US is Seizing $12 Billion in Bitcoin, But What Will They Do With It?

The US Treasury’s effort to seize $12 billion in Bitcoin from Cambodia’s Prince Group marks a turning point in crypto crime enforcement. If successful, these assets could significantly strengthen Trump’s Strategic Reserve—unless victims reclaim their stolen funds.

The US is moving to seize around $12 billion in Bitcoin from Prince Group, a Cambodian-based pig butchering operation. It’s also applying massive sanctions to the Huione Group for facilitating money laundering.

If Treasury can acquire and gain ownership of these assets, it could substantially boost Trump’s Strategic Reserve. However, many defrauded Americans may attempt to reclaim their stolen money.

More Bitcoin For The US Government

Pig butchering scams were already a huge problem before 2025’s unprecedented crypto crime wave, but escalating fraud is making all these problems much larger.

One recent incident shows the scale of these incidents, as the Treasury is moving to seize $12 billion in Bitcoin from a long-running scheme:

The Treasury also released a statement on this pig butchering operation, although it does not directly address the effort to seize these bitcoins.

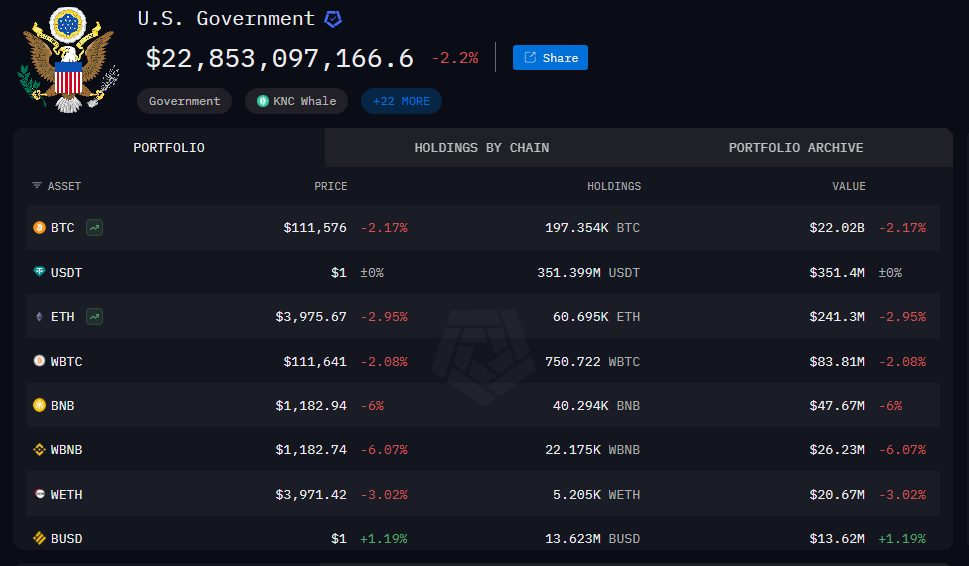

US Government Bitcoin Portfolio Till Now. Source:

US Government Bitcoin Portfolio Till Now. Source:

It claimed that a multinational investigation targeted the Prince Group, a Cambodian-based crime ring. By 2024, this group apparently stole at least $10 billion from US citizens.

Additionally, the Treasury finalized its efforts to sever the Huione Group from the US financial system, due to its history of facilitating money laundering.

Private crypto firms have levied restrictions upon the Cambodian financial conglomerate, but the US government is making a major escalation here.

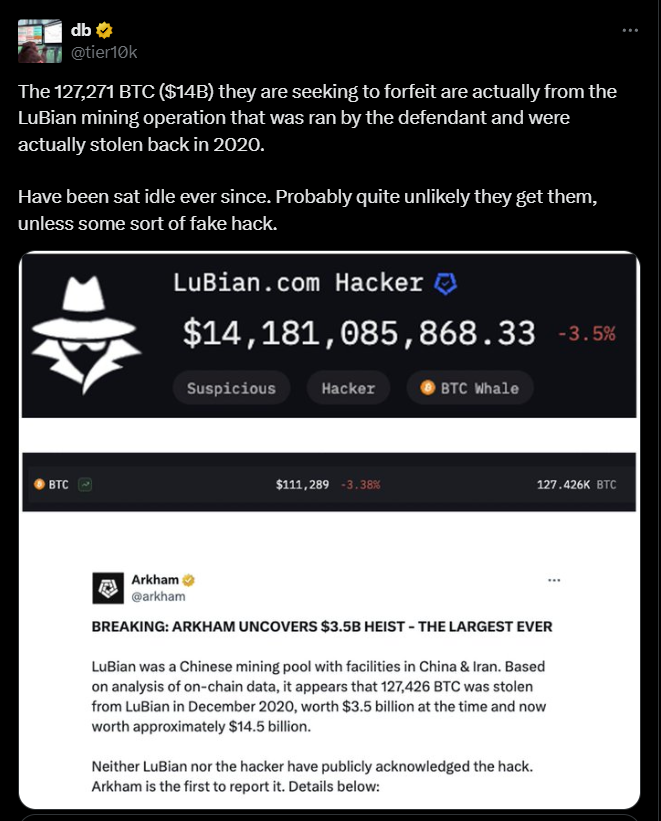

Some reports suggest these funds could actually be linked to the biggest crypto hack till date involving LuBian mining pool.

Source:

Source:

Strategic Reserve Implications?

The Prince Group’s operations were truly frightening, including human trafficking, torture, sexual exploitation, and more. Treasury’s report details all these unseemly aspects, which may be too lurid for our coverage.

However, as far as the crypto community is concerned, there’s one crucial point to realize. If the Treasury can successfully seize this Bitcoin, it could be a huge windfall for Trump’s planned Strategic Reserve.

Specifically, the administration has run into a major problem: it custodies huge quantities of seized bitcoins, but it doesn’t have legal ownership. It can’t exactly put these assets into a Strategic Reserve if it’s legally obligated to return them to the actual fraud victims.

There may be an opportunity here, depending on a few things. If the Treasury can acquire these assets, $12 billion is a huge windfall. If even a tiny fraction of initial theft victims fail to pursue reimbursement, this Bitcoin may be up for grabs.

In short, there are many factors in the air right now. The US may fail to seize these bitcoins, or a huge chunk may simply return to their initial owners. If, however, it can retain a few billion dollars’ worth, this could make a Bitcoin Reserve truly formidable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Algo Falls by 0.69% as Market Fluctuations and Ongoing Downtrend Persist

- Algo (ALGO) fell 0.69% in 24 hours to $0.1434, contrasting with 5.52% weekly gains but a 57.16% annual decline amid crypto market uncertainty. - Switzerland delayed CARF crypto reporting rules until 2027, citing stalled international data-sharing talks, hindering global regulatory alignment. - Bonk (BONK) launched Europe's first ETP on SIX Swiss Exchange, enabling traditional investors to access memecoins without digital wallets. - Ethereum prepares December 3 gas limit upgrade to 60M, enhancing layer-2

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c