This $45 Million BNB Airdrop Wants To Revive Meme Coin Momentum

BNB Chain’s $45 million Reload Airdrop with Four.Meme targets meme coin traders hit by the crash—hoping to restore confidence and ignite a fresh rally.

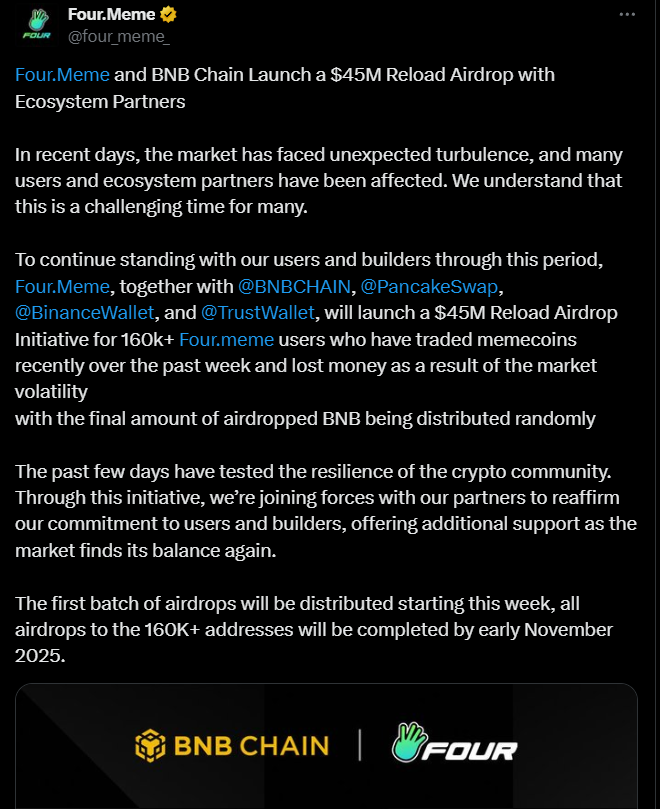

BNB Chain has launched a $45 million “Reload Airdrop” in partnership with Four.Meme, PancakeSwap, Binance Wallet, and Trust Wallet to reignite trading activity across its meme coin ecosystem.

The initiative targets retail traders hit by the recent market crash, where billions were wiped from speculative tokens.

BNB Airdrop To Trigger a Meme Coin Super Cycle

The airdrop will distribute roughly $45 million worth of BNB to more than 160,000 eligible addresses.

According to project details, recipients will be chosen through a randomized allocation system rather than based strictly on trading losses. Distribution will take place in multiple waves between mid-October and early November.

BNB Chain described the initiative as an effort to “reload” user confidence and liquidity in the meme coin sector. Over the past few months, meme coins have been one of the most active yet volatile segments on the network.

Four.Meme Announces BNB Airdrop

Four.Meme Announces BNB Airdrop

The move follows a wave of losses during the October 10 market crash, when several tokens built on Four.Meme suffered steep declines.

Four.Meme, a no-code meme coin launchpad on BNB Chain, allows users to create and list tokens with minimal technical knowledge.

Since launch, it has seen billions in cumulative trading volume, but also faced scrutiny following an exploit earlier this year that exposed flaws in automated liquidity mechanisms.

“The meme coin community is one of the most active and creative communities in the ecosystem, who have been affected the most by recent events especially during the past week,” wrote BNB Chain.

The Reload Airdrop marks one of BNB Chain’s largest coordinated relief efforts, signaling growing institutional and retail attention to its ecosystem.

However, analysts warn that the randomized nature of the airdrop may create disputes over fairness and transparency. Such “recovery” airdrops risk promoting moral hazard by rewarding risky trading behavior.

Overall, the airdrop comes as BNB defies broader market pressure, recently hitting a new all-time high above $1,370.

The altcoin’s resilience and active user base have reinforced its position as one of the strongest performers in 2025’s volatile crypto markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aerodrome price surges 10% after Animoca Brands announces strategic investment

Ethereum News Today: Fusaka Upgrade for Ethereum: Achieving Scalability While Maintaining Security and Decentralization

- Ethereum's Fusaka upgrade completes final testnet phase, set for December 3 mainnet launch to enhance scalability and compete with high-throughput blockchains. - Key EIPs like PeerDAS reduce node costs and enable 12,000 TPS, with phased deployment prioritizing security while expanding data capacity and parallel execution. - Upgrade aligns with Ethereum's "Surge" roadmap to resolve the blockchain trilemma, following Pectra's staking improvements and preceding 2026's Glamsterdam phase. - Market analysts pr

Web3’s Fluctuations Encounter 7-Month Nurturing: Fortify Labs Strives for Long-Term Stability

- Fortify Labs, a Web3 accelerator backed by TZ APAC, launched its 2026 application cycle, offering up to $1.3M in funding and seven-month mentorship for sustainable blockchain projects. - The program emphasizes long-term incubation over rapid scaling, leveraging Tezos and Etherlink ecosystems to balance scalability, compliance, and cross-chain interoperability for DeFi and gaming. - Past successes include Questflow (156x user growth) and Sogni AI (90,000 mainnet users), highlighting tailored support in to

Visa’s growth in stablecoin adoption is propelling digital assets into the worldwide marketplace

- Visa expands stablecoin payments across Ethereum, Solana, Stellar, and Avalanche, supporting USD/EUR-pegged assets convertible to 25+ fiat currencies. - Partnerships with Circle and PayPal enable financial institutions to mint/burn stablecoins via Visa's tokenized platform, accelerating $140B+ crypto flows since 2020. - CEO highlights 400% YoY growth in stablecoin-linked card spending, with $2.5B+ annualized settlement volumes in Q4 2025, driven by cross-border payment demand. - Strategic expansion align