October 14th Key Market Information Discrepancy, A Must-See! | Alpha Morning Report

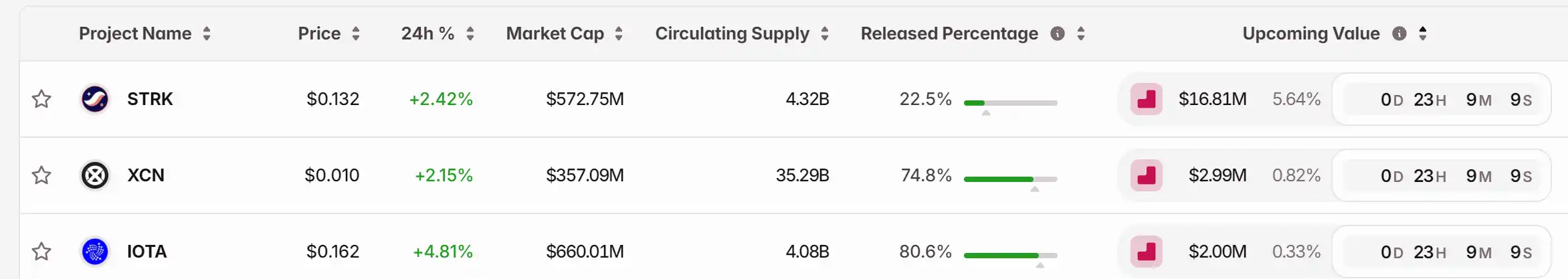

1. Top News: Crypto Market Remains Calm Overnight, Ethereum Surges Past $4200 Leading Partial Altcoin Recovery 2. Token Unlock: $STRK, $XCN, $IOTA

Featured News

1.Cryptocurrency Market Calm Last Night and This Morning, Ethereum Surges Past $4200 Leading Alts Rebound

2.BNB Chain Collaborates with Four.Meme to Launch $45 Million BNB "Rebirth Support" Airdrop with Random Allocation

3.Monad Airdrop Claiming Opens Today at 21:00

4.Pyth Network Partners with Kalshi to Bring Real-Time Prediction Market Data onto the Chain

5.Zora Teases Video Hinting at Upcoming Livestream Feature

Articles & Threads

1. "How to Keep Up with So Many Prediction Markets?"

With Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announcing its plan to invest around $2 billion in prediction market platform Polymarket at a valuation of about $9 billion on October 7, just three days later, another prediction market giant, Kalshi, also announced a $300 million funding round, valuing the company at $5 billion. Meanwhile, Polymarket founder Shayne Coplan, who had previously retweeted or liked posts about the platform potentially launching a token, this time listed a series of mainstream crypto asset symbols followed by $POLY ticker on social media, which can be seen as a "hint" at issuing a token. This series of news triggered FOMO sentiment among community members. With the news spreading, the prediction market track once again became a hot topic of discussion.

2. "Black Swan Operator? Who Is the Mysterious Whale Garrett Jin?"

The discussion about the Black Swan flash crash event on October 11 is still ongoing, and the community continues to question the identity of the whale who accurately shorted over $1.1 billion before the event. On-chain detective analysis suggests that the address in question may belong to former BitForex CEO Garrett Jin. At noon today, Garrett Jin posted three consecutive updates on his personal X account to respond to market rumors for the first time, clarifying that he has no connection to the Trump family or "Little Trump" and emphasizing that his previous actions were not insider trading. He also stated that the funds used were not personal but belonged to his clients.

Market Data

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Supreme Court Decision on Tariffs May Require $140 Billion in Refunds and Prompt Federal Reserve to Lower Rates

- UBS warns a Supreme Court ruling against Trump's tariffs could force $140B refunds, straining U.S. fiscal resources and prompting potential Fed rate cuts. - The refunds stem from 39% Swiss tariffs deemed potentially unlawful, with fiscal impact equivalent to 7.9% of 2025's projected budget deficit. - Legal challenges highlight executive overreach risks, while reduced tariffs could boost consumer spending and ease inflation, creating room for Fed easing. - Swiss business leaders have lobbied Trump to lowe

Ethereum Updates: TRON's GreatVoyage: Strengthening USDT's $122B Network to Compete with Ethereum

Arm's Low-Power Architectures Overcome AI Energy Constraints, Fuel 34% Growth in Revenue

- Arm Holdings reported $1.14B Q3 revenue, 34% YoY growth surpassing forecasts, driven by AI/data center demand. - Royalty revenue rose 21% to $620M while licensing revenue jumped 56% to $515M, reflecting strong IP adoption. - Strategic shift to develop full-chip solutions via Compute Sub Systems aims to compete with Nvidia/Amazon in AI hardware. - Parent company SoftBank explored Arm-Marvell merger to strengthen AI infrastructure, highlighting industry consolidation trends. - 20 "buy" ratings and $155 pri

Fed Faces a Choice: Boost Growth or Curb Mounting Debt?

- U.S. household debt hit $18.59 trillion in Q3 2025, driven by rising credit card, student loan, and home equity debt with delinquency rates at multi-year highs. - The Fed initiated rate cuts amid slowing job growth but faces a dilemma: easing economic strain risks inflating a consumer debt bubble while tightening worsens defaults. - Retailers, banks, and auto lenders face fallout as discretionary spending declines and loan defaults rise, while essential goods and debt collectors see increased demand. - P