Celsius wins nearly $300 million from Tether in bankruptcy case, a fraction of its $4.3 billion claim

Quick Take Celsius and Tether reached a $299.5 million settlement ending a year-long court battle over allegedly improper bitcoin liquidations before the lender’s 2022 collapse. The payout represents roughly 7% of the $4.3 billion Celsius originally sought, closing one of the final disputes in its three-year bankruptcy saga.

Celsius Network’s bankruptcy estate has secured a $299.5 million settlement from stablecoin issuer Tether, ending a high-stakes legal fight over billions of dollars in allegedly mishandled bitcoin collateral.

The agreement, announced Monday by the Blockchain Recovery Investment Consortium (BRIC), a joint venture between VanEck and GXD Labs, marks a major resolution in one of the largest remaining disputes from Celsius’s more than three-year bankruptcy restructuring saga.

Celsius had originally sought $4.3 billion in damages, alleging that Tether improperly liquidated 39,542 bitcoins before the expiration of a required 10-hour waiting period in 2022. The newly reached settlement represents roughly 7% of the amount Celsius had pursued in court.

The adversary proceeding was filed in August 2024 in the U.S. Bankruptcy Court for the Southern District of New York. In July 2025, Judge Martin Glenn allowed Celsius to proceed with the majority of its claims, clearing the way for Tuesday's deal.

Tether CEO Paolo Ardoino confirmed the settlement in a post on X, writing : “Tether is pleased to have reached a settlement of all issues related to the Celsius bankruptcy.”

Celsius filed for bankruptcy in July 2022 after revealing a $1.2 billion balance-sheet shortfall. The firm emerged from bankruptcy protection in November 2023 and has since been managed by BRIC to recover illiquid and litigation-linked assets on behalf of creditors.

Former CEO Alex Mashinsky was sentenced in May to 12 years in prison after pleading guilty to commodities fraud and a scheme to manipulate the price of Celsius’s native token, CEL, according to court filings. Prosecutors said Mashinsky “orchestrated one of the biggest frauds in the crypto industry.”

Tether had previously denied any wrongdoing, calling the lawsuit “baseless” and arguing that Celsius sought to “impose the costs of its own mismanagement” on the stablecoin issuer.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA could slip below $0.30 as bearish momentum builds

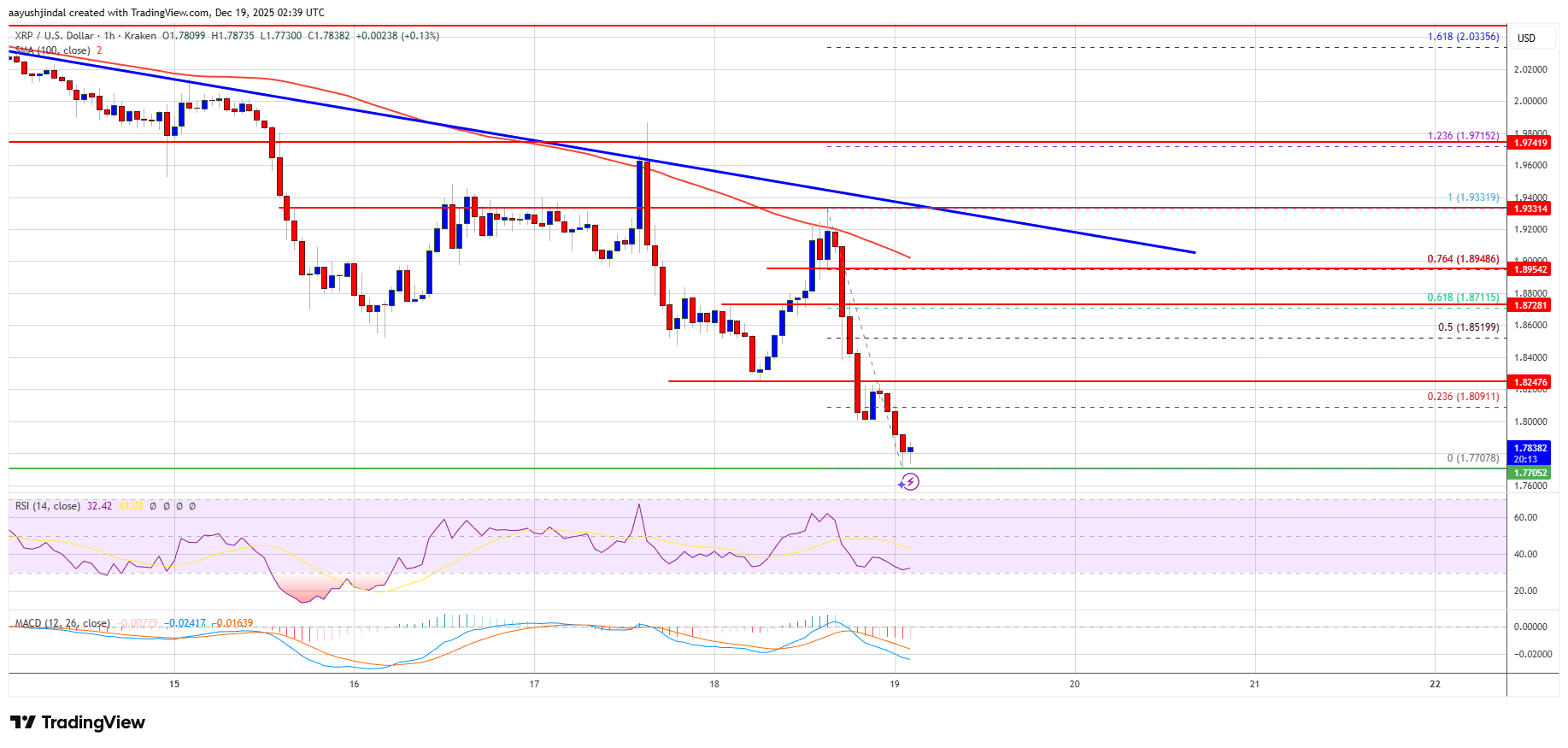

XRP Price Turns Lower as a Familiar Pattern Reappears Again

DAT Remains Uncollapsed as Altcoins Enter Stage 5; Traders Build Watchlists and Place Buy Orders