in the Pi economy can coexist with regulatory integrity.

The network is at a crossroads. On the one hand, the marketplace’s explosive growth could become a showcase for decentralized commerce. On the other hand, it could go out as a cautionary tale of unchecked expansion.

Both outcomes hinge on how it responds to the allegations now gripping the Pi community.

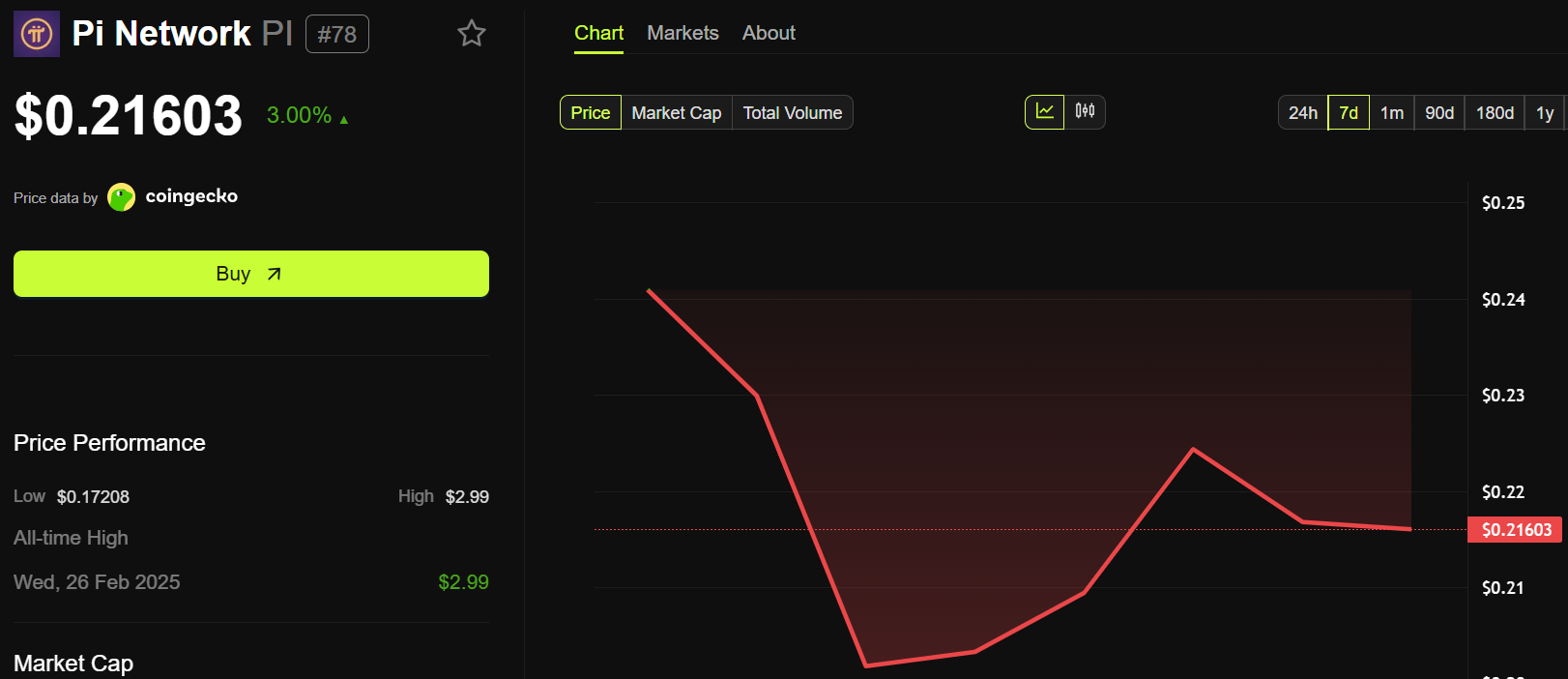

Pi Network (PI) Price Performance. Source:

Pi Network (PI) Price Performance. Source:

As of this writing, Pi Network’s PI Coin was trading for $0.21603, up 3% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Institutional Momentum Propels Bitget to Become Crypto’s Second Major Player

- Bitget became the second-largest crypto exchange in 2025 with $23.1B volume, driven by 80% institutional trading activity. - Institutional spot trading on Bitget surged from 39.4% to 72.6% by July 2025, improving liquidity metrics and order book depth. - The exchange expanded institutional services like USDT-backed loans and custody partnerships with Fireblocks, attracting $2.6M from Laser Digital. - Regulatory shifts (U.S. SAB 121 repeal, MiCA) and BlackRock's $88B Bitcoin ETF accelerated institutional

Bitcoin News Update: Powell's Ambiguity Triggers Market Drop, Bitcoin Dips Under $110K

- Fed’s 25-basis-point rate cut and Powell’s uncertainty over a December cut triggered Bitcoin’s 5% drop below $110,000. - Markets reacted sharply, with the Dow falling 200 points and $261M in Bitcoin futures liquidations. - Analysts highlight macroeconomic risks and U.S.-China trade talks as key factors influencing Bitcoin’s range-bound action.

Tech's investment in AI and geopolitical advantages drive up stocks and digital currencies

- Meta's $51.2B Q3 revenue beat estimates but EPS fell short, yet its AI/cloud investments bolster Wall Street optimism and 27% stock gains in 2025. - Intel's TSMC executive recruitment rumors and NVIDIA's $1B Nokia investment highlight AI talent/resource wars driving tech stock surges. - Trump-Xi trade talks and $36.2B Boeing deal boost Bitcoin 1.6% as investors anticipate eased tensions stabilizing crypto markets. - Magnificent Seven's 34% S&P 500 dominance reflects AI-driven tech consolidation, with hyp

Quack AI Introduces x402 BNB on BNB Chain